Arthur Hayes predicted a dramatic crash in Bitcoin’s worth however claimed that it could rebound to a brand new all-time excessive by the top of the 12 months.

The vast majority of his arguments have been unrelated to as we speak’s DeepSeek-related market turmoil, however he claimed that these occasions might function a catalyst.

Arthur Hayes Expects a Mini-Monetary Disaster for Bitcoin

Arthur Hayes, former CEO of BitMEX, has dramatically modified his short-term predictions for Bitcoin. Earlier this month, he claimed that the worth of Bitcoin would peak in mid-March earlier than dealing with a extreme correction.

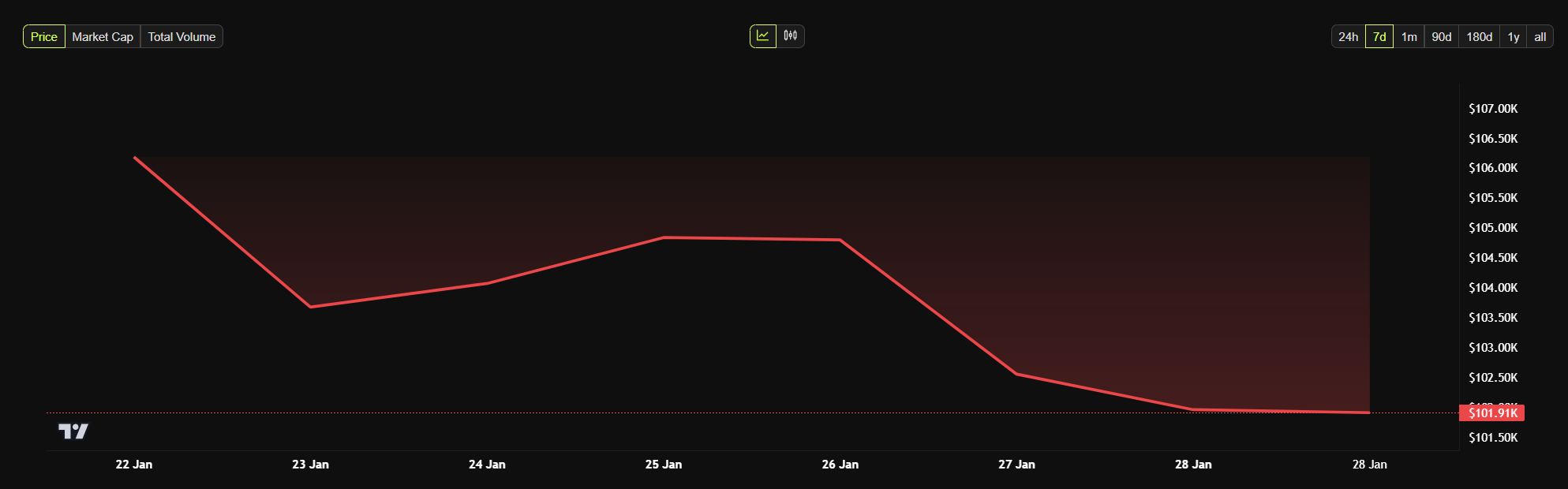

Nonetheless, as we speak, Hayes up to date his prediction to assert that BTC was already on the precipice of this decline.

“Reversing the order of my tryptic essay collection. I’m calling for a $70,000 to $75,000 correction in BTC, a mini monetary disaster, and a resumption of cash printing that may ship us to $250,000 by the top of the 12 months,” Hayes claimed.

Hayes later posted an in depth breakdown of this projection on his private weblog. He famous many world financial components.

Hayes’ short-term bearish prediction for Bitcoin relies on the deteriorating world fiat liquidity atmosphere. That is being pushed by rising US 10-year Treasury yields, a tightening Federal Reserve, and slowed cash printing in main economies just like the US, China, and Japan.

These components have elevated monetary stress. In flip, it’s making a detrimental atmosphere for fiat-priced belongings, together with Bitcoin, which Hayes argues is extremely delicate to world liquidity circumstances.

“Why do I imagine in a 30% correction for Bitcoin? A lot of these pullbacks happen typically all through the bull market, given how risky Bitcoin is. Extra importantly, the market exceeded the March 2024 all-time excessive proper after Trump received re-election in early November 2024. Many others, together with myself, have written extensively about how Trumpism heralds an acceleration of cash printing within the US and the way different nations would reply in sort with cash printing applications of their very own to spice up their home economies,” Hayes wrote.

His preliminary predictions have been unrelated to DeepSeek, the Chinese language AI protocol that decimated the crypto market as we speak. Nonetheless, DeepSeek’s affect solely elevated his conviction.

Though BTC ETFs hit document volumes on Friday, long-term holders offered their belongings in substantial portions. Crypto-related companies like MicroStrategy additionally felt the sting of DeepSeek regardless of shopping for enormous quantities of BTC.

For Hayes, nonetheless, this solely enhanced pre-existing tendencies in Bitcoin.

Though President Trump has promised pro-crypto adjustments at many regulators, Hayes believes “the Fed will do what it could to frustrate the Trump agenda.” In brief, he thinks private vendettas will intrude with coherent coverage.

Hayes additionally examined just a few completely different nations’ financial insurance policies and the way they could affect Bitcoin. Finally, he stays assured that any doldrums might be short-term and solely result in better positive factors.

For now, nonetheless, the worth drops might show fairly painful.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.