As markets await the Federal Open Market Committee’s (FOMC) choice on January 29, crypto buyers discover themselves at a important juncture. Following the primary ever crypto govt order by US President Donald Trump and yesterday’s DeepSeek worth crash, macroeconomics are as soon as within the focus.

Crypto Market FOMC Preview

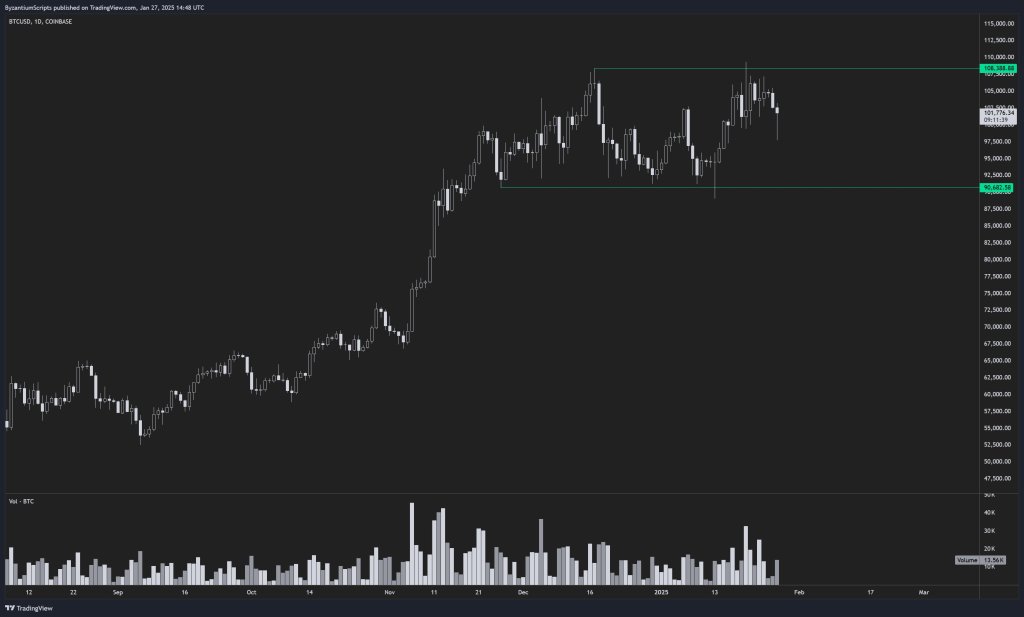

Crypto analyst Byzantine Normal (@ByzGeneral) has recognized a consolidation vary between $90,682 and $108,388 for Bitcoin. He anticipates restricted motion previous to the FOMC assembly, citing three potential situations for the way the market would possibly reply as soon as the Fed concludes its discussions: “Like I stated in my thread yesterday, we’re actually simply consolidating between this vary ($90,682 – $108,388). And I anticipate nothing materials to occur till Wednesday FOMC. After which there are 3 prospects with solely 2 outcomes…FOMC shock dovish -> escape of vary, FOMC impartial -> chop in vary for longer, FOMC hawkish -> chop in vary for longer”

Crypto market members typically interpret a dovish stance—one which alerts or enacts rate of interest cuts or an prolonged pause—as supportive of risk-on property, together with Bitcoin and crypto. A shock dovish tilt might be the catalyst for breaking the present buying and selling vary, in response to Byzantine Normal. A impartial or hawkish outlook, however, would possibly imply an prolonged interval of sideway worth motion.

Of their evaluation, banking big ING laid out the broader macroeconomic context that would affect the Fed’s choice and projections for 2025. In accordance with ING: “Federal Reserve set for an prolonged pause. After 100bp of fee cuts the Fed has signalled it wants proof of financial weak point and extra subdued inflation prints to justify additional coverage loosening. President Trump’s low tax, light-touch regulation insurance policies must be excellent news for progress, whereas immigration controls and commerce tariffs present upside threat for costs, suggesting we may have a protracted watch for the following lower.”

The December FOMC noticed a 25bp fee lower, however the subsequent commentary advised a slower and extra gradual path of easing for 2025, probably totaling simply 50bp for the 12 months. ING factors out that robust financial efficiency and protracted inflation pressures present much less incentive for the Fed to decrease charges shortly. The financial institution additionally highlights a lingering risk that the Fed might even undertake a extra hawkish tone than it has publicly acknowledged thus far:

“In actual fact, the danger is that the Fed is definitely extra hawkish than they indicated… Nevertheless, with President Trump having simply received re-election and his coverage plans differing so starkly from President Joe Biden’s, Fed Chair Jay Powell acknowledged that some felt the necessity to incorporate the potential coverage shifts into their December 2024 projections forward of time. Nevertheless, not all did and since his inauguration, there was little signal of any moderation in Trump’s key coverage thrust.”

ING’s economists additional observe that market members largely anticipate no coverage change on January 29, whereas the financial institution itself beforehand anticipated a March fee lower—an occasion it now sees as more and more unlikely: “Which means no change to financial coverage is a certainty on 29 January and it makes our earlier name of a March fee lower look unlikely – at the moment simply 6bp of a 25bp transfer is discounted by monetary markets.”

Nevertheless, ING nonetheless forecasts three fee cuts for 2025, hinging on a gradual cooling of the labor market and moderating wage pressures. They emphasize that rising Treasury yields, increased borrowing prices, and a stronger greenback may mix to tighten monetary situations, finally forcing the Fed’s hand later within the 12 months: “Subsequently we take the view that the Fed might must push more durable and lower charges somewhat additional than at the moment priced by markets, however that’s extra prone to be a second half of 2025 growth.”

On the stability sheet discount (quantitative tightening, or QT), ING sees the Fed presumably ending QT in 2025 if extra liquidity shrinks to ranges under what the central financial institution deems snug. The financial institution pegs $3 trillion in reserves as a important threshold: “We’re at the moment at US$3.5tn. So we’re snug. On the identical time, the reverse repo stability is operating at US$125bn, and if that have been to hit zero, then we’d hit some extent of tightness. That’s shut, as QT is operating at US$60bn monthly. QT might have to finish by mid-2025 based mostly on a easy extrapolation of this.”

Relating to forex markets, ING means that the greenback may retain its power if the Fed stays cautious about easing: “December’s FOMC assembly actually added help to the greenback bull run… it’s laborious to see the January FOMC occasion threat being learn extra dovishly… We doubt the Fed is able to push again towards these market expectations. This could maintain greenback fee spreads comparatively huge and argues that the FOMC is not going to be the rationale the greenback corrects decrease.”

With President Donald Trump beginning his second time period, questions in regards to the Fed’s independence have resurfaced. Traditionally, Chair Jerome Powell has deflected solutions of political affect: On the upcoming FOMC assembly, Powell may be anticipated to dodge questions in regards to the Fed’s independence and the potential impression by Trump.

The President, nonetheless, has been express about his views on rates of interest. When requested if he anticipated the Fed to hearken to his calls for for fee cuts, Trump responded: “I’d make a robust assertion.” After being requested if he expects the Fed to pay attention, he answered “Yeah.”

At press time, the full crypto market cap stood at $3.45 trillion.

Featured picture from Shutterstock, chart from TradingView.com