HBAR has remained in a chronic interval of consolidation, with restricted development during the last two months. Its repeated makes an attempt to interrupt out of the $0.40 resistance stage have failed, dampening dealer sentiment.

This lack of upward momentum has led to rising skepticism out there relating to the token’s short-term efficiency.

HBAR Merchants Change Their Opinion

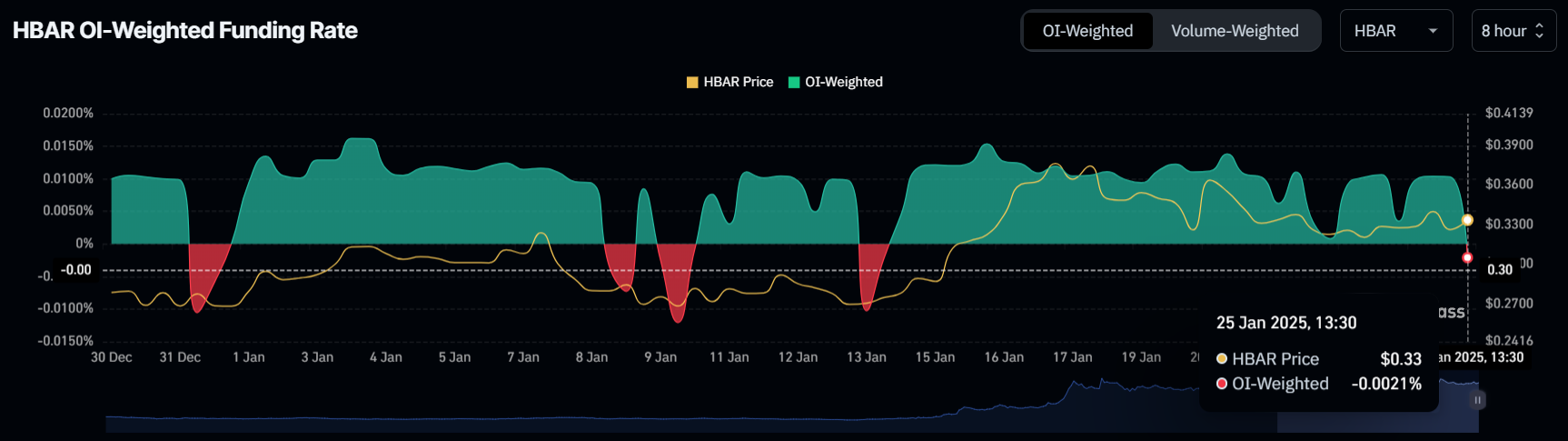

HBAR’s funding fee just lately dipped into the bearish zone after sustaining optimistic ranges for over 11 days. This shift signifies that merchants have turned bearish as brief contracts gained dominance over lengthy positions. The failed breakout makes an attempt have brought about merchants to reevaluate their outlook, resulting in a cautious stance on HBAR.

The rising choice for brief contracts suggests rising uncertainty amongst market members. This stems from skepticism about HBAR’s skill to beat resistance ranges, reinforcing the necessity for the token to safe stronger assist to regain investor confidence.

