Disclaimer: The opinions expressed by our writers are their very own and don’t signify the views of U.At this time. The monetary and market data offered on U.At this time is meant for informational functions solely. U.At this time isn’t responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary specialists earlier than making any funding choices. We consider that every one content material is correct as of the date of publication, however sure presents talked about could now not be out there.

The world’s largest crypto alternate, Binance, simply skilled a mass exodus of Ethereum (ETH). In accordance with a report from Whale Alert, 24,600 ETH, price about $78.12 million in present costs, simply left the alternate in a single tranche to an unknown vacation spot.

The recipient pockets, with the tackle “0xe9b,” that acquired these hundreds of thousands within the main altcoin is unknown to Whale Alert’s database. Nonetheless, Arkham’s extra refined information identifies this tackle as StakeStone — a liquidity-providing protocol that operates inside the Berachain ecosystem and permits Bitcoin and Ethereum to be staked in an optimized method.

Possibly this was only a routine liquidity adjustment. Possibly not. This doesn’t preclude it being a giant whale inside the Berachain and Ethereum networks who determined to withdraw $78.12 million to its personal storage.

Nonetheless, the ripple impact on the worth of the altcoin might not be as apparent because it often is when some main participant withdraws massive sums from the centralized alternate.

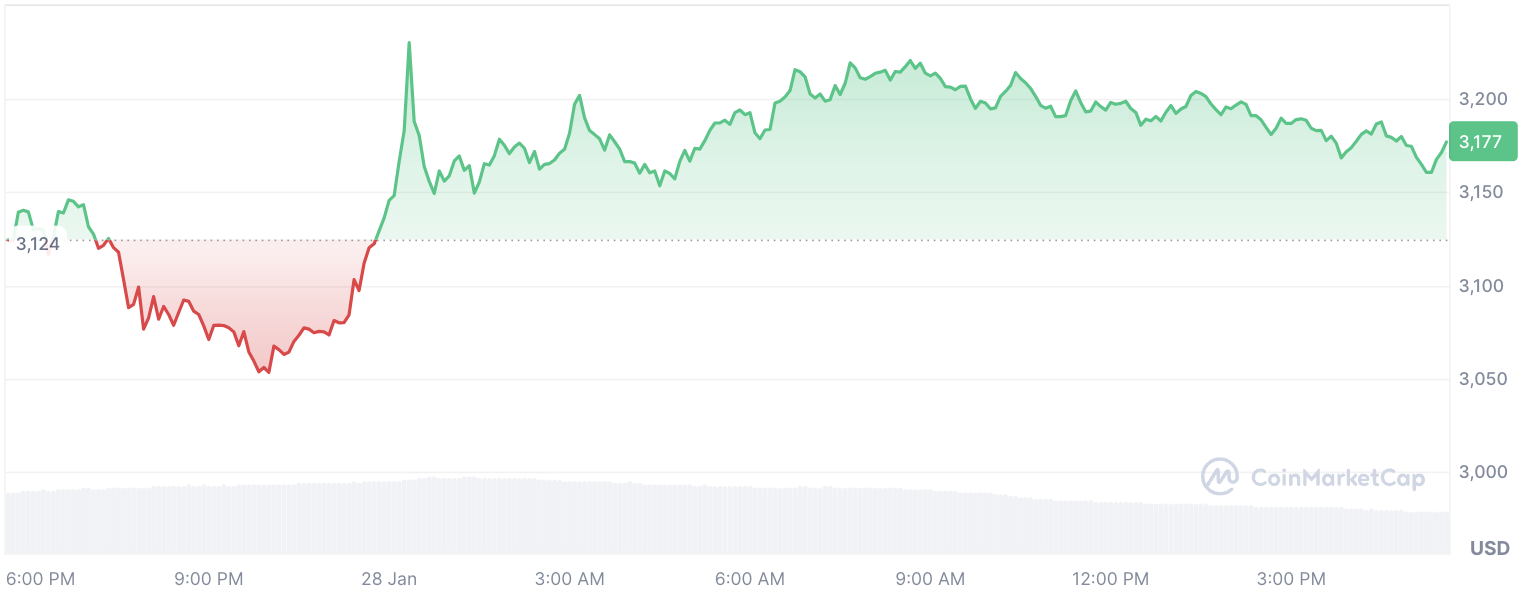

Ethereum (ETH) worth response

The endgame stays a thriller. For Ethereum, the broader context is considered one of fragility. To date in 2025, ETH has struggled to carry its personal, dropping 5.19% of its worth for the reason that starting of the 12 months. The short-term image is even much less forgiving — a painful 22% drop from this month’s excessive to this month’s low.

And but, regardless of this notable retreat, the affect on ETH costs has been muted. For now.

Nonetheless, the broader market uncertainty surrounding Ethereum stays, formed by persistent macroeconomic headwinds, evolving regulatory pressures and waning danger urge for food. In the meantime, the $78 million departure provides one other layer of intrigue to ETH’s already sophisticated narrative.