- Ethereum’s long-to-short ratio is five-to-one, creating market imbalance and potential for sharp worth actions

- Excessive bullish sentiment might set off a “pump and dump,” resulting in fast surges adopted by speedy declines

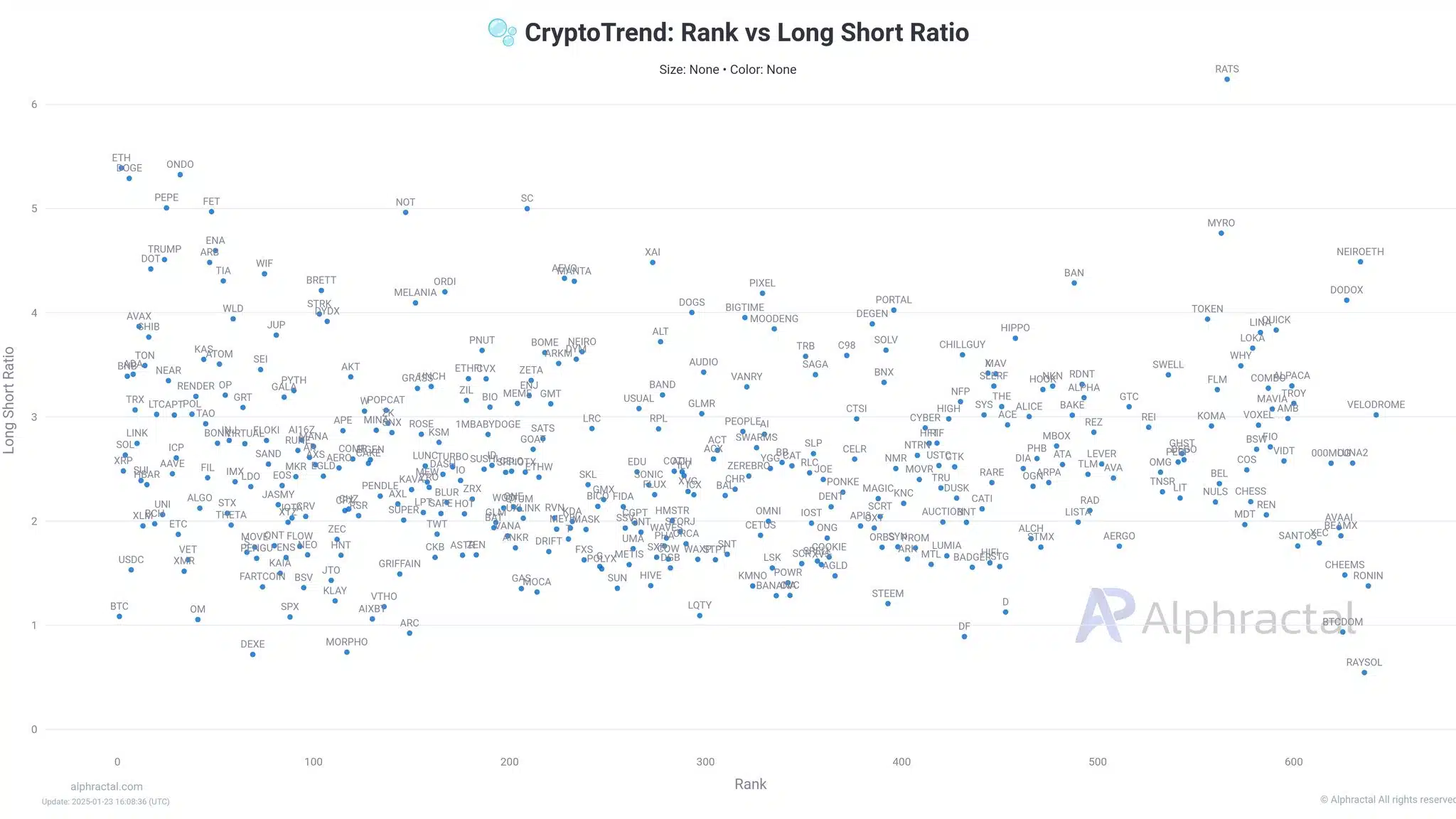

Ethereum’s [ETH] worth could also be poised for potential volatility within the coming days, with current information revealing a strikingly excessive long-to-short ratio.Proper now, for each brief place, there are 5 lengthy positions – Creating a major imbalance out there.

This might set the stage for speedy worth swings as merchants alter their positions in response to altering market situations. Such an imbalance usually results in heightened danger, and Ethereum might see a “pump and dump” state of affairs unfold, one the place the worth surges earlier than quickly dropping once more.

Lengthy v brief ratio considerations

Supply: Alphractal

The long-to-short ratio for Ethereum was alarmingly excessive at press time, with 5 lengthy positions for each brief. This skewed ratio urged that the market has been closely bullish. Nonetheless, it additionally creates a precarious state of affairs for merchants.

In line with the scatter plot chart, Ethereum could also be positioned within the higher vary of long-to-short ratios alongside Dogecoin [DOGE] and Polkadot [DOT].

Such a excessive focus of lengthy positions is an indication that vital worth motion might immediate merchants to shut their positions, doubtlessly flipping to shorts. This cascading impact might result in speedy sell-offs, intensifying volatility. With this imbalance, the danger of a worth correction looms massive, heightening the necessity for vigilance amongst Ethereum buyers.

