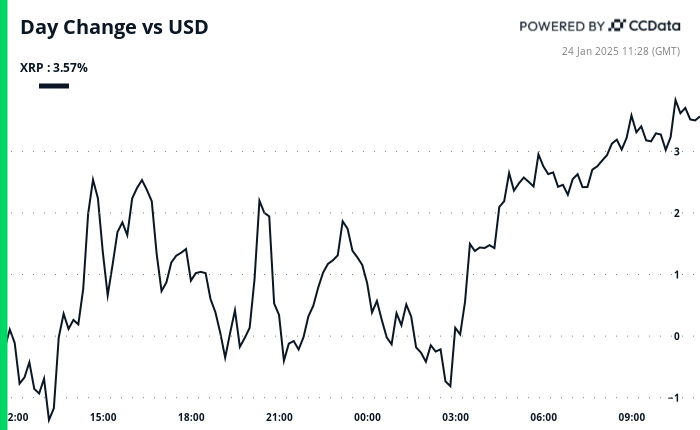

XRP is up by greater than 3.5% during the last 24-hour interval to now commerce at $3.19 because the cryptocurrency recovers from a major correction that got here after the Chicago Mercantile Change (CME) denied it was itemizing futures tied to the cryptocurrency.

The value of the native token of the XRP Ledger may, in accordance with in style cryptocurrency analyst, carry on rising to the $4.4 mark based mostly on a key technical sample, but the cryptocurrency market has lately been seeing important volatility.

Bitcoin’s worth, for instance, skilled substantial fluctuations throughout the previous 24 hours in response to U.S. President Donald Trump’s government order. This order seeks to create a extra favorable regulatory framework for digital property throughout the nation. The administration has been tasked with creating insurance policies that can set up a strong basis for the sector, together with the potential for establishing a “digital asset stockpile.”

XRP’s restoration throughout the volatility is probably going tied to its current drawdown that got here after it briefly noticed its complete market capitalization surpass that of Wall Road big Goldman Sachs. Behind the drop was CME’s clarification on potential XRP futures on its platform.

The Chicago Mercantile Change (CME) is usually seen as a barometer of institutional exercise within the cryptocurrency area. Earlier screenshots of pages hinting on the potential launch of futures contracts for each XRP and SOL circulated on social media, fueling rumors that the launch would happen on February 10.

Nevertheless, the trade clarified that these have been “beta pages” from its web site that had been launched in error. A spokesperson for the agency defined that mock-ups have been included in its testing atmosphere, and no choices had been made relating to these futures contracts.

As with most cryptocurrencies, XRP skilled a surge in worth late final 12 months as a result of optimism a couple of extra favorable regulatory atmosphere below President-elect Donald Trump’s administration. Anticipated coverage modifications, such because the institution of a strategic Bitcoin reserve and the appointment of Paul Atkins as the top of the Securities and Change Fee (SEC), have considerably boosted investor confidence.

It’s value noting that Atkins is thought to be a crypto-friendly determine to guide the regulatory company, which has been concerned in a authorized battle with Ripple, a outstanding participant within the XRP ecosystem. This authorized dispute facilities round Ripple’s XRP gross sales.

Trump’s pro-crypto stance has led many to take a position that XRP may quickly launch a spot exchange-traded fund (ETF) that gives publicity to the cryptocurrency. A number of firms, together with Bitwise, Canary Capital, WisdomTree, and 21Shares, have already filed for spot XRP ETFs. Ripple’s CEO, Brad Garlinghouse, has expressed the assumption that such a fund is “inevitable.”

Featured picture through Pexels.