- SOL might flip ETH in 2025, per a Delphi Digital report.

- The analysis agency cited sturdy metrics, protocol alignment, and superior tradition as key catalysts.

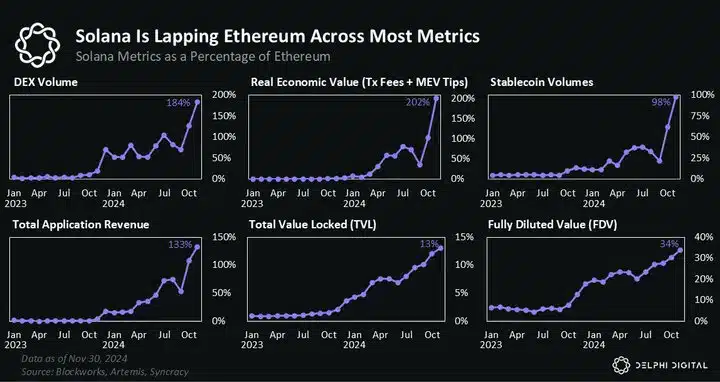

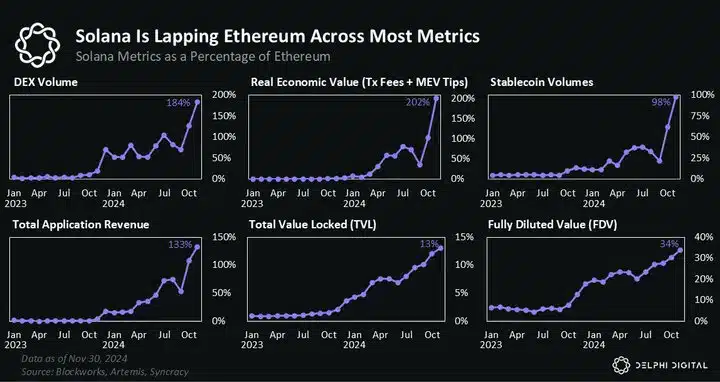

Up to now few months, Solana [SOL] has eclipsed Ethereum on key metrics like every day DEX buying and selling quantity, customers, charges, and worth efficiency.

Based on crypto analysis agency Delphi Digital (DD), Solana’s outperformance development might persist in 2025 and flip ETH as the highest layer 1 resolution. The analytic agency acknowledged,

“Trump’s memecoin launch on Solana has fueled debates about whether or not Solana might overtake Ethereum as the highest L1. Delphi sees SOL as a robust contender to surpass Ethereum.”

Will SOL flip ETH in 2025?

The agency cited 4 key fronts to assist its SOL’s outperformance thesis.

The primary indicator was metrics, and SOL topped key indicators other than TVL (complete worth locked), which measures the variety of locked funds within the DeFi ecosystem.

SOL’s TVL ($12B) was solely 13% of ETH’s ($86B) — A 7x extra locked funds than Solana. This confirmed excessive investor confidence in Ethereum relative to Solana.

Supply: Delphi Digital

However DD famous that Solana’s nice consumer expertise (UX) and scaling options via Firedancer might increase its lead on Ethereum on key metrics.

“Solana’s outperformance will proceed to be pushed by two components. Superior UX & higher content material. Whereas Ethereum has develop into extra fragmented with L2s, Solana has one unified ecosystem.”

Moreover, the DD report added that Ethereum’s perceived ‘lack of protocol path’ might give Solana an higher hand.

Regardless of the current restructuring on the Ethereum Basis (EF), the analysts have been unsure of the impression within the medium-term.

“Solana’s management emphasizes pragmatic outcomes whereas Ethereum prioritizes philosophical and long-term targets. Vitalik not too long ago did announce an enormous shift within the EF management construction, however outcomes stay to be seen.”

Lastly, protocol alignment was one other issue that might tip Solana’s win in 2025. Per DD, Ethereum’s L2 strategy has efficiently pushed enlargement however hasn’t benefited its Layer 1, not like Solana’s design.

“From the beginning, Solana has prioritized constructing and optimizing its L1 whereas Ethereum has outsourced varied capabilities of its L1 as a part of its dedication to decentralization.”

The SOL/ETH ratio, which tracks SOL’s relative worth efficiency towards ETH, has been on an uptrend since October 2023. This meant that SOL’s has outperformed ETH on the value entrance over a 12 months.

Supply: SOL/ETH, TradingView

Regardless of ETH’s transient lead through the December sell-off, SOL bounced again strongly in January. In actual fact, SOL eclipsed ETH by 36% final week and defended the rising channel sample.

At press time, SOL was valued at $263, up 38% on year-to-date (YTD), and will faucet $350. Quite the opposite, ETH was down 0.8% on YTD and was valued at $3.3K.