- Bitcoin and Trump – two names which have grow to be inseparable. The outcomes? Onerous to disregard.

- Might we be on the point of one other explosive run, with the market cap hovering to document double-digit progress?

Bitcoin [BTC] and Trump – a duo that may’t be ignored. You possibly can’t discuss one with out the opposite, and the outcomes communicate for themselves.

Bitcoin has simply hit a brand new all-time excessive of $109,350, with a 5% surge pushed by Trump’s return to the White Home.

However this relationship goes deeper, rooted in historical past. In 2017, throughout Trump’s first 12 months in workplace, the crypto market skyrocketed by 34.7%. So, may historical past repeat itself, with the market cap set to hit a document $10 trillion?

Key statistics you’ll be able to’t overlook

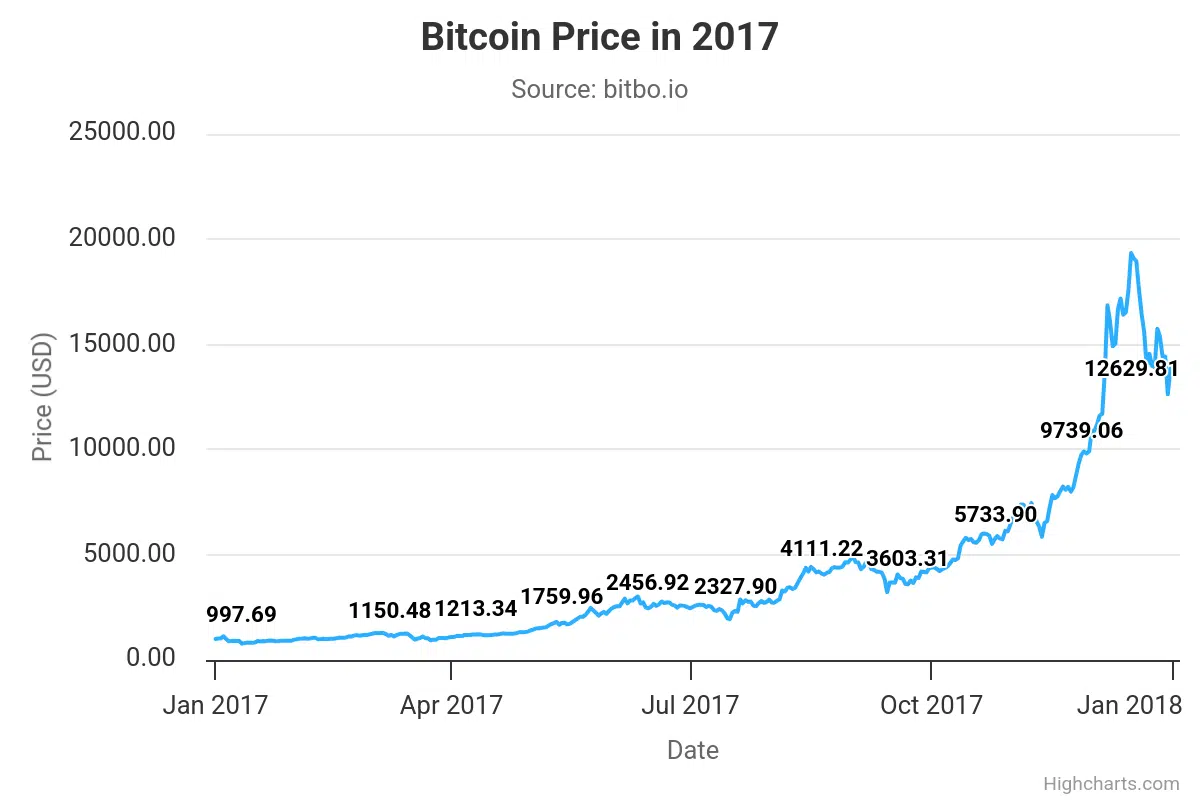

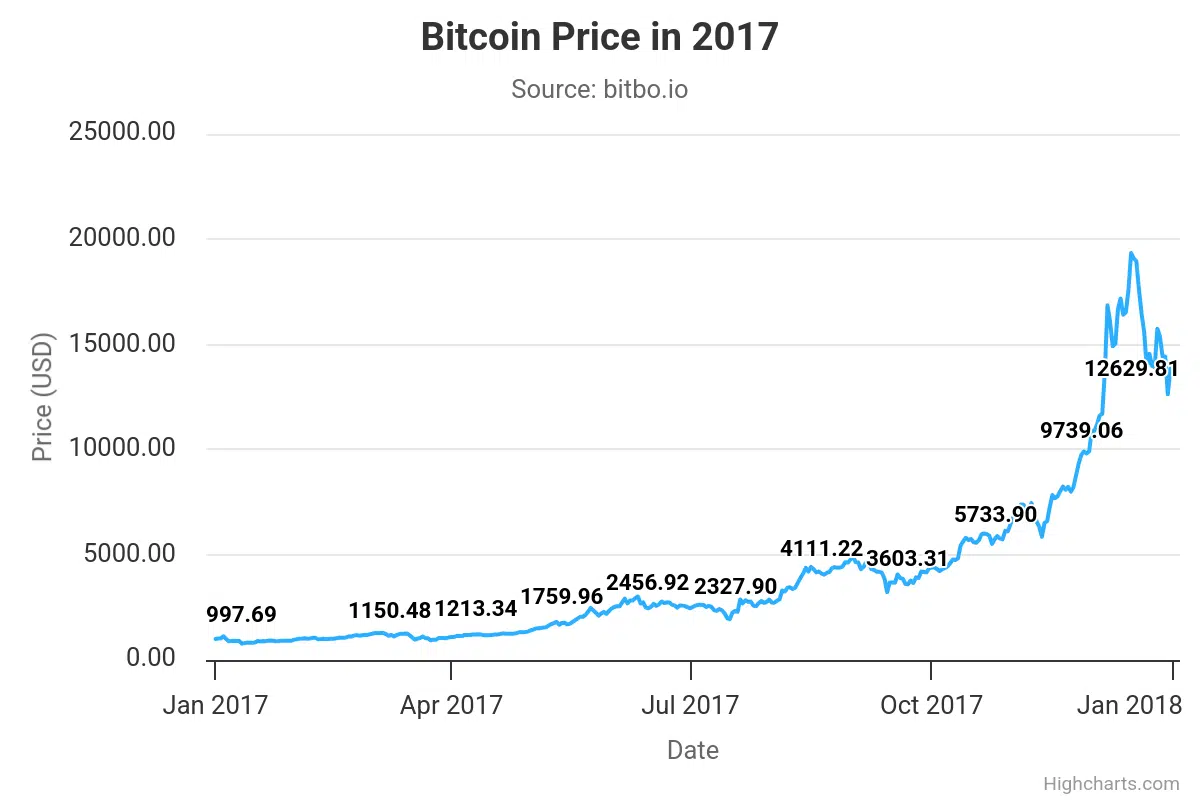

Flashback to 2017, Bitcoin kicked off the 12 months at simply $997.69. By December, it had skyrocketed with a 1290% YTD achieve, with Q3 being its golden interval.

Supply: BitBo

Quick-forward to 2024: regardless of the post-election liquidity, the halving increase, and the launch of BTC ETFs, Bitcoin’s progress was 8x slower than in its record-breaking 2017 run.

Now, in 2025, volatility is sky-high – enter Trump’s pro-crypto motion. The market is hungry for Bitcoin-friendly insurance policies to spark the subsequent leg up.

So, for the dream of a $10 trillion market cap to grow to be a actuality, all of it hinges on one factor: execution.

Nonetheless, it’s not simply Bitcoin. The altcoin and memecoin markets are heating up too.

The current surge with TRUMP coin is proof – traders are diversifying and hedging towards rising dangers, and the broader market is beginning to observe go well with.

The stage is about. With FOMO kicking in as Bitcoin eyes key resistance ranges, the complete crypto market may see a flood of capital. And if that occurs, a $10 trillion market cap may not be so far-fetched in spite of everything.

So, a easy Bitcoin-Trump sail? Not so quick!

