Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.At present. The monetary and market info supplied on U.At present is meant for informational functions solely. U.At present is just not accountable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding selections. We consider that every one content material is correct as of the date of publication, however sure affords talked about could now not be out there.

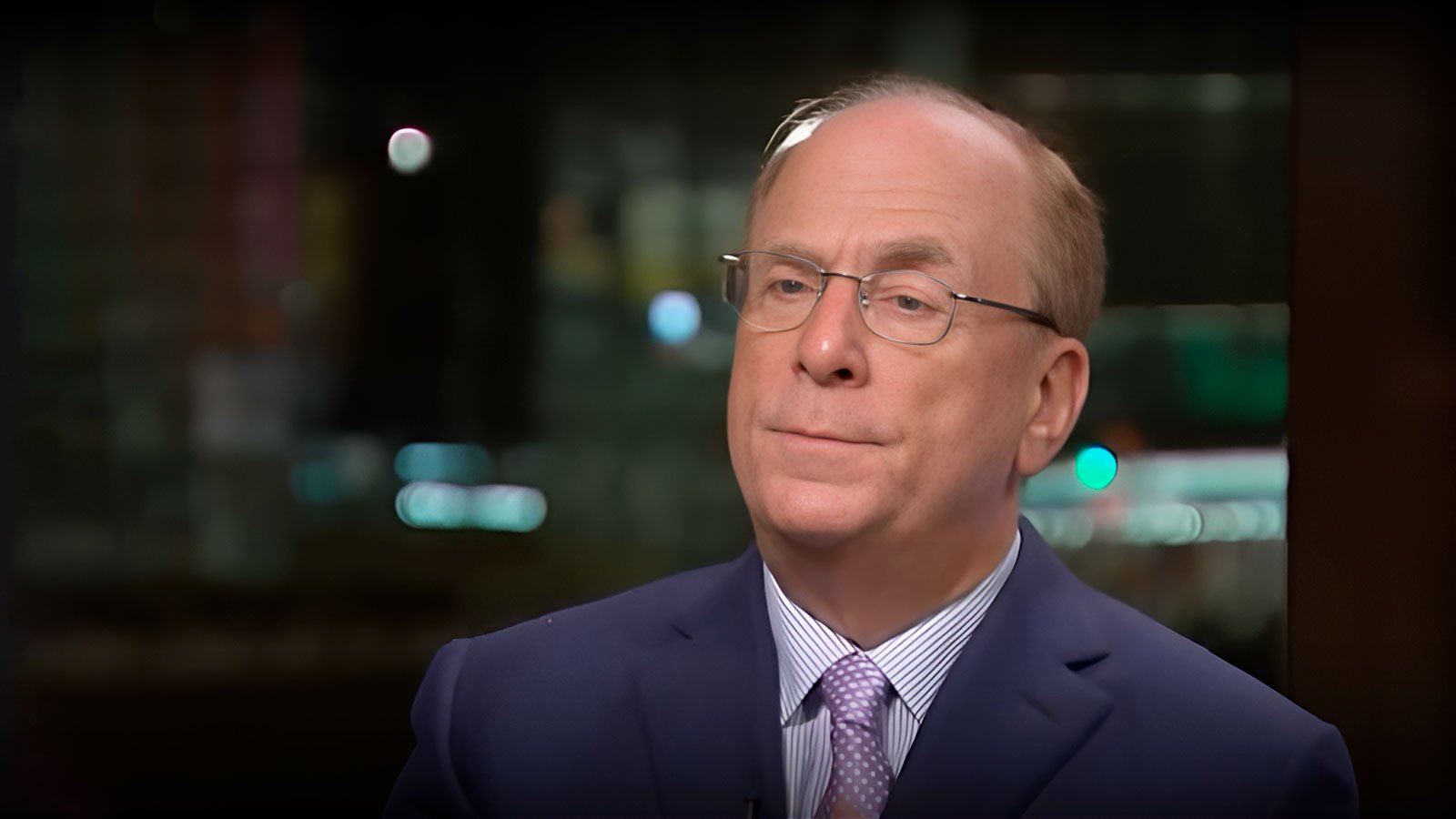

Throughout a dialog with Bloomberg’s Francine Lacqua at Bloomberg Home in Davos, BlackRock CEO Larry Fink has recommended that the value of Bitcoin, the main cryptocurrency by market cap, might doubtlessly surge all the way in which to the $700,000 stage.

This might occur if the cryptocurrency skilled a lot broader institutional adoption.

Fink has revealed that he just lately had a dialog with a sovereign wealth fund concerning a possible Bitcoin funding. The fund was asking the BlackRock boss whether or not it ought to have a 2% allocation or a 5% allocation.

“If all people adopted this dialog, it might be $500,000, $600,000, $700,000 per Bitcoin…I’m not selling it by the way in which. That’s not my promotion,” he stated.

As reported by U.At present, the top of the $10 trillion asset supervisor behemoth has repeatedly argued that Bitcoin might doubtlessly function a substitute for gold.

Most just lately, he has opined that the flagship coin might function a hedge in opposition to forex debasement or political instability. “I’m a giant believer within the utilization of that as an instrument,” he stated.

In keeping with information supplied by analytics platform SoSoValue, BlackRock’s iShares Bitcoin Belief ETF (IBIT) has now surpassed a complete of $60 billion price of internet belongings.

Disclaimer: The opinions expressed by our writers are their

personal and don’t signify the views of U.At present. The monetary and market info

supplied on U.At present is meant for informational functions solely. U.At present is just not

accountable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct

your individual analysis by contacting monetary specialists earlier than making any funding

selections. We consider that every one content material is correct as of the date of publication,

however sure affords talked about could now not be out there.