- CoinShares and NYSE filed for Litecoin and XRP ETFs, signaling rising curiosity in increasing crypto funding choices.

- The SEC’s new crypto process pressure, led by Hester Peirce, goals to simplify rules and enhance transparency for the crypto business.

- Trump’s administration is anticipated to take a pro-crypto stance, doubtlessly paving the way in which for extra various spot ETFs.

A wave of crypto ETF filings hit regulators on Friday, marking a brand new push to broaden the vary of tradable digital belongings. CoinShares submitted registration papers for 2 new ETFs: the “CoinShares Litecoin ETF” and the “CoinShares XRP ETF.” In the meantime, the NYSE adopted go well with, submitting a 19b-4 for the “Grayscale Litecoin Belief,” sparking pleasure amongst market watchers.

However that wasn’t all. The NYSE additionally filed for a “Grayscale Solana Belief,” and each Grayscale filings hinted at plans to ultimately convert these trusts into spot ETFs. This flurry of exercise comes simply days after Donald Trump formally kicked off his second presidential time period, changing Gary Gensler as SEC chair with crypto-friendly Paul Atkins—a transfer signaling a possible pivot in crypto regulation.

A Shift in SEC Dynamics?

Underneath Trump’s administration, the SEC seems poised for a friendlier method towards crypto. The company not too long ago launched a brand new crypto process pressure, helmed by Commissioner Hester Peirce (usually referred to as “Crypto Mother”). In keeping with the SEC’s assertion, this staff will concentrate on creating clearer registration pathways, enhancing disclosure, and utilizing enforcement sources extra strategically.

Over the previous 12 months, the SEC has authorized spot Bitcoin and Ethereum ETFs, however filings at the moment are pouring in for a broader array of cryptocurrencies, together with DOGE, LTC, and XRP. It appears the business is bracing for a regulatory shift, with corporations dashing to place themselves forward of any new guidelines.

Market Impacts and Ripple Results

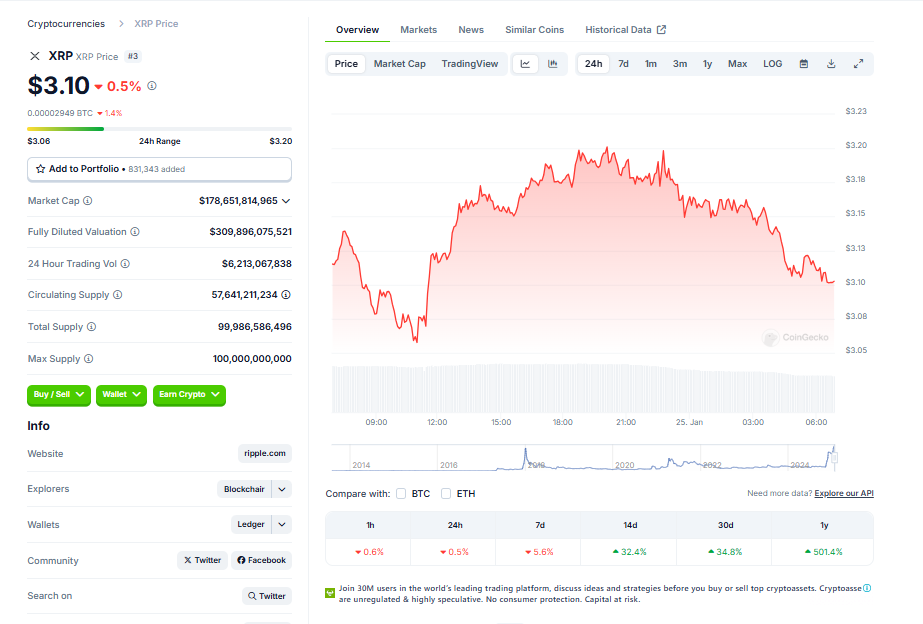

The filings arrive in opposition to a backdrop of optimism surrounding the brand new administration’s crypto stance. Litecoin (LTC) rose 2.49% following the information, whereas XRP noticed a slight dip of 0.42%. These ETFs might considerably enhance the market profile of Litecoin and XRP, providing institutional buyers simpler entry to those belongings.

The crypto neighborhood is now speculating on what’s subsequent. Will the SEC ship on expectations of streamlined regulation? And the way may these modifications reshape the aggressive panorama for main tokens like XRP and LTC?