- MicroStrategy hints in the direction of including 2,530 BTC, bringing its whole holdings to 450,000 BTC.

- Regulatory shifts below Trump might enhance crypto insurance policies, fueling optimism for Bitcoin traders.

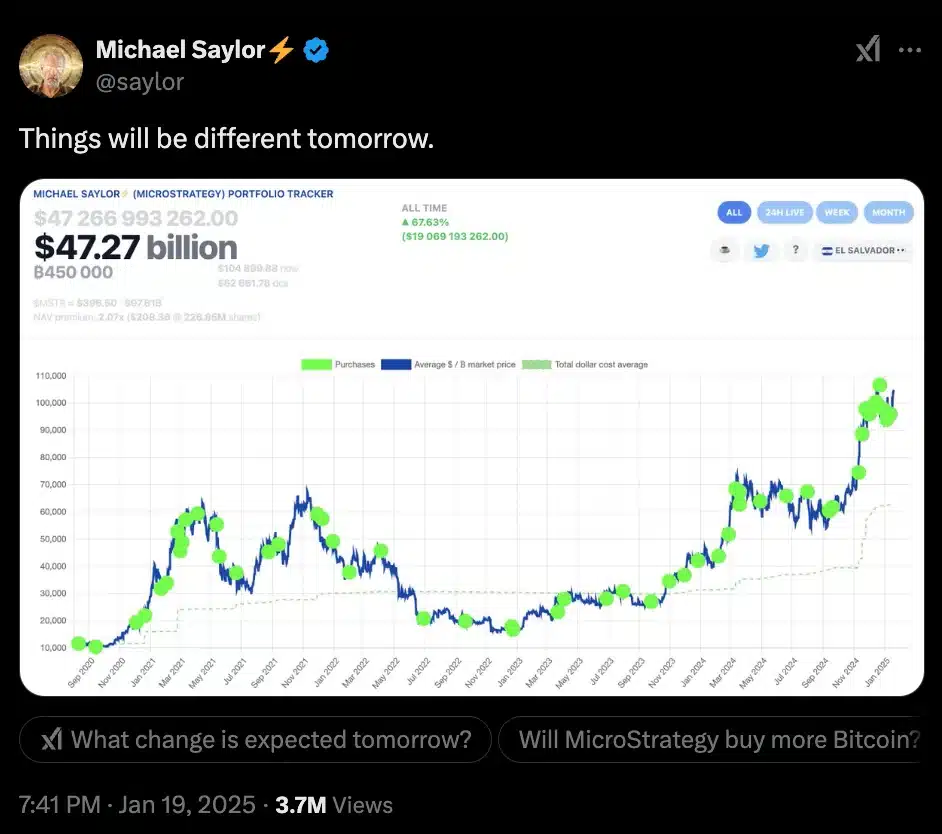

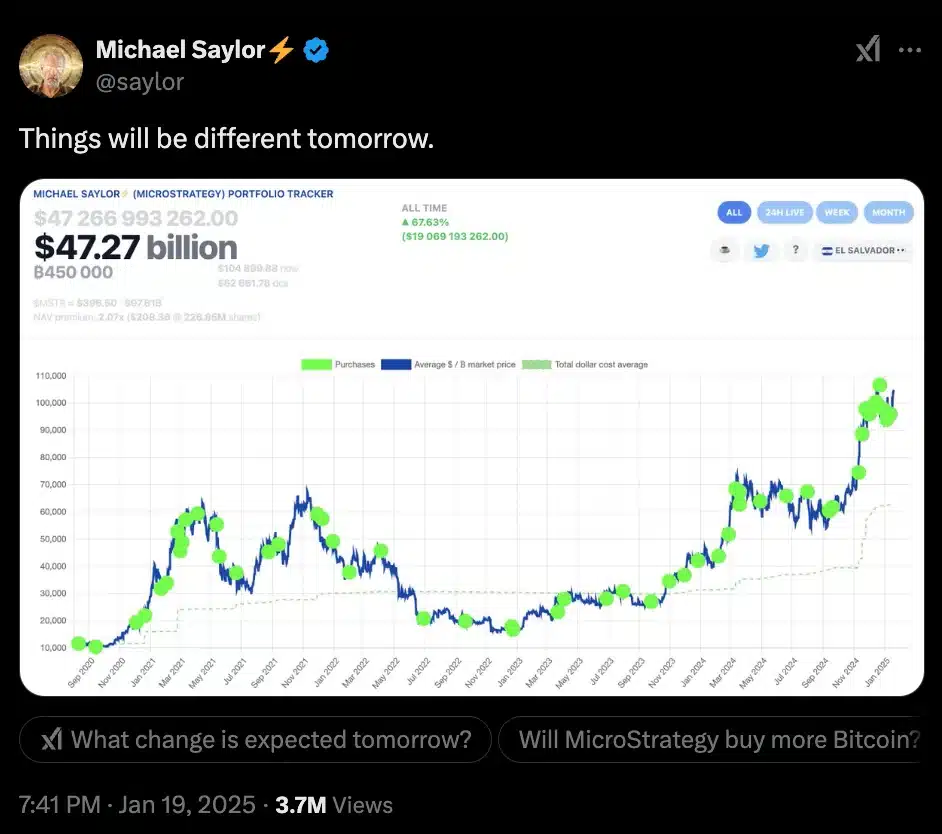

Amid the thrill surrounding Bitcoin [BTC] reserves and Trump memecoins, MicroStrategy’s co-founder Michael Saylor has as soon as once more captured consideration together with his constant Bitcoin advocacy.

On the nineteenth of January, Saylor hinted at yet one more BTC buy, marking the eleventh consecutive week of such indicators.

Because the crypto world watches carefully, MicroStrategy’s unwavering dedication to increasing its Bitcoin holdings continues to gasoline discussions about institutional confidence within the main cryptocurrency.

Saylor and his plan for MicroStrategy

Taking to X, Saylor famous,

Supply: Michael Saylor/X

On the thirteenth of January, MicroStrategy added 2,530 BTC to its holdings, a purchase order valued at roughly $243 million.

This acquisition brings the corporate’s whole Bitcoin reserves to a formidable 450,000 BTC, solidifying its place as the most important company holder of the cryptocurrency.

The acquisition aligns with MicroStrategy’s formidable 21/21 plan, aiming to boost $42 billion by means of fairness and fixed-income securities to fund Bitcoin acquisitions.

This relentless accumulation underscores the agency’s long-term confidence in Bitcoin’s potential as a strategic asset.

What lies forward?

