Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.Right this moment. The monetary and market data supplied on U.Right this moment is meant for informational functions solely. U.Right this moment just isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding selections. We consider that every one content material is correct as of the date of publication, however sure affords talked about might now not be obtainable.

There have been some uncommon buying and selling patterns in XRP perpetual futures currently. In response to liquidation knowledge, there’s a huge 3,750% distinction between lengthy and quick positions. CoinGlass knowledge signifies that in only one hour, greater than 97% of the $500,000 that was liquidated in XRP futures got here from the lengthy facet, leaving simply $14,000 tied up with the shorts.

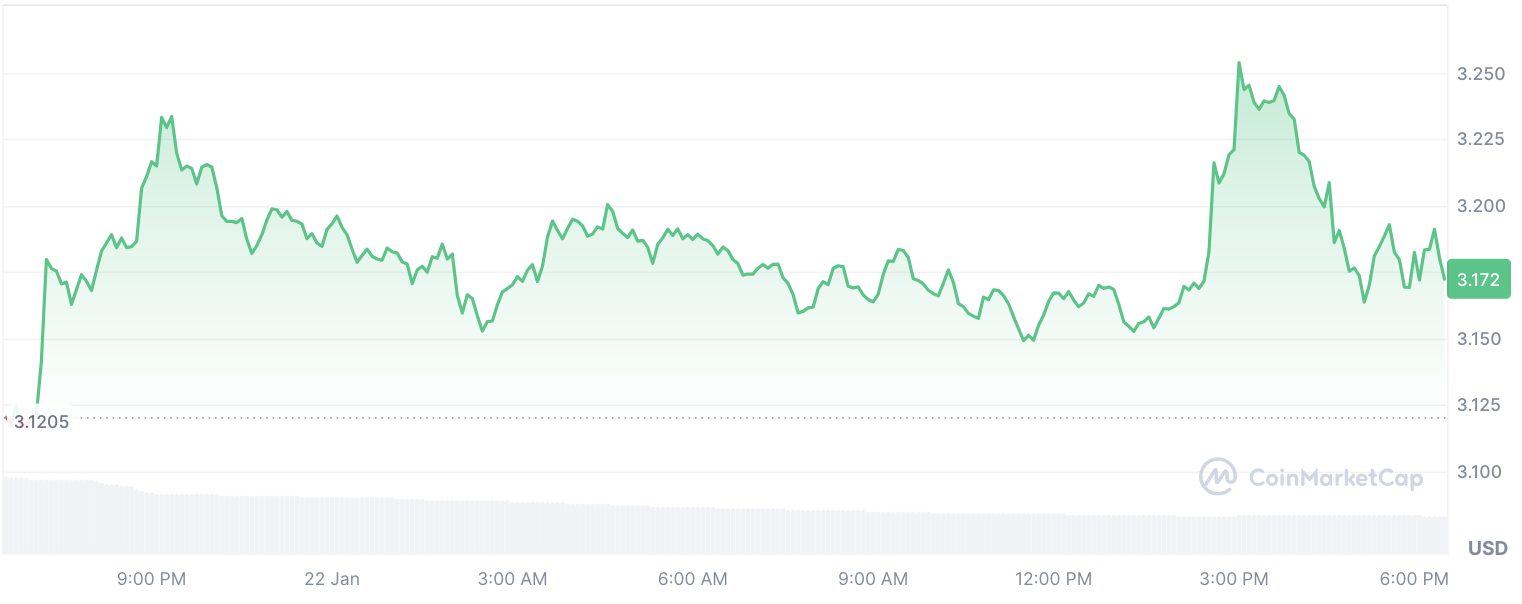

This huge distinction occurred similtaneously a small 1.5% drop in XRP’s value. Earlier beneficial properties of two.3% within the cryptocurrency’s worth had made merchants really feel good, in order that they had been taking aggressive lengthy positions.

However then, all of it modified actually rapidly, and that led to a bunch of liquidations. This confirmed that some methods had been too dangerous as a result of they had been overleveraged, and a few weren’t managed effectively.

The identical phenomenon is happening on the remainder of the cryptocurrency market. Within the final 12 hours, whole liquidations throughout digital belongings hit $79.28 million. Lengthy positions accounted for $53.25 million of this, far outpacing the $26.04 million briefly liquidations.

January hits completely different

For XRP, the massive imbalance reveals a number of overconfidence out there and a dependence on buying and selling based mostly on momentum.

Whereas lots of people expect the market to maintain going up because the 12 months will get going, occasions like these present how fragile that type of pondering will be. November’s rally made us suppose that January could be robust, however you will need to keep in mind that markets can change rapidly and catch merchants off guard.

The truth that lengthy positions are getting hit the toughest in terms of liquidations reveals that the cryptocurrency markets are feeling fairly optimistic. However, as with different crypto belongings, XRP continues to be fairly risky.