Coinbase, the biggest US-based crypto change, is being criticized by customers for important delays in processing Solana (SOL) transactions.

Customers have reported ready over 14 hours to ship or obtain SOL, sparking considerations in regards to the change’s liquidity and operational practices.

Considerations Develop Over Coinbase Liquidity Points and Staking Practices

Coinbase customers have expressed widespread frustration over delayed transactions. One investigative journalist reported the cancelation of their transaction after a full day of pending standing. One other consumer shared that they’d two transactions caught for over 14 hours.

A rising narrative means that Coinbase is likely to be staking clients’ SOL with out their consent to earn yield. Some speculate that the delays might stem from the unstaking course of, probably wanted to replenish working reserves earlier than executing transactions.

“Deposit SOL to Coinbase, they take your SOL and stake it to earn yield off your deposits, and oops — if everybody needs SOL suddenly, they don’t have your liquidity,” one consumer summarized.

This incident comes amid heightened trade skepticism following the collapse of FTX. Your entire saga uncovered important mismanagement and a lack of transparency in centralized exchanges (CEXs), with critics arguing that the newest sample is paying homage to that incident.

CryptoCurb, a preferred consumer on X, questioned Coinbase’s solvency and known as for rapid Proof of Reserve (PoR) audits. He additionally criticized the trade for seemingly abandoning PoR audits, a key reform measure launched after the FTX debacle.

“It’s trying VERY probably that Coinbase was caught staking their clients SOL with out clients consent. That is NOT okay if confirmed,” the consumer wrote.

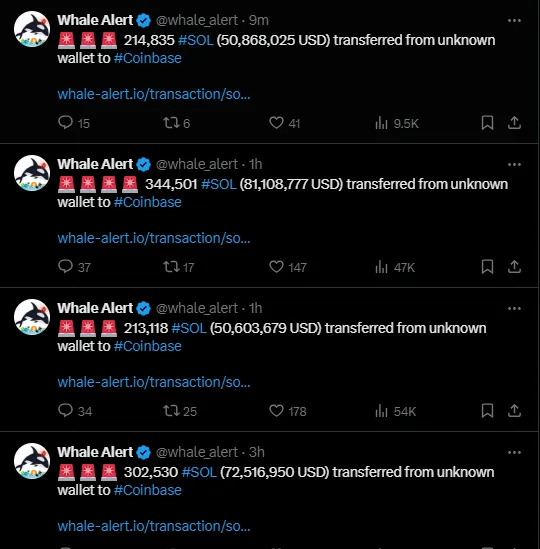

Fueling the suspicion additional, blockchain-tracking platform Whale Alert flagged a number of massive SOL transactions from unknown wallets to Coinbase change.

Amid the continued SOL transaction delays and huge transfers, customers urge Coinbase to offer clear proof of its liquidity and operational integrity. Coinbase Assist responded to consumer complaints, attributing the delays to “technical and blockchain points.”

Nevertheless, Mert Helius, a distinguished developer, ascribed the delays to Coinbase’s inside infrastructure, which struggles to deal with Solana’s fast transaction speeds.

“This has nothing to do with the chain [Solana]. My guess is they simply can’t sustain with the tip of the chain as a result of they generalize their indexing to all chains however don’t account for the way completely different these chains are,” Helius clarified.

One other consumer, Sidehustle, identified that Coinbase’s largest Solana validator is ready to unstake 567,000 SOL — value roughly $130 million — on the finish of the present epoch.

“Did they run out of liquid SOL and are actually ready till the epoch boundary to push via withdrawals?” he questioned.

This isn’t the primary time Coinbase has confronted scrutiny over its custody practices. Lately, BlackRock filed to amend its IBIT Bitcoin ETF amid consumer considerations over Coinbase’s custodial companies. As BeInCrypto reported, traders known as for Coinbase, as custodian, to offer on-chain proof of Bitcoin purchases for ETFs to make sure transparency.

“Topic to affirmation of the foregoing required minimal stability, Coinbase Custody shall course of a withdrawal of Digital Belongings from the Custodial Account to a public blockchain deal with inside 12 hours of acquiring an Instruction from Consumer or Consumer’s Approved Representatives,” an excerpt within the submitting learn.

Past this controversy, Coinbase has lately launched Bitcoin-backed loans for USDC, drawing blended reactions from the crypto neighborhood.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.