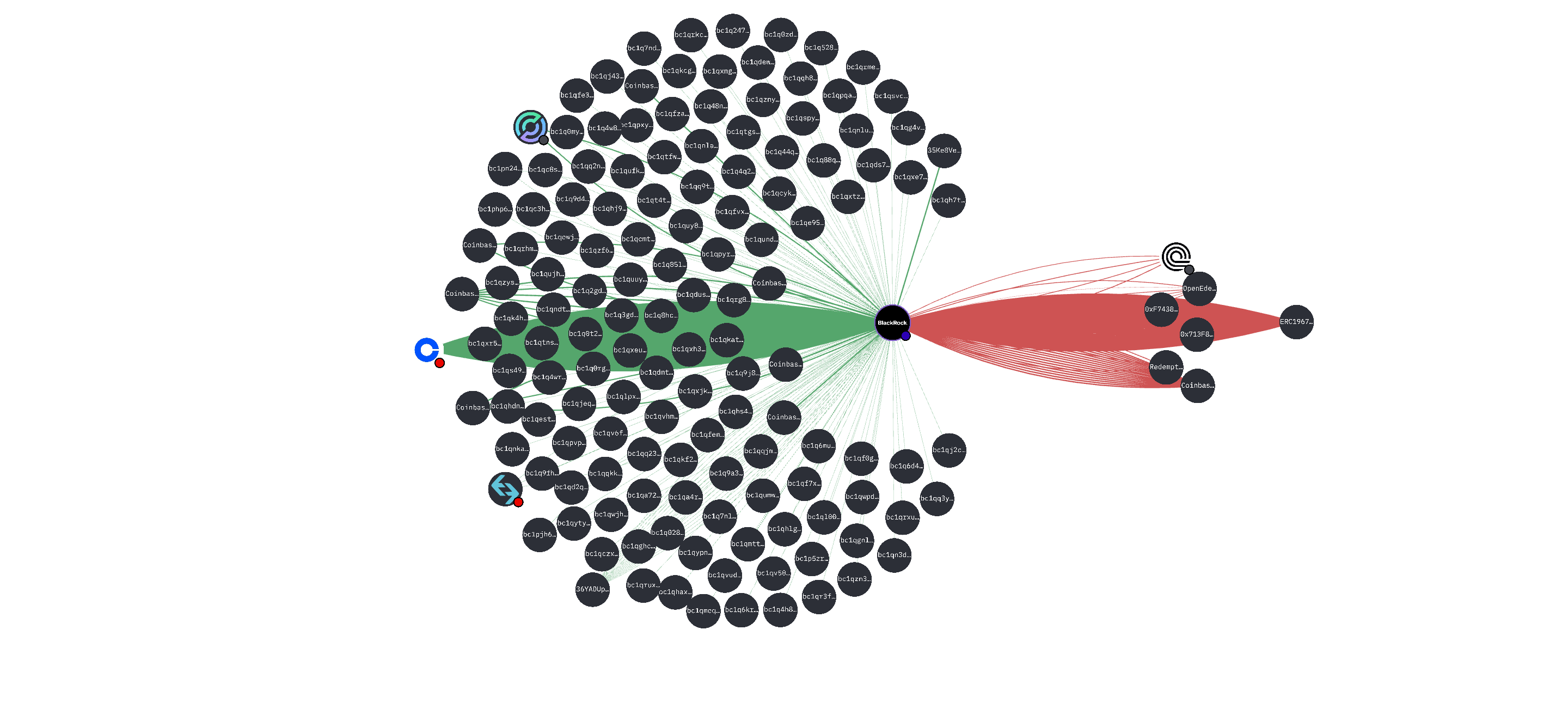

BlackRock now holds an extraordinary 60 billion value of Bitcoin (BTC) throughout its iShares Bitcoin Belief (IBIT), with 574,118.84380 BTC recorded on the ETF’s stability sheet. Latest knowledge from Farside Buyers exhibits that Bitcoin ETFs have lately acquired a complete of 188.7 million, with BlackRock alone getting $154.6 million — 81% of internet inflows.

BlackRock’s aggressive accumulation of Bitcoin has positioned it among the many largest institutional holders of the cryptocurrency, even surpassing MicroStrategy’s well-known holdings.

Larry Fink, the CEO, has additionally obtained market individuals speaking about Bitcoin’s potential by suggesting a value goal as excessive as $700,000 if extra establishments undertake it. He has been speaking with a sovereign wealth fund about allocating 2% to five% of their belongings to Bitcoin, which exhibits that even entities that normally keep away from threat have gotten .

Whereas Bitcoin continues to be BlackRock’s fundamental crypto funding, its $4 billion Ethereum ETF (ETHA) exhibits a much bigger plan to unfold out into digital belongings. The agency is specializing in Bitcoin and Ethereum, exhibiting that they assume blockchain will turn out to be an enormous a part of the monetary world, despite the fact that there are nonetheless a variety of unknowns on the subject of rules.

However, market analysts say, BlackRock’s big $60 billion Bitcoin funding — that is about 2.7% of the entire cryptocurrency provide — might completely change how cash flows and the way costs are set.

The IBIT ETF has been doing higher than its rivals, getting regular inflows even with Bitcoin’s latest ups and downs. Fink’s optimistic view traces up with the rising curiosity from establishments, however there are nonetheless some doubters who say that macroeconomic challenges and regulatory scrutiny might nonetheless be main elements to look at.