Nasdaq has submitted a proposal to the US Securities and Change Fee (SEC) to allow in-kind creation and redemption for BlackRock’s iShares Bitcoin ETF (IBIT).

This request, filed on January 24, seeks to amend the ETF’s operational framework to permit direct Bitcoin transactions alongside the present cash-based mannequin.

BlackRock Bitcoin ETF Influx Streak Aligns With Nasdaq’s In-Form Push

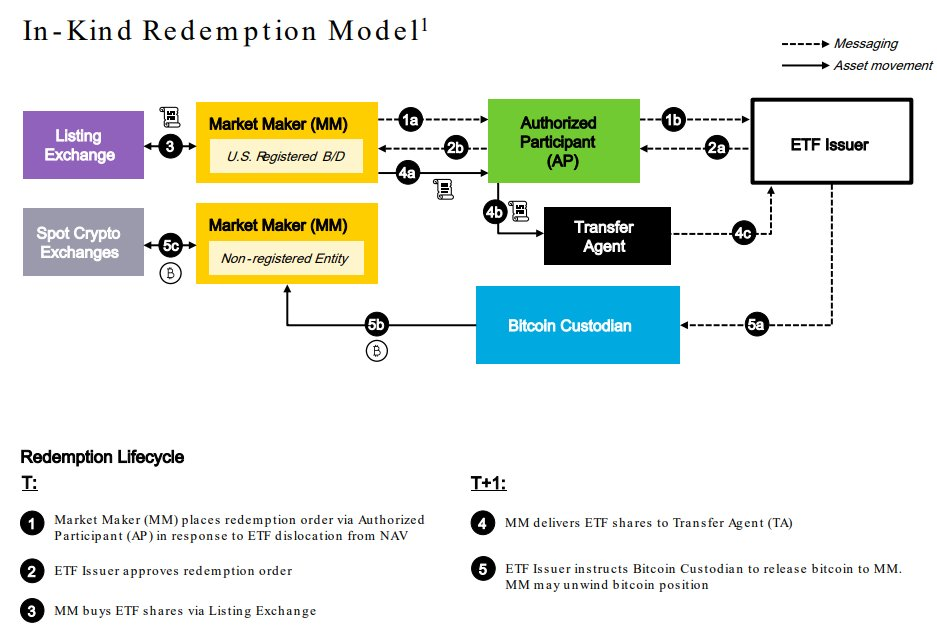

The proposed in-kind course of would simplify the ETF’s creation and redemption system, decreasing the variety of intermediaries concerned. Nevertheless, this characteristic can be unique to institutional members, leaving retail buyers out of the in-kind course of.

If authorized, the change would permit licensed members (APs) to settle transactions in Bitcoin as an alternative of changing the asset to money. This technique presents potential advantages, together with tax effectivity, improved worth alignment with Bitcoin’s market worth, and a extra streamlined course of.

“BTC ETFs are about to be extra environment friendly just like European ETPs. Authorised Individuals can now create and redeem instantly with Bitcoin than solely utilizing money,” crypto analyst Tom Wan said.

James Seyffart, an ETF analyst at Bloomberg, highlighted this mannequin’s operational effectivity. He famous that in-kind transfers contain fewer steps and events in comparison with the cash-based course of, which ought to make ETFs commerce extra easily. This effectivity may additional improve the enchantment of Bitcoin ETFs to institutional buyers.

“What it means is that ETFs ought to commerce much more effectively than they already do theoretically as a result of issues could be streamlined,” Seyffart mentioned.

The request from Nasdaq displays a rising demand for extra versatile ETF buildings. When spot Bitcoin ETFs first launched in January 2024, the SEC required issuers to make use of solely a money redemption mannequin as a result of the regulator “didn’t need brokers touching precise Bitcoin,” in accordance with Seyffart.

Nevertheless, because the market matures, requires in-kind transfers have gained momentum, with proponents arguing that they higher align with the decentralized nature of digital belongings.

The submitting coincides with a interval of great progress for IBIT. In response to information from SoSoValue, the ETF has just lately attracted over $2 billion in recent inflows throughout a six-day streak.

Since its debut, IBIT has amassed $39.7 billion in inflows, cementing its place because the top-performing spot Bitcoin ETF within the US.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.