Crypto markets will witness almost $4 billion price of Bitcoin (BTC) and Ethereum (ETH) choices expire at present.

Market watchers are significantly attentive to this occasion on account of its potential to affect short-term tendencies by the quantity of contracts and their notional worth. Inspecting the put-to-call ratios and most ache factors can present insights into merchants’ expectations and attainable market instructions.

Bitcoin and Ethereum Choices Expiring At present

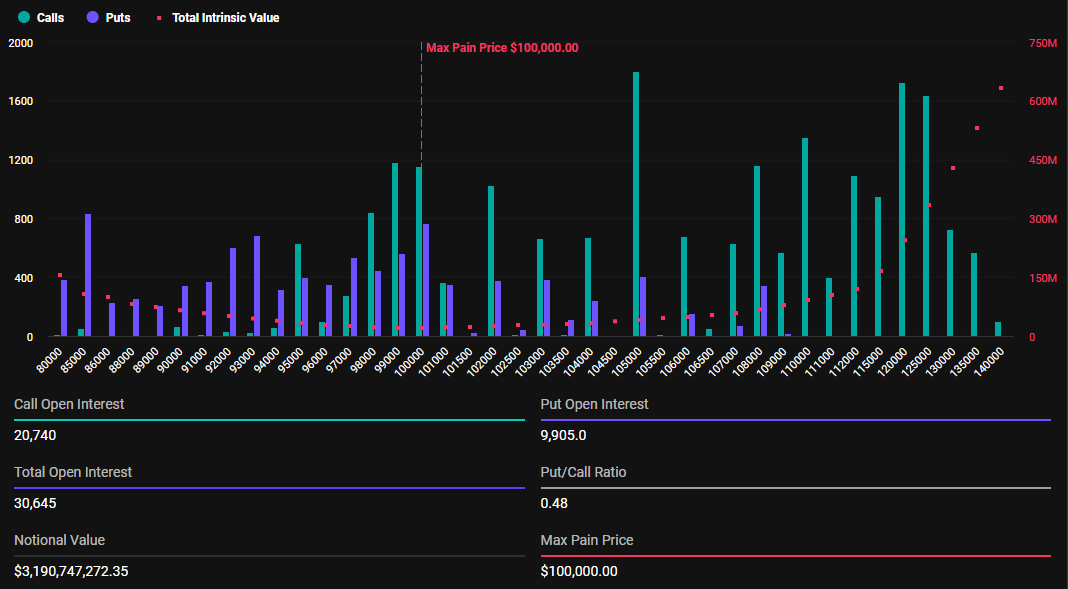

The notional worth of at present’s expiring BTC choices is $3.19 billion. In accordance with Deribit’s information, these 30,645 expiring Bitcoin choices have a put-to-call ratio of 0.48. This ratio suggests a prevalence of buy choices (calls) over gross sales choices (places).

The info additionally reveals that the utmost ache level for these expiring choices is $100,000. In crypto choices buying and selling, the utmost ache level is the worth at which most contracts expire nugatory. Right here, the asset will trigger the best variety of holders’ monetary losses.

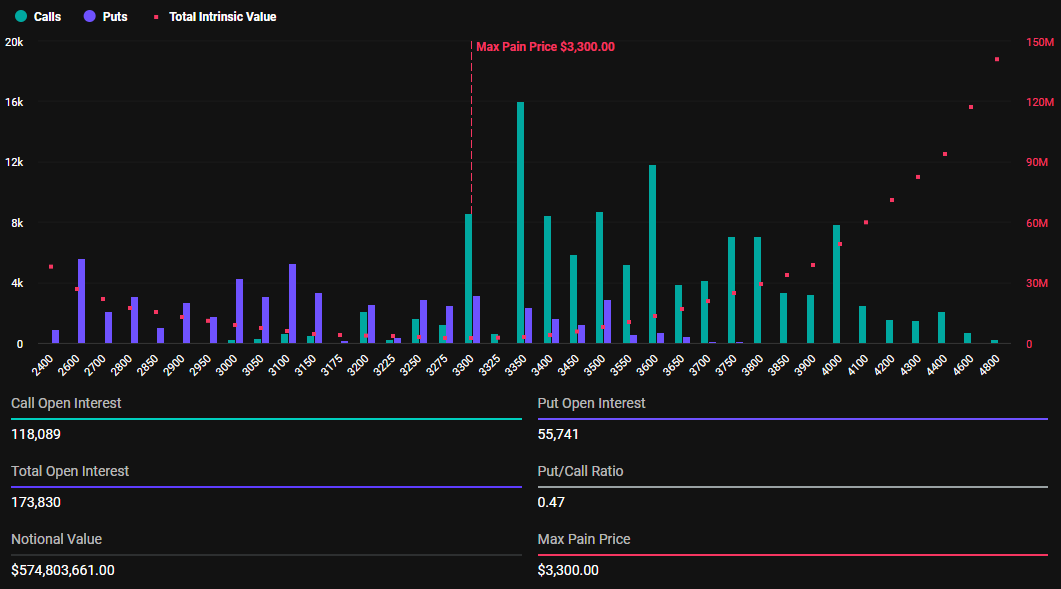

Along with Bitcoin choices, 173,830 Ethereum contracts are set to run out at present. These expiring choices have a notional worth of $574.8 million and a put-to-call ratio of 0.47. The utmost ache level is $3,300.

The present market costs for Bitcoin and Ethereum are above their respective most ache factors. BTC is buying and selling at $103,388, whereas ETH sits at $3,305.

“BTC max ache ticks increased, whereas ETH merchants place close to key ranges,” Deribit noticed.

This implies that if the choices have been to run out at these ranges, it might typically signify losses for possibility holders.

The end result for choices merchants can fluctuate considerably relying on the precise strike costs and positions they maintain. To evaluate potential features or losses at expiration precisely, merchants should think about their complete choices place, together with present market circumstances.

What the Expiring Contracts Imply for the Market

These expiring contracts come amid President Donald Trump’s government order to create a digital asset stockpile within the US. If permitted, this initiative may embody a reserve capturing extra crypto property aside from Bitcoin.

Past a digital asset stockpile, the president additionally established a cryptocurrency work group to develop a federal regulatory framework governing digital property. The US SEC (Securities and Trade Fee) has additionally repealed the SAB 121 coverage, giving banks the inexperienced mild to custody crypto.

These developments, coupled with the expiration of the BTC and ETH choices, function bullish fundamentals that might encourage volatility. Analysts at CryptoQuant reveal an fascinating investor outlook that reveals complete analysis is crucial earlier than concluding.

“Is that this the calm earlier than an impending storm? The market continues to grind decrease even after the SEC introduced the institution of a Crypto Regulatory Process Drive. BTC has damaged beneath $106,000 and is presently hanging by a thread across the $102,000 stage,” the analysts wrote.

Additional, the analysts observe elevated curiosity in buying choices contracts with a strike worth of $95,000 for January. This might point out that merchants are searching for safety towards potential draw back danger as Bitcoin teases with a lack of momentum.

The shift in sentiment from a bullish to a extra cautious perspective is attributed to the fluctuating market circumstances.

However, analysts count on the crypto market to stay range-bound till there’s extra readability on how latest financial information, particularly the weak Client Worth Index (CPI) studying, will impression the Federal Open Market Committee (FOMC) assembly scheduled for subsequent week. This assembly may probably affect the Fed’s upcoming coverage choices.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.