Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Trade Fee (SEC) that might rework the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, targeted on BlackRock’s iShares Bitcoin Belief (IBIT), seeks to introduce “in-kind” bitcoin redemptions, providing a streamlined and cost-effective different to the present money redemption course of.

JUST IN: BlackRock information to permit in-kind creations and redemptions for its spot Bitcoin ETF! pic.twitter.com/SSigX4utRG

— Bitcoin Journal (@BitcoinMagazine) January 24, 2025

What Are In-Type Redemptions?

Beneath the proposed system, institutional gamers referred to as approved contributors (APs) – answerable for creating and redeeming ETF shares – may choose to change ETF shares instantly for bitcoin quite than money. This innovation eliminates the necessity to promote bitcoin to generate money for redemptions, simplifying the method whereas reducing operational prices.

Whereas this selection would solely be accessible to institutional contributors and never retail traders, specialists recommend that the improved effectivity may not directly profit on a regular basis traders. By lowering operational hurdles, in-kind redemptions have the potential to make Bitcoin ETFs extra streamlined and cost-efficient for all market contributors.

Associated: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Value Amid Inflation Worries

Why the Change?

The money redemption mannequin, applied in January 2024 when spot Bitcoin ETFs have been first authorised by the SEC, was designed to maintain monetary establishments and brokers from dealing with bitcoin instantly. This strategy prioritized regulatory simplicity in the course of the nascent phases of Bitcoin ETFs.

Nevertheless, the fast development of the Bitcoin ETF market has created new alternatives to enhance its infrastructure. With evolving rules and a extra mature digital asset ecosystem, Nasdaq and BlackRock now see a pathway to undertake a extra environment friendly in-kind redemption mannequin.

Advantages of In-Type Redemptions

- Operational Effectivity:

- Reduces the complexity and variety of steps within the redemption course of.

- Streamlines ETF operations, saving each time and prices.

- Tax Benefits:

- Avoiding the sale of bitcoin minimizes capital positive aspects distributions, making ETFs extra tax-efficient for institutional traders.

- Market Stability:

- Reduces promote strain on bitcoin throughout redemptions, doubtlessly stabilizing the asset’s worth.

Regulatory and Market Context

Nasdaq’s proposal coincides with vital regulatory developments beneath the pro-Bitcoin Trump administration. Latest coverage shifts, such because the repeal of Employees Accounting Bulletin 121 (SAB 121), have paved the best way for broader cryptocurrency adoption. The removing of SAB 121 eradicated limitations that beforehand discouraged banks from providing cryptocurrency custody providers, making a extra favorable setting for improvements like Nasdaq’s in-kind redemption mannequin.

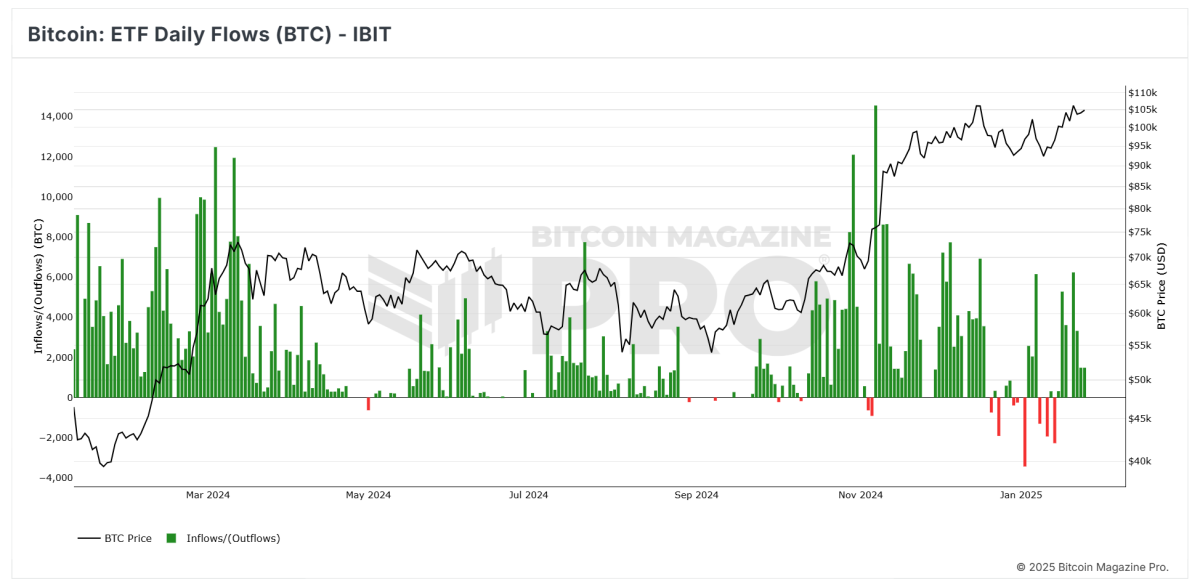

BlackRock’s Bitcoin ETF: A Market Chief

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market chief, with over $60 billion in inflows. The fund’s constant development highlights institutional demand for Bitcoin funding merchandise. Improvements like Nasdaq’s in-kind redemption mannequin may additional improve IBIT’s attraction to institutional traders.

Word the constant upward development of inexperienced candles, reflecting robust and regular inflows.

Associated: What Bitcoin Value Historical past Predicts for February 2025

Conclusion

Nasdaq’s proposal to introduce in-kind redemptions for BlackRock’s Bitcoin ETF represents a pivotal second for the Bitcoin ETF market. By simplifying redemption processes, providing tax efficiencies, and lowering promote strain on bitcoin, the mannequin stands to considerably improve the attraction and efficiency of Bitcoin ETFs for institutional traders.

Because the Bitcoin ETF market matures and regulatory help continues to develop, improvements like this are poised to drive additional adoption. If authorised, Nasdaq’s proposal may mark a essential step ahead, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset funding whereas not directly benefiting retail contributors.

With a positive regulatory local weather and rising institutional curiosity, the way forward for Bitcoin ETFs seems to be brighter than ever.