Bitcoin’s worth dipped under the $100,000 mark throughout Monday’s intraday buying and selling session. Whereas the main coin’s worth has since rebounded to commerce at $102,691 at press time, its short-term holders (STHs) nonetheless really feel the sting of the non permanent worth drop.

On-chain information reveals that this cohort of BTC holders continues to promote at a loss.

Bitcoin Quick-Time period Holders Depend Their Losses

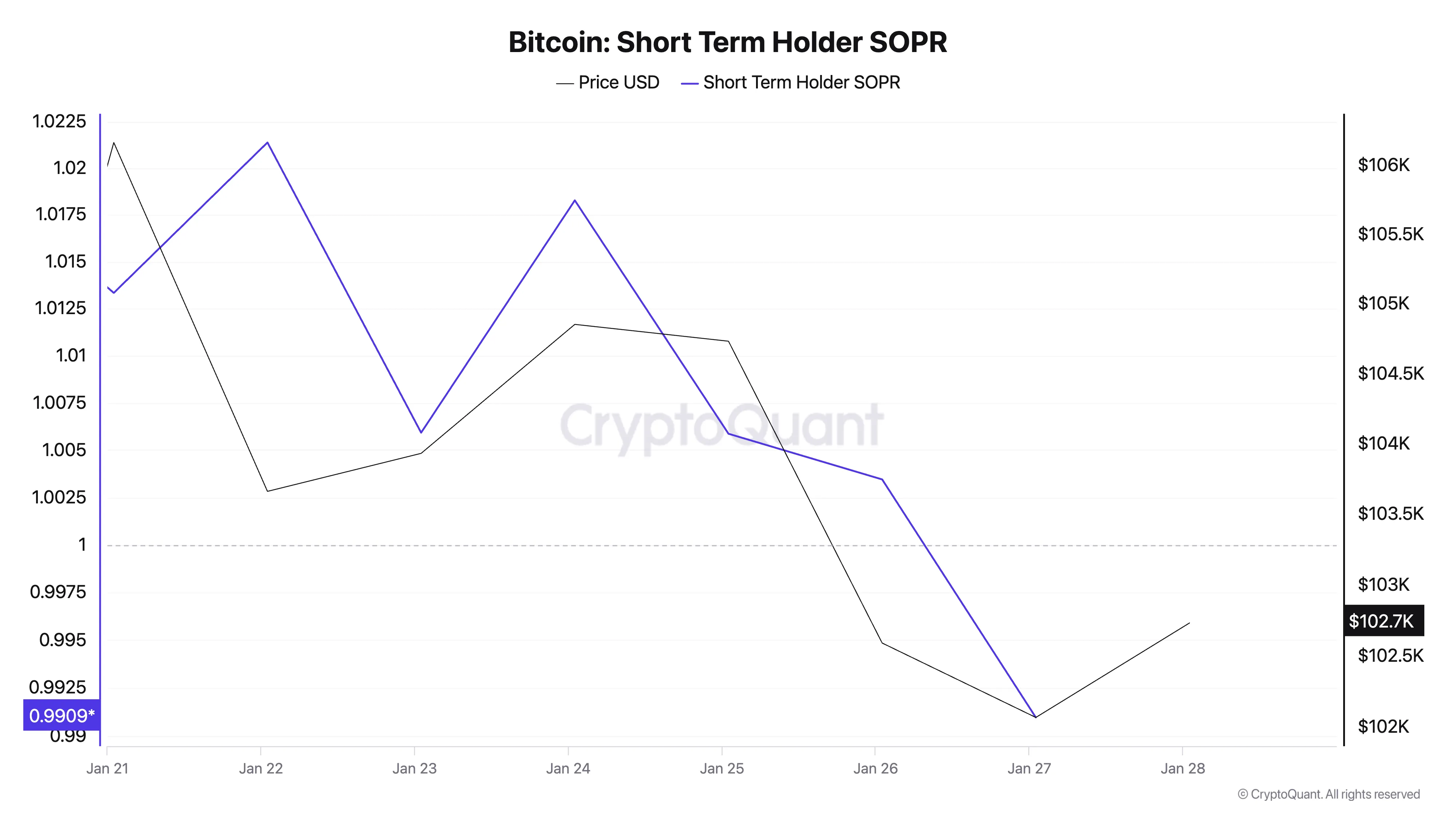

In response to information from CryptoQuant, the Spent Output Revenue Ratio (SOPR) for Bitcoin’s STHs has trailed downward over the previous week. Because the coin’s worth broke under the $100,000 mark yesterday, the metric’s worth fell below 1. As of this writing, it’s at 0.99.

