Larry Fink, CEO of BlackRock, not too long ago speculated that Bitcoin might doubtlessly attain valuations as excessive as $700,000 per BTC. This projection arises towards the backdrop of intensifying issues about foreign money debasement and international financial instability, positioning Bitcoin as a hedge towards vulnerabilities in conventional monetary programs. Fink’s comment was not an outright endorsement however somewhat a mirrored image on a current assembly he had with a sovereign wealth fund. The fund sought recommendation on whether or not to allocate 2% or 5% of its funding portfolio to Bitcoin. In keeping with Fink, if institutional adoption continues to develop and comparable allocation methods are embraced broadly, market dynamics might drive Bitcoin to such outstanding heights.

Fink made this placing assertion throughout a current interview, explaining that Bitcoin’s potential for exponential development is intently tied to fears of financial downturns and fiat foreign money devaluation. Fink described Bitcoin as an “worldwide instrument” able to mitigating localized financial fears.

JUST IN: $11.5 trillion BlackRock CEO Larry Fink says Bitcoin might go as much as $700,000 if there’s extra concern of foreign money debasement and financial instability.pic.twitter.com/WOXclAsjDP

— Bitcoin Journal (@BitcoinMagazine) January 22, 2025

A Message to the Market

With BlackRock managing $11.5 trillion in property, Fink’s phrases carry vital weight, sending a transparent message to retail and institutional buyers alike. His endorsement transcends private opinion, serving as a market sign about Bitcoin’s potential trajectory. Lengthy heralded as “digital gold,” Bitcoin is seen as a retailer of worth that may defend wealth from inflation and governmental fiscal mismanagement. Fink’s recognition of this narrative might additional speed up its adoption amongst conventional buyers.

Associated: From Laser Eyes to Upside-Down Pics: The New Bitcoin Marketing campaign to Flip Gold

A Well timed Forecast

Fink’s prediction comes as international economies grapple with hovering inflation, escalating nationwide money owed, and geopolitical tensions that threaten foreign money stability. Bitcoin, with its mounted provide of 21 million cash and decentralized construction, presents another asset class that’s resistant to the inflationary pressures inherent in fiat currencies. On this local weather, its worth proposition turns into more and more compelling.

BLACKROCK IS BACK.

THEY JUST BOUGHT $600 MILLION OF BITCOIN, THEIR LARGEST BUY SO FAR THIS YEAR. pic.twitter.com/QLAm5eaik4

— Arkham (@arkham) January 22, 2025

BlackRock’s Bitcoin ETF: A Sign of Institutional Curiosity

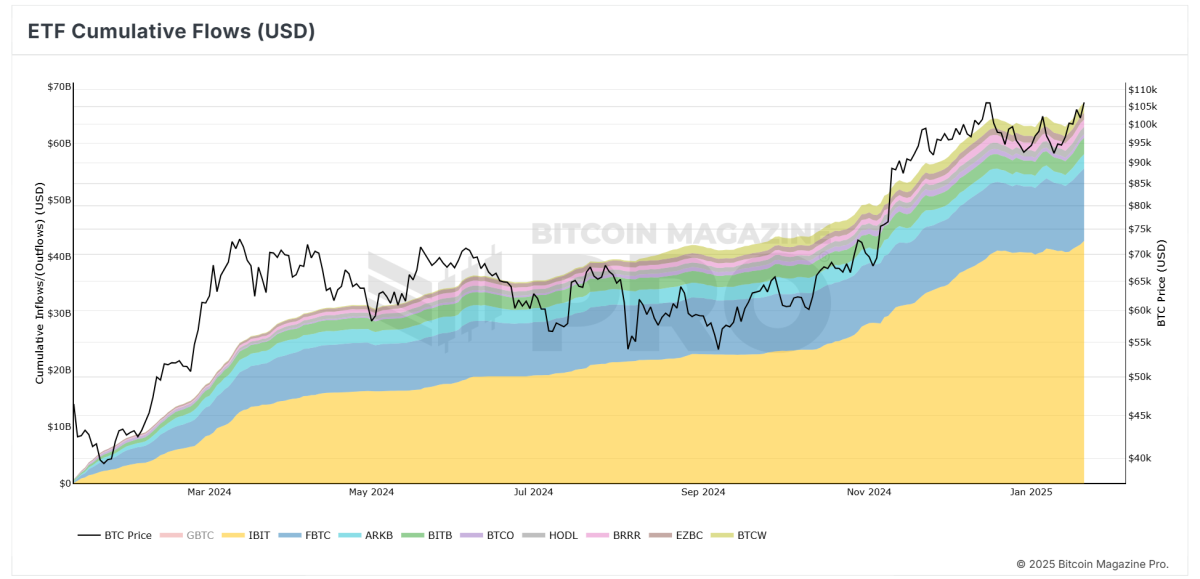

BlackRock’s deepening involvement in Bitcoin reached a milestone on January 21, 2025, when the agency bought $662 million price of Bitcoin for its exchange-traded fund (ETF), their largest each day buy up to now this yr.

BlackRock’s iShares Bitcoin Belief (IBIT) surpassed the agency’s iShares Gold Belief (IAU) in internet property in October 2024. This milestone was achieved simply months after IBIT’s launch in January 2024, highlighting the speedy development and growing investor curiosity in Bitcoin-focused exchange-traded funds.

A Balanced Perspective

Whereas Fink’s projection is undeniably bullish, it stays contingent on the continuation of present financial developments. If international financial stability improves or modern monetary programs emerge to alleviate fears of foreign money debasement, Bitcoin’s worth trajectory might stabilize at a decrease stage. Nonetheless, Fink’s high-profile commentary underscores its rising function as a reputable asset class.

Associated: David Bailey Forecasts $1M Bitcoin Worth Throughout Trump Presidency

Bitcoin’s Subsequent Chapter

Bitcoin’s evolution from a distinct segment digital experiment to a mainstream monetary instrument is accelerating. Fink’s remarks might sign a pivotal second, not only for Bitcoin, however for its broader acceptance in conventional finance. For buyers and fanatics, that is greater than a vote of confidence—it’s an indication that the combination of Bitcoin into the worldwide monetary panorama is just not solely imminent however already underway.

Because the world watches, Bitcoin’s function in redefining finance continues to develop. Fink’s prediction serves as a reminder that Bitcoin is now not a fringe thought however a vital participant in the way forward for cash.