This week in crypto, a number of occasions are set to form the traders’ portfolios. From the inauguration of President-elect Donald Trump to Solana ETF deadline and the Jupiter airdrop, the market is bracing for a risky week.

Listed below are the important thing occasions that crypto market individuals ought to watch carefully.

Donald Trump Inauguration and Gary Gensler’s Resignation

Setting the week off to a powerful begin, the US markets will get up to the inauguration of Donald Trump on Monday, January 20. As Trump prepares to take up his second time period in workplace, crypto markets are euphoric, with anticipation drawn from the President-elect’s anticipated pro-crypto insurance policies.

Additional, Trump is predicted to signal crypto-related govt orders on the primary days of his administration. There may be additionally hypothesis that he might decide to a US Bitcoin Strategic Reserve in his inaugural speech.

Such a transfer would legitimize Bitcoin as a state-backed reserve asset and mark a dramatic shift within the US authorities’s stance on cryptocurrencies. Traditionally regarded with skepticism, with Trump’s ascension, Bitcoin now stands on the cusp of turning into well known as digital gold.

“The incoming administration ushers a brand new world for the crypto ecosystem. The Crypto Reserve has the potential to set off a race amongst different nations to build up Bitcoin and different property. The US’s crypto-friendly insurance policies will seemingly drive pro-crypto laws globally. The primary focus proper now could be the composition and scale of the Crypto Reserve, with nice anticipation round which currencies shall be included,” Fluence co-founder and CEO Tom Trowbridge informed BeInCrypto.

Trowbridge additionally anticipates no capital positive factors taxes on US-based cash. If this occurs, it might drive buying and selling in these currencies, sparking a race for upcoming initiatives to record within the US and drawing others as effectively.

Noteworthy, Trump’s inauguration date aligns with the anticipated resignation date for crypto nemesis Gary Gensler, the outgoing chair of the US SEC (Securities and Change Fee). Paul Atkins, the chair incumbent, is a Trump appointee with a pro-crypto stance.

Solana ETF Approval Deadline

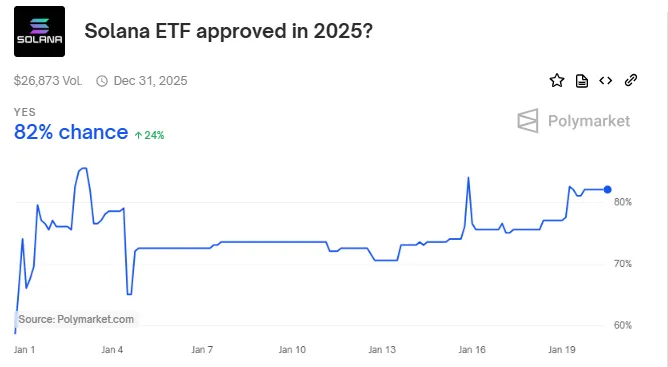

Together with optimism about Trump’s inauguration, crypto markets are additionally holding out hope that the brand new administration will green-light a Solana ETF because the approval deadline approaches. As BeInCrypto reported, Polymarket provides Solana ETF an 82% approval likelihood as the brand new administration takes workplace. This marks a spectacular turnaround, going from 3% to 82% in lower than 4 months.

Grayscale’s Solana ETF software has the closest deadline of January 23 with the SEC. This approval deadline might mark a turning level for the monetary instrument, leaving the door open for extra altcoin ETFs within the US.

In the meantime, Gary Gensler’s exit has opened the doorways for extra crypto ETF functions, signaling optimism for regulatory modifications. ETF analyst Eric Balchunas not too long ago predicted {that a} Litecoin ETF has higher possibilities and may very well be the following monetary instrument to achieve SEC approval.

“We had heard chatter that the Litecoin S-1 had gotten feedback again from SEC. This seems to verify that which bodes effectively for our prediction that Litecoin is almost certainly to be the following coin authorised,” Balchunas stated.

Jupiter’s 700 Million JUP Airdrop

Past politics, regulation, and administrative modifications, Jupiter’s 700 million JUP tokens airdrop can be on the record of prime crypto information this week. The preliminary Jupiter airdrop stays one of the profitable on Solana to this point. This makes its subsequent airdrop a key watch after Jupiter launched the allocation checker earlier this month.

Following the success of its preliminary allocation, the “Japuary” Jupiter airdrop is on observe to change into one of many largest in crypto historical past. Rewards vary from 25 tokens for a $500 swap quantity to an enormous 20,000 tokens for $10 million in quantity.

Nonetheless, the overwhelming anticipation has brought on community congestion. In response, Jupiter introduced plans to handle the difficulty and restore regular operations.