Market sentiment

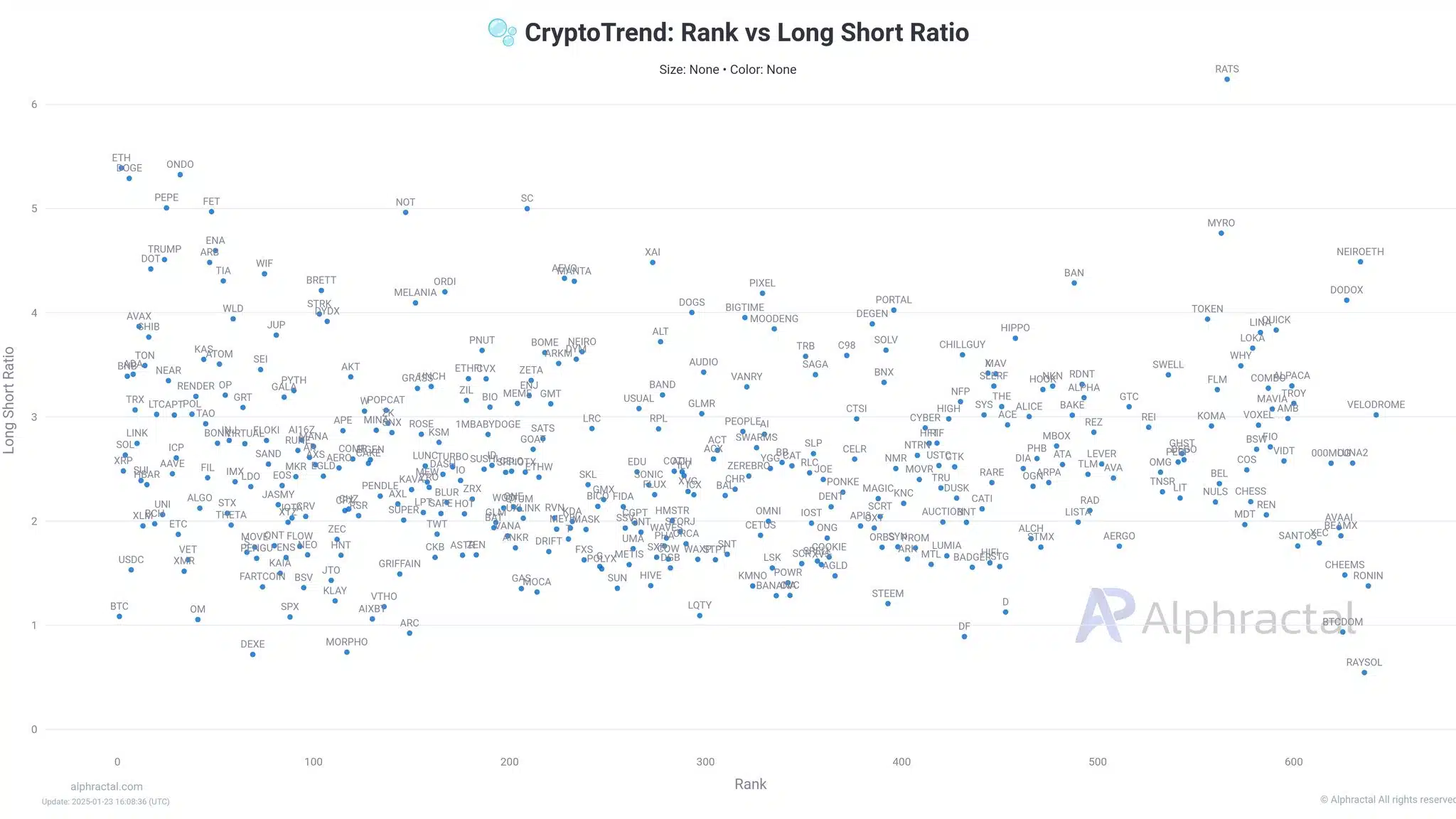

Supply: Alphractal

Current information highlighted Ethereum’s long-short ratio exceeding 5, signaling robust bullish sentiment amongst merchants. Nonetheless, this optimism might masks underlying fragility.

Comparatively, Bitcoin [BTC] appeared to lag with a ratio near 1 – Reflecting a extra balanced market view.

Ethereum’s elevated ratio aligns it with belongings like ONDO and TRUMP, which have additionally demonstrated heightened bullishness currently. Such disparity underscores Ethereum’s sensitivity to market shifts, the place any downturn might set off widespread liquidations.

The prevailing bullish pattern might reverse swiftly if Ethereum’s worth fails to fulfill expectations. With broader market dynamics in flux, even slight modifications in sentiment might ignite vital worth swings.

Learn Ethereum’s [ETH] Value Prediction 2025–2026

Potential affect on Ethereum buyers

The elevated long-to-short ratio offered a heightened danger of a “pump and dump” state of affairs. In such occasions, ETH’s worth might surge as merchants double down on lengthy positions, solely to face sharp declines once they rush to liquidate. This cycle usually unfolds quickly, pushed by excessive volatility and cascading cease losses.

For Ethereum buyers, this implies potential short-term beneficial properties might shortly flip into vital losses. In truth, the aforementioned information collectively highlighted Ethereum’s precarious place out there.

With its excessive ratios, merchants could be higher served by being ready for swift reversals.