- Solana’s potential CME futures launch may appeal to institutional buyers and increase its market credibility.

- SOL’s bullish breakout suggests potential targets at $316.25 and $343.03 if momentum sustains.

- Key help ranges at $246.54 and $216.90 might supply shopping for alternatives in case of a pullback.

Solana (SOL) continues to attract consideration within the crypto world, with whispers of an upcoming launch of SOL futures on the CME Group platform circulating out there. If this rumor proves true, it could possibly be an enormous leap for Solana, as futures on a significant alternate like CME would deliver a way of credibility and open the door to institutional buyers who’ve been sitting on the sidelines.

Celebrated for its lightning-fast blockchain and minimal transaction prices, Solana has already carved out its area of interest as a best choice for decentralized purposes (dApps) and DeFi initiatives. Including CME futures to the combo may increase its attraction even additional, injecting liquidity into the market and reinforcing its place as a heavyweight within the ever-evolving crypto panorama.

SOL Worth Motion: Bulls Eye $300 and Past

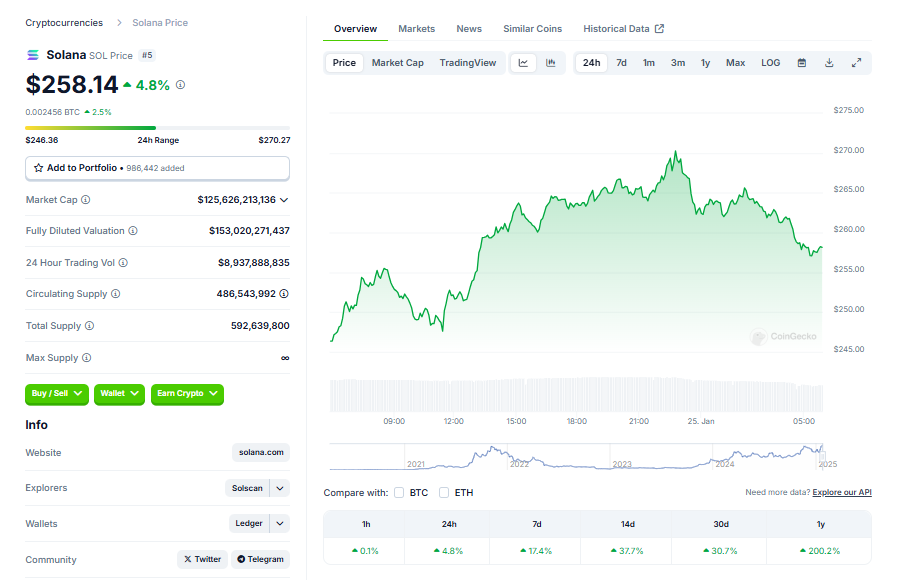

On the 4-hour chart, SOL is flashing indicators of bullish power after breaking out of a descending channel, which ended a corrective W-X-Y construction. This breakout ignited a robust five-wave rally, sending SOL hovering to $294 earlier than settling into its present consolidation part.

Now, we see a symmetrical triangle taking form—typically an indication of indecision, however on this case, it has all of the makings of a bull flag. If the development holds, this sample may arrange SOL for one more push to new highs. The Relative Energy Index (RSI) hovers simply above impartial, hinting at growing bullish momentum however leaving room for additional positive aspects.

Key ranges to look at: quick resistance sits at $264.87 (0.236 Fibonacci retracement), with robust help at $246.54 (0.382 Fibonacci stage). A breakout past resistance may affirm the following leg of SOL’s upward journey.

Brief-Time period Worth Prediction

Zooming into the 15-minute chart, SOL seems to be consolidating inside a symmetrical triangle, following wave (v)’s peak at $294 on Jan 19. This sample might both precede a bullish continuation or a short-term corrective pullback.

- Bullish Situation: If SOL breaks upward, it may kick off a recent impulse wave, with Fibonacci extensions pointing to potential targets at $316.25 (0.786 extension), $343.03 (1.0 extension), and even $420 (1.618 extension) in an prolonged rally.

- Bearish Situation: A breakdown beneath the triangle may sign a transfer towards $216.90 (0.618 Fibonacci retracement), providing potential purchase alternatives for these ready on the sidelines.

Is the Correction Over?

The massive query stays: has the ABC correction from Solana’s all-time excessive ended, or is there extra draw back to come back?

Within the bullish case, the correction might have ended on Jan 23 with a better low at $242. If that’s the case, the uptrend may quickly resume, aiming for a brand new all-time excessive. Conversely, within the bearish case, SOL may dip additional to $216 earlier than rallying.

Key Ranges to Monitor

Resistance:

- Quick: $264.87 (0.236 Fibonacci retracement).

- Key: $316.25 (0.786 Fibonacci extension).

- Main: $343.03 (1.0 Fibonacci extension).

Assist:

- Quick: $246.54 (0.382 Fibonacci retracement).

- Key: $216.90 (0.618 Fibonacci retracement).

- Essential: $195.81 (0.786 Fibonacci retracement).

Brief-Time period Goal: Above $316.25 if bullish momentum builds.

Invalidation Zone: Under $216.90, suggesting additional correction is probably going.

This evaluation makes use of Elliott Wave Principle, Fibonacci instruments, and RSI to map potential paths for SOL. As consolidation continues, merchants are watching carefully—will the breakout affirm bulls are in management, or will bears get the higher hand? Keep tuned.