Regardless of going through a stringent regulatory surroundings below SEC Chair Gary Gensler and President Joe Biden’s administration, MicroStrategy, below the management of Michael Saylor, has remained unwavering in its Bitcoin-focused technique.

Final 12 months, the corporate unveiled an formidable plan to boost $42 billion over the following three years to speculate completely in Bitcoin.

Nonetheless, the feasibility of this plan hinges on the corporate’s potential to safe funds by means of fairness and fixed-income securities.

Having already raised $10 billion in debt, MicroStrategy finds itself navigating important monetary challenges.

With rising inflation, climbing rates of interest, and Bitcoin’s infamous volatility compounding the uncertainties within the inventory market, the agency faces mounting dangers because it deepens its dedication to the main cryptocurrency.

Nonetheless, the panorama for cryptocurrencies might shift considerably with Donald Trump taking workplace and Paul Atkins main the SEC.

High Republican officers, together with commissioners Hester Peirce and Mark Uyeda, are reportedly getting ready to overtake the company’s cryptocurrency insurance policies.

Potential modifications embody issuing steering on when cryptocurrencies qualify as securities and reassessing pending enforcement circumstances.

Market developments

This optimism aligns with current market actions, as Bitcoin climbed 2.00% to $107,106.89 within the final 24 hours, based on CoinMarketCap.

In the meantime, MicroStrategy’s inventory (MSTR) surged 8.04%, reaching $396.50, as per Google Finance—suggesting robust investor confidence in each Bitcoin and the agency’s technique.