Este artículo también está disponible en español.

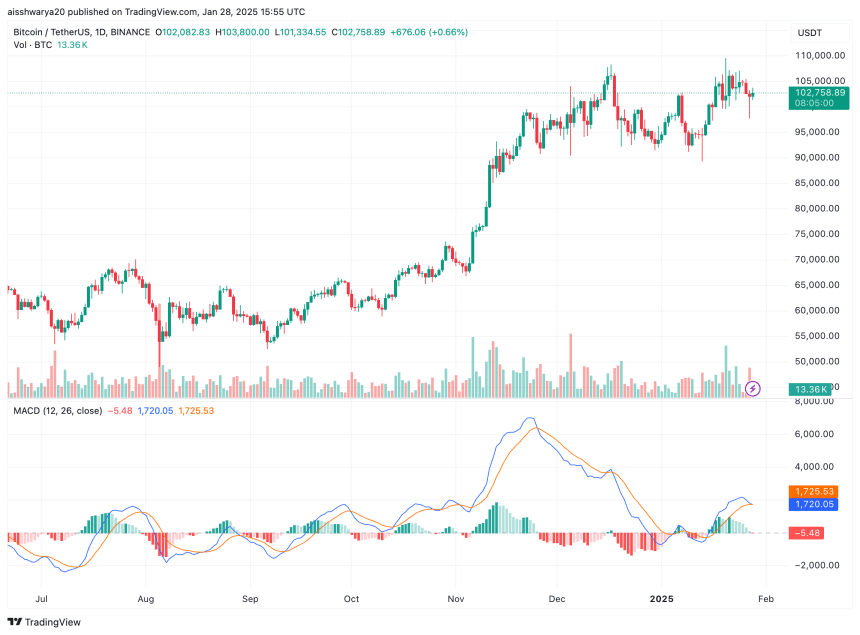

Yesterday, the NASDAQ slid 3% as China’s low-cost AI mannequin, DeepSeek, despatched shockwaves by way of the tech trade, triggering a steep sell-off in US chipmakers. Whereas Bitcoin (BTC) additionally dipped to a low of $97,777, the flagship cryptocurrency has since recovered most of its losses, buying and selling above the important thing $100,000 value stage.

Bitcoin Holding Sturdy Regardless of NASDAQ Promote-Off

Bitcoin’s resiliency amid the inventory market sell-off is ‘extraordinarily bullish’, says Bitwise’s European Head of Analysis, Andre Dragosch. They highlighted that the main digital asset has outperformed NASDAQ over the previous two days and is at present displaying restricted draw back threat.

It’s price noting that BTC has gained near $5,000 since yesterday’s dip to $97,777, buying and selling at $102,758 on the time of writing. In distinction, the S&P 500 closed yesterday’s final buying and selling session down 1.5%.

Associated Studying

The decoupling between BTC and the inventory market is additional evidenced by differing investor sentiments. In accordance with the ‘Concern & Greed Index’, the inventory market at present sits at 44/100, indicating lingering worry amongst traders after yesterday’s market downturn.

Conversely, the Index’s studying for the crypto market stands at 72/100, suggesting a sentiment of greed towards digital property. Nonetheless, this might additionally point out that the crypto market is lagging behind the inventory market and will expertise an extra drawdown whereas the inventory market seeks stability.

In the meantime, Keith Alan, co-founder of Materials Indicators, shared a submit on X, viewing BTC’s temporary stoop as a dip-buying alternative and including to his BTC place. Alan famous:

That wick to $97,750 shouldn’t shake your confidence on this Bitcoin bull run, however it ought to remind you {that a} deep correction can, and more than likely will, develop when the market will get over hyped.

Equally, seasoned crypto dealer and analyst Rekt Capital shared insights on Bitcoin’s present value momentum, stating that it’s “nonetheless comparatively early” in BTC’s parabolic part for this market cycle. Traditionally, this part has lasted about 300 days on common, and BTC is at present at day 82.

BTC Prime Not In But?

Though BTC reached a brand new all-time excessive (ATH) of $108,786 on January 20, some analysts consider the highest shouldn’t be but in for the cryptocurrency. In accordance with evaluation by Stockmoney Lizards, BTC may attain a cycle peak of $400,000 by November 2025.

Associated Studying

An additional rally for BTC appears believable, as ‘whales’ have began accumulating the cryptocurrency since Donald Trump’s inauguration. Different projections recommend BTC could peak at $249,000 underneath the Trump administration.

On a longer-term horizon, BTC may attain as excessive as $1.5 million in accordance to Metcalfe’s Legislation. At press time, BTC trades at $102,758, up 1.1% prior to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com