Bitcoin’s progress over the previous eight years has been spectacular, nevertheless it additionally makes the asset extra weak to sudden value swings. The current clashes with the Fed present simply how shortly issues can change.

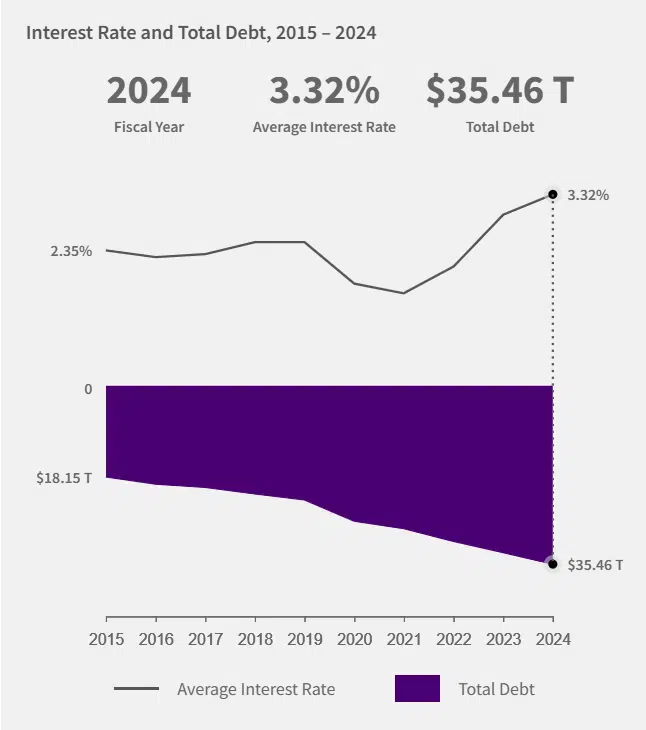

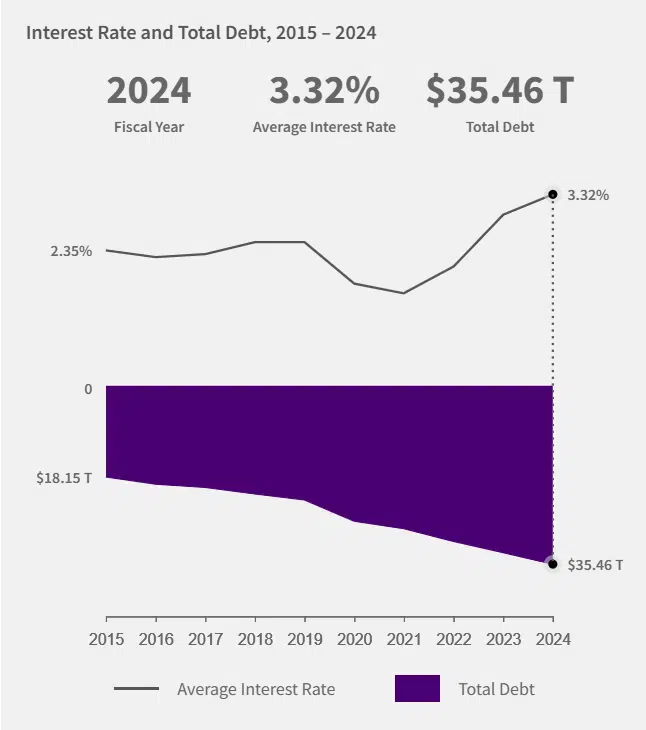

The larger problem lies in rising macro-economic tensions, and even Trump’s efforts is probably not sufficient to unravel them. The U.S. nationwide debt is one instance of a possible threat that might shake issues up.

U.S. Division of the Treasury

Whereas Trump pushes for peace offers and tax cuts to curb inflation, it’s nonetheless unclear whether or not these strikes will convey stability.

Learn Bitcoin’s [BTC] Worth Prediction 2025-26

Not like his 2017 presidency, this time, there are extra uncertainties within the combine. A repeat of the crypto market surge isn’t assured.

With a lot at stake, the subsequent few months will likely be essential in figuring out if the bull run continues or falters.