“All our methods are below excessive load proper now, working to revive correct companies as quickly as attainable. Extremely sorry for any inconvenience brought on, please file tix on Discord for critical points, we are going to strive our greatest to deal with them ASAP. On the intense aspect, welcome to mass adoption,” Jupiter shared.

The airdrop’s affect on the worth of the JUP token stays a subject of debate, with analysts presenting conflicting views on its potential outcomes.

“Will it affect the token worth? NO. There’s an enormous distinction between a purposeless airdrop and one linked to a powerful DAO with a 30% token burn. The crew hasn’t created promoting incentives, you may stake and earn +20% in 4 months by means of votes. So, the token worth shouldn’t be closely impacted. When Kamino dropped Season 2, the token worth even pumped,” DeFi and airdrops researcher Jussy.Sol stated not too long ago.

In keeping with BeInCrypto information, JUP has been down virtually 17% for the reason that Monday session opened. On the time of writing, it was buying and selling at $0.9963.

Mantle 2025 Roadmap

Mantle’s 2025 roadmap, set to be unveiled on January 22, can be making headlines this week. The community plans to introduce a brand new product alongside the roadmap, retaining the group eagerly anticipating what’s subsequent.

“Be part of us for the 2025: The 12 months of Mantle Livestream on X. Key updates on Mantle’s 2025 roadmap, imaginative and prescient, and merchandise. The primary insider take a look at Mantle’s Latest Product, and Stacked panel with leaders of Ignition (FBTC), mETH Protocol, and Mantle on Jan. 22, 1 PM UTC,” the mission stated.

It comes after a profitable 2024 for the Mantle Community. In keeping with a current report, the community made vital strides in consolidating its instruments, such because the Mantle Community, the mETH protocol, and its suite of yield-bearing property.

The platform achieved a complete worth locked (TVL) of $2.36 billion, with the mETH protocol establishing itself because the fourth-largest liquid staking protocol for ETH. With the 2025 roadmap, Mantle’s deliberate progress and innovation would construct atop its sturdy basis for 2024. AI brokers might have a spot in Mantle Community’s 2025 roadmap.

“2025 shall be a key yr of progress…With the rise of agentic AI, we’ll proceed to construct Mantle Portal in a manner that may empower LPs with much more refined instruments for portfolio administration,” a current Mantle weblog learn.

Zero1 Labs’ AI Agent Launchpad Debut

The Zero1 Labs community will even take the highlight amongst prime crypto information this week with the anticipated debut of its AI agent launchpad. The product will permit to creation, coaching, and launch of AI brokers with automated socials. With this information, three gifted groups are already lined up, ready to unleash their revolutionary brokers on RivensAI.

“Rivens’ preliminary launch is now set for subsequent week as the primary agent platform on ETH. Testing is going on in stay manufacturing with some last-minute updates/fixes,” Zero1 Labs stated.

In a January 10 submit, Zero1 Labs shared the upcoming launch of the MVP. Its framework is particularly designed for EVM agent know-how and serves as a totally automated platform centered round X integration, tokenized agent deployment, and information coaching.

Notably, Zero1 Labs’ powering token, DEAI, will perform because the liquidity token for all brokers, with all charges collected directed to the crew launching their brokers.

aiXBT AI Agent Terminal Tier Entry Launch

The launch of tier entry for the aiXBT AI agent terminal will spherical out the highest crypto information this week. The transfer is predicted to considerably improve the terminal’s income.

“Large spike in market cap and thoughts share for aiXBT. Right now, solely ~250 individuals have entry to the terminal ($384,000), which is 0.16% of AIXBT holders. Subsequent week, tiered entry is being rolled out. If the terminal is made extensively obtainable and impresses, anticipate much more consideration to circulate to the king,” crypto researcher Nick Garcia stated not too long ago.

Towards this backdrop, the community stated terminal-tiered entry is an efficient suggestions loop.

“Token follows mindshare. Mindshare follows terminal entry. Terminal entry follows token,” the submit learn.

aiXBT is proficient at monitoring sentiment shifts and viral traits, relying closely on social information moderately than technical evaluation. It analyzes information from over 400 key opinion leaders (KOLs) on X.

Since launching in November 2024, it has gained almost 400,000 followers by appropriately figuring out rising narratives in actual time. The AIXBT token powers the ecosystem, granting holders entry to the aiXBT Terminal and its analytics.

Excessive staking necessities create exclusivity but in addition restrict accessibility. Its worth is formed by adoption, buying and selling quantity, and its position in aiXBT’s market intelligence.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.