The STH-SOPR gauges the profitability of the short-term holders of a selected crypto asset. It typically affords insights into whether or not buyers who’ve held a particular asset for 3 to 6 months are in a worthwhile or unprofitable place.

If the STH-SOPR is above 1, it signifies that short-term holders are, on common, promoting their cash at a revenue. Conversely, if the STH-SOPR is under 1, it means that these holders are promoting at a loss.

At 0.99 as of this writing, BTC’s STH-SOPR means that buyers who’ve held their cash for lower than six months are, on common, promoting at a loss under their acquisition foundation.

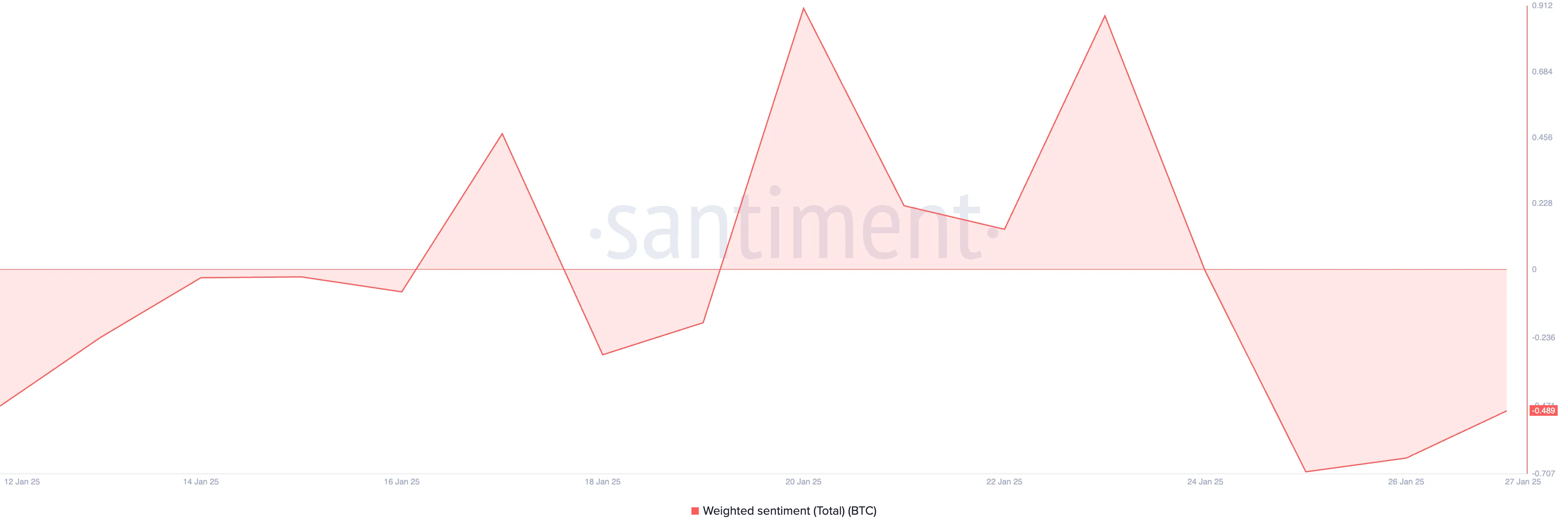

Though BTC’s worth has rebounded from Monday’s low, a unfavourable bias continues to path the king coin. That is evidenced by its unfavourable weighted sentiment, presently at -0.48.

An asset’s weighted sentiment measures its total optimistic or unfavourable bias. It tracks the quantity of social media mentions and the sentiment expressed in these mentions.

As with BTC, a unfavourable worth is a bearish sign. It signifies that buyers have change into more and more skeptical in regards to the token’s near-term outlook, inflicting them to commerce much less.

BTC Worth Prediction: Will It Reclaim $109K or Slip Under $100K?

BTC’s worth will shed its latest good points if this unfavourable bias strengthens and buying and selling momentum wanes. It might drop under $100,000 to commerce at $99,378 in that case.

Conversely, if the uptrend is sustained and market sentiment improves, the coin might try to reclaim its all-time excessive of $109,356.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.