The current divergence in U.S. Treasury yields, the place shorter-term yields have been declining whereas longer-term yields are on the rise, has sparked important curiosity throughout monetary markets. This growth offers important insights into macroeconomic situations and potential methods for Bitcoin buyers navigating these unsure occasions.

We’ve just lately noticed a divergence in U.S. Treasury yields, with shorter-term yields declining whereas longer-term yields are rising. 🏦

What do you suppose this indicators for the federal government bond market, Bitcoin, and the broader monetary markets? 🤓

Let me know 👇 pic.twitter.com/eJmj6hhyKV

— Bitcoin Journal Professional (@BitcoinMagPro) January 27, 2025

Treasury Yield Dynamics

Treasury yields mirror the return buyers demand to carry U.S. authorities debt, and they’re a important barometer for the financial system and financial coverage expectations. Right here’s a snapshot of what’s taking place:

- Brief-term yields falling: Declining yields on short-term Treasury bonds, such because the 6-month yield, counsel that markets are anticipating the Federal Reserve will pivot to price cuts in response to financial slowdown dangers or decrease inflation expectations.

- Lengthy-term yields rising: In the meantime, rising yields on longer-term bonds, just like the 10-year Treasury yield, point out rising considerations about persistent inflation, fiscal deficits, or higher-term premiums required by buyers for holding long-duration debt.

This divergence in yields typically hints at a shifting financial panorama and may function a sign for buyers to recalibrate their portfolios.

Associated: We’re Repeating The 2017 Bitcoin Bull Cycle

Why Treasury Yields Matter for Bitcoin Traders

Bitcoin’s distinctive properties as a non-sovereign, decentralized asset make it significantly delicate to macroeconomic developments. The present yield surroundings might form Bitcoin’s narrative and efficiency in a number of methods:

- Inflation Hedge Enchantment:

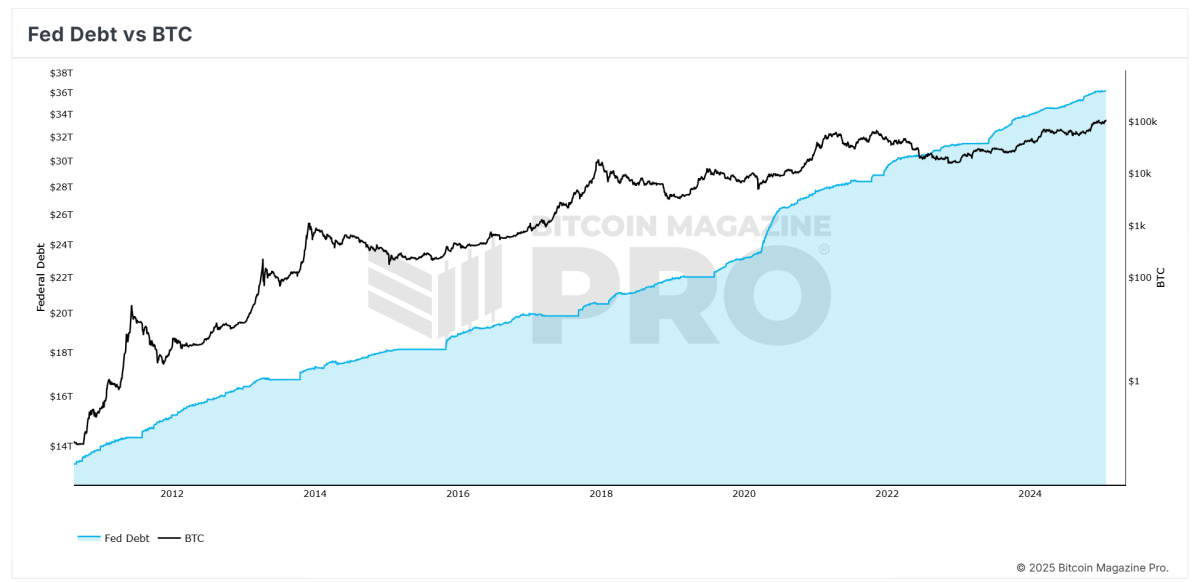

- Rising long-term yields might mirror persistent inflation considerations. Traditionally, Bitcoin has been seen as a hedge in opposition to inflation and forex debasement, doubtlessly growing its enchantment to buyers trying to defend their wealth.

- Danger-On Sentiment:

- Declining short-term yields might point out looser monetary situations forward. Simpler financial coverage typically fosters a risk-on surroundings, benefiting property like Bitcoin as buyers search increased returns.

- Monetary Instability Hedge:

- Divergence in yields, significantly if it results in an inverted yield curve, can sign financial instability or recession dangers. Throughout such durations, Bitcoin’s narrative as a safe-haven asset and different to conventional finance might acquire traction.

- Liquidity Issues:

- Decrease short-term yields scale back borrowing prices, doubtlessly resulting in elevated liquidity within the monetary system. This liquidity typically spills into danger property, together with Bitcoin, fueling upward worth momentum.

Broader Market Insights

The impression of yield divergence extends past Bitcoin to different areas of the monetary ecosystem:

- Inventory Market: Decrease short-term yields usually enhance equities by decreasing borrowing prices and supporting valuation multiples. Nonetheless, rising long-term yields can strain development shares, significantly these delicate to increased low cost charges.

- Debt Sustainability: Larger long-term yields enhance the price of financing for governments and companies, doubtlessly straining closely indebted entities and creating ripple results throughout world markets.

- Financial Outlook: The divergence might mirror market expectations of slower near-term development coupled with longer-term inflationary pressures, signaling potential stagflation dangers.

Associated: What Bitcoin Worth Historical past Predicts for February 2025

Takeaways for Bitcoin Traders

For Bitcoin buyers, understanding the interaction between Treasury yields and macroeconomic developments is important for knowledgeable decision-making. Listed below are some key takeaways:

- Monitor Financial Coverage: Hold an in depth eye on Federal Reserve bulletins and financial knowledge. A dovish pivot might create tailwinds for Bitcoin, whereas tighter coverage would possibly pose short-term challenges.

- Diversify and Hedge: Rising long-term yields might result in volatility throughout asset courses. Diversifying into Bitcoin as a part of a broader portfolio technique might assist hedge in opposition to inflation and financial uncertainty.

- Leverage Bitcoin’s Narrative: In an surroundings of fiscal deficits and financial easing, Bitcoin’s story as a non-inflationary retailer of worth turns into extra compelling. Educating new buyers on this narrative might drive additional adoption.

Conclusion

The divergence in Treasury yields underscores shifting market expectations round development, inflation, and financial coverage—elements which have far-reaching implications for Bitcoin and broader monetary markets. For buyers, understanding these dynamics and positioning accordingly can unlock alternatives to capitalize on Bitcoin’s distinctive function in a quickly altering financial panorama. As at all times, staying knowledgeable and proactive is essential to navigating these complicated occasions.

For ongoing entry to reside knowledge, superior analytics, and unique content material, go to BitcoinMagazinePro.com.

Disclaimer: This text is meant for informational functions solely and doesn’t represent monetary recommendation. Readers are inspired to conduct thorough impartial analysis earlier than making funding choices.