The worth of Layer-2 (L2) token MOVE has soared 12% over the previous 24 hours, making it the market’s prime gainer. This double-digit rally comes after the Donald Trump-backed DeFi platform World Liberty Monetary acquired $2 million price of MOVE tokens on Tuesday.

Nonetheless, with a persistent bearish bias in opposition to MOVE, this rally could also be short-lived. Because of this.

Motion’s MOVE Token Spikes Amid Trump-Linked Buy

On Tuesday, the Trump family-backed DeFi platform World Liberty Monetary purchased $2 million price of MOVE tokens. In accordance with Arkham Intelligence, the acquisition occurred in a number of batches throughout the US morning hours, with the primary transaction settling at 14:22 UTC.

A couple of minutes later, at 14:48 UTC, a distinguished crypto account on X DB reported that the Motion is among the blockchain networks at present in discussions with the Elon Musk-led Division of Authorities Effectivity (D.O.G.E).

These occasions have led to a spike in MOVE’s worth even after the Motion’s co-founder, Rushi Manche, clarified that the Layer-2 community has had no official communication or contact with the DOGE.

“hectic morning as regular and recognize all of the help from everybody. (I) wish to make clear that nothing from the motion labs places of work or progress workforce have crossed DOGE’s desks — all crypto could be very early stage throughout the board and coverage remains to be an ongoing dialogue all through the whole administration,” Manche wrote on X.

MOVE Rallies, However There Is a Catch

Whereas MOVE at present outperforms the highest 100 cryptos, its worth positive aspects could not final, as on-chain information reveals that the bearish bias in opposition to it stays important.

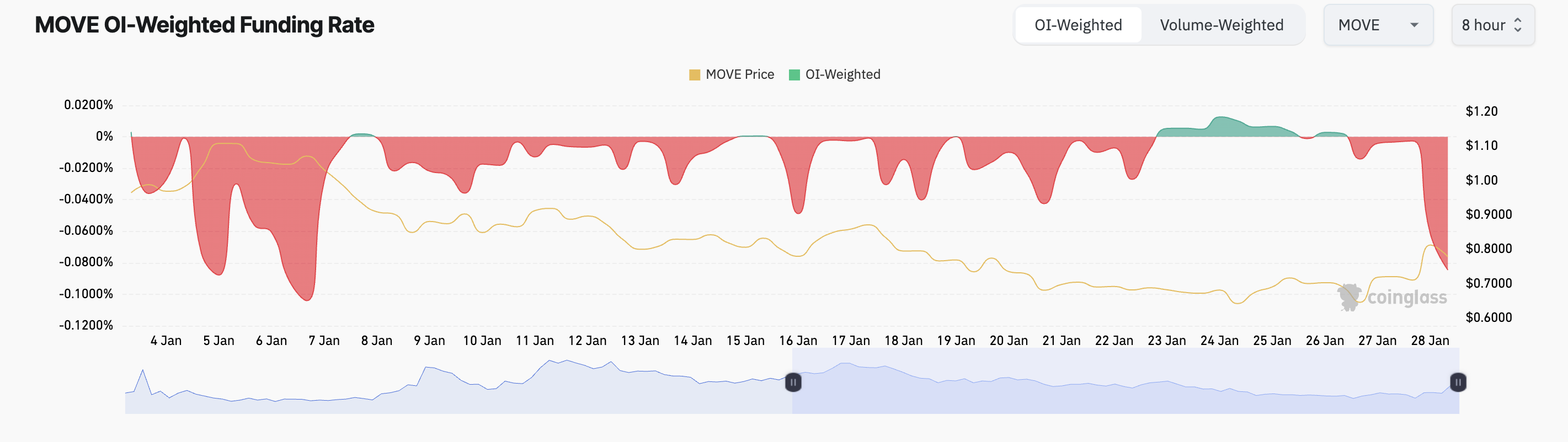

For instance, its funding fee has dropped to its lowest since January 7, indicating a spike in demand for brief positions. At press time, this stands at -0.084%. The funding fee is a periodic price exchanged between lengthy and quick merchants in perpetual futures contracts. It’s designed to maintain contract costs aligned with the spot market.

A adverse funding fee means quick merchants are paying lengthy merchants, indicating that the market sentiment is bearish regardless of the value rally. This implies that the MOVE rally is pushed by quick squeezes quite than robust natural demand, casting doubt on the rally’s sustainability.

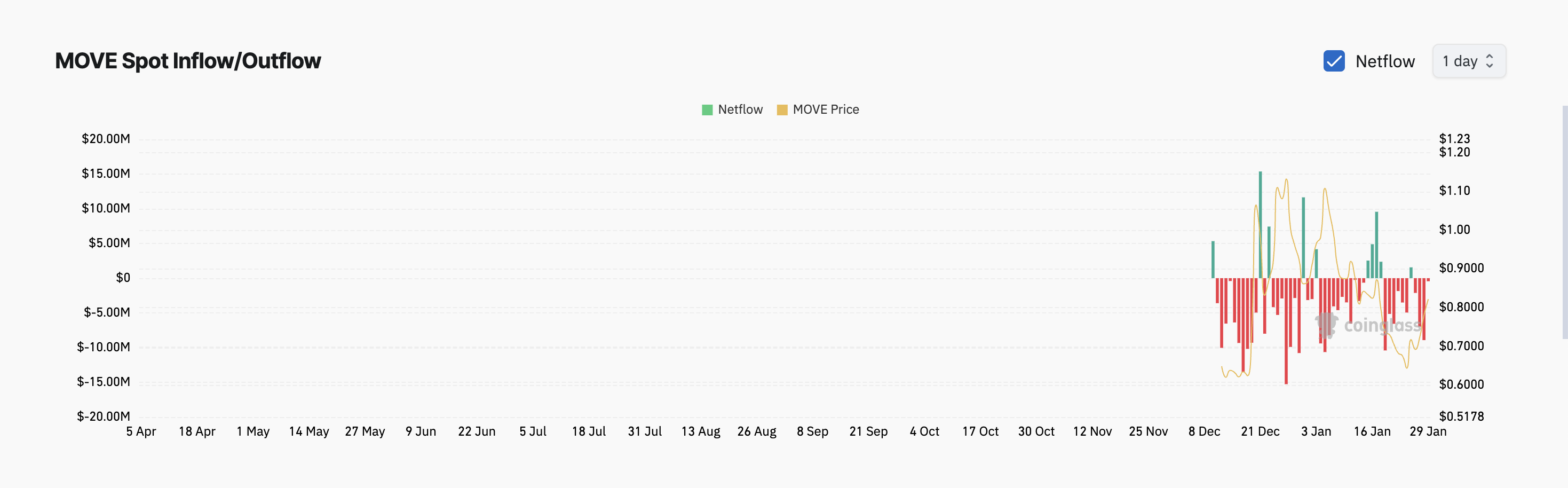

Furthermore, MOVE has continued to document spot outflows regardless of its worth rally. In accordance with Coinglass, the altcoin has witnessed 4 days of consecutive outflows totaling $19 million.

As of this writing, outflows from the MOVE spot markets on Wednesday totals $440,470, indicating that market individuals are promoting their tokens for revenue.

MOVE Value Prediction: Revenue-Taking Could Drag Token to New Lows

MOVE dangers shedding its latest positive aspects if profit-taking exercise persists. In that case, the L2 token’s worth might plunge to $0.71. If this help stage fails to carry, it might drop additional to $0.55.

Then again, if precise demand for MOVE spikes, it might break above $0.87 and climb towards $1.08.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.