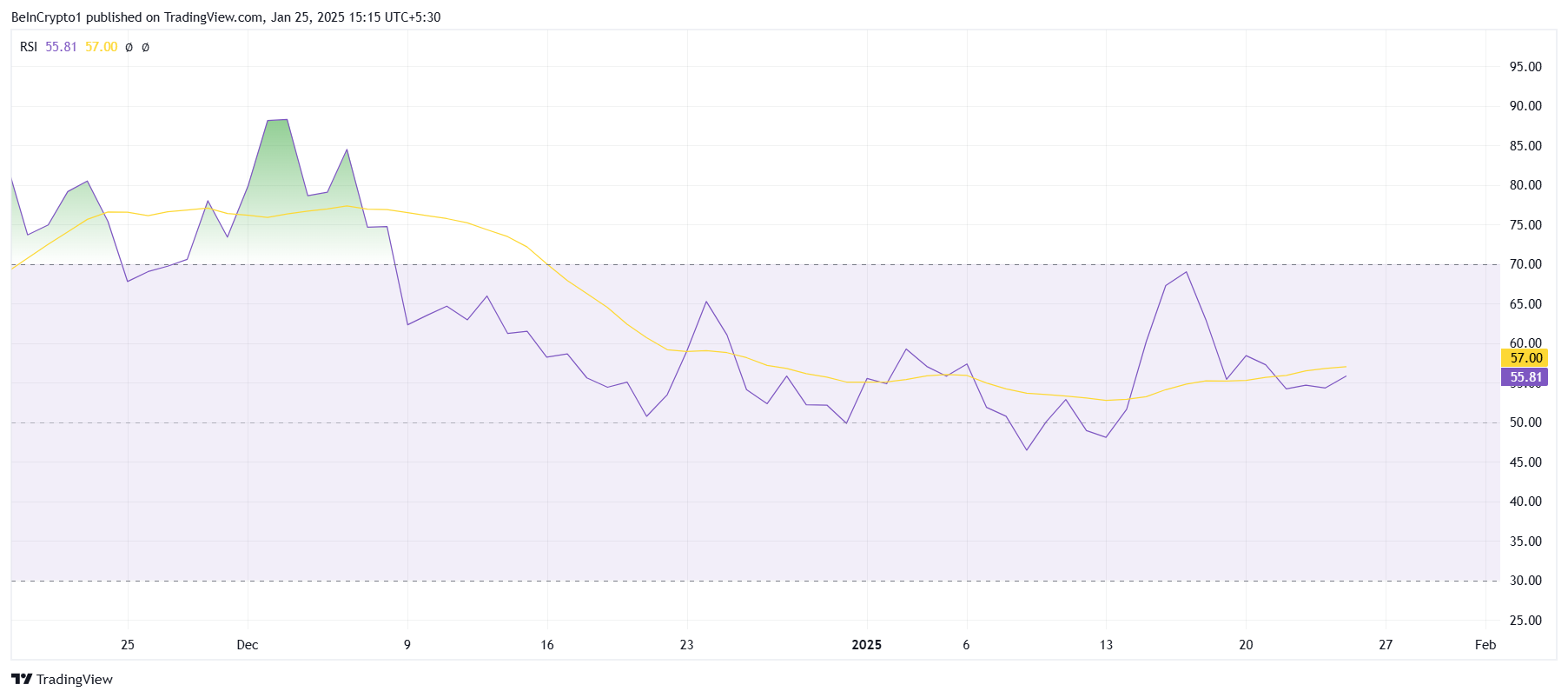

Regardless of the bearish sentiment, HBAR’s Relative Energy Index (RSI) stays above the impartial 50.0 mark. This means that the broader market momentum remains to be favoring bullish tendencies, offering a possible buffer towards bearish strain. The RSI’s place highlights that HBAR retains some underlying energy.

The RSI’s stability may stop HBAR from experiencing sharp declines, at the same time as bearish cues dominate short-term market sentiment. If the broader cryptocurrency market continues to carry bullish momentum, HBAR could discover assist and keep away from additional consolidation at decrease ranges.

HBAR Worth Prediction: Breaking Out

HBAR is at present buying and selling at $0.33, aiming to ascertain this stage as a assist ground. Efficiently doing so is essential for the token to problem the $0.39 resistance stage. A break above this resistance may set the stage for additional upward motion.

The blended market sentiments may play a pivotal position in figuring out HBAR’s course. If the token manages to rise past $0.39, it may rally towards $0.47, bringing it nearer to its all-time excessive of $0.57. This state of affairs would require sustained bullish momentum and renewed market confidence.

Nevertheless, a decline to $0.25 would seemingly lead to continued consolidation for HBAR. Any additional drop beneath this stage would invalidate the bullish outlook completely, signaling potential long-term weak point.

Disclaimer

In step with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.