- Michael Saylor, co-founder of MicroStrategy, is featured on the quilt of Forbes for his daring Bitcoin funding technique.

- MicroStrategy now holds over 471,000 BTC and has seen its inventory soar by greater than 700% in a yr.

- Saylor warns {that a} Bitcoin value crash may severely affect MicroStrategy’s inventory and the broader crypto market.

In a telling signal of simply how far Bitcoin and the crypto market have come, Michael Saylor, co-founder of MicroStrategy, now graces the quilt of Forbes Journal. The function dives deep into Saylor’s journey and the audacious technique that has turned his firm into what many are calling a “Bitcoin proxy.”

Michael Saylor’s Bitcoin Empire

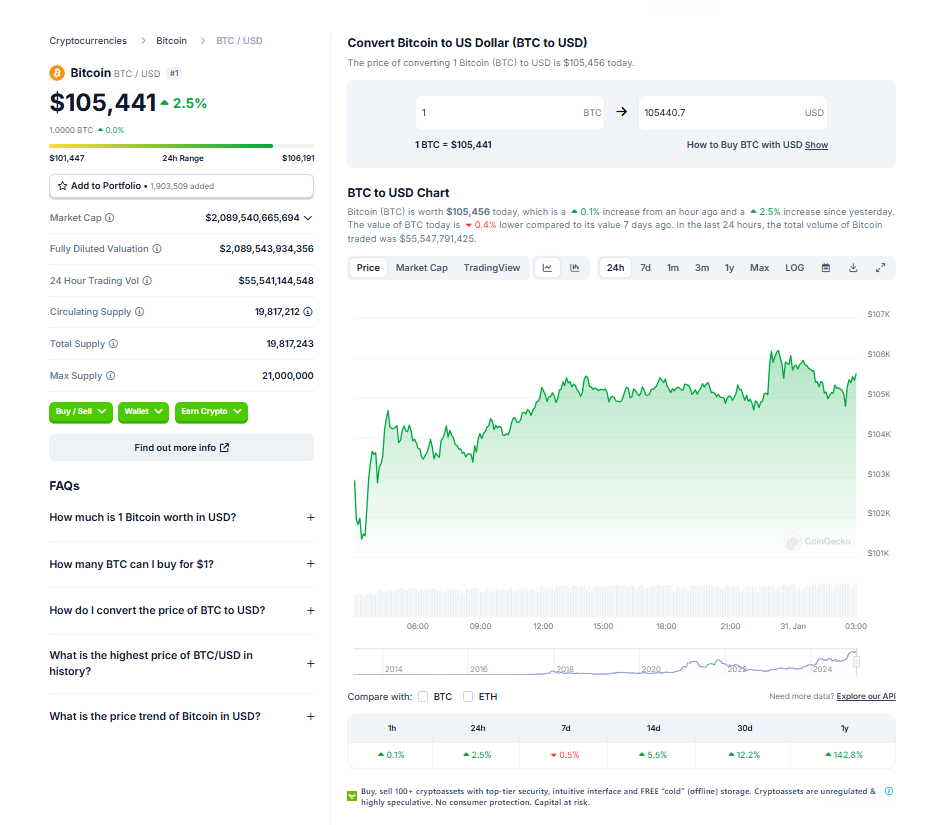

The article highlights a game-changing second in crypto historical past: final yr’s U.S. SEC approval of Bitcoin ETFs. That regulatory win ignited a rally, pushing Bitcoin’s value previous the $100,000 milestone by early December, greater than doubling in simply 12 months. Proper across the identical time, MicroStrategy’s inclusion within the Nasdaq 100 despatched its inventory by the roof, hovering over 700% in a yr.

MicroStrategy now boasts a staggering stash of 471,107 BTC—making it the most important Bitcoin holder exterior of Satoshi Nakamoto (rumored to have round 1 million tokens). Naturally, this has catapulted Saylor’s private wealth, from a good $1.9 billion to a jaw-dropping $9.4 billion in simply over a yr. In his interview with Forbes, Saylor defined it in his signature, nearly eccentric model:

“Individuals suppose that’s loopy. How can such a small firm have that liquidity? It’s as a result of we put a crypto reactor in the midst of the corporate, pull capital in, after which we spin it. That places volatility within the fairness and makes our choices and convertible bonds essentially the most attention-grabbing and highest-performing out there.”

The Forbes Curse?

In fact, all this comes with dangers—ones Saylor is aware of too properly. “If Bitcoin’s value crashes, our inventory will drop even tougher and quicker than the token itself,” he admitted. Nonetheless, MicroStrategy is holding agency to its id as “the world’s first and largest Bitcoin Treasury.” This daring positioning has attracted main institutional curiosity within the firm’s convertible bonds.

Issued between 2021 and 2022, these six bonds, maturing from 2027 to 2032, provide ultra-low rates of interest starting from 0% to 2.25%. That’s fairly wild in at present’s bond market, the place yield-hungry buyers are turning to riskier non-public credit score for returns. Impressively, MicroStrategy’s bonds have delivered a hefty 250%+ return since issuance.

However right here’s the twist: Some are questioning if Saylor may face the notorious “Forbes Curse.” The final crypto mogul to grace the journal’s cowl was none aside from Sam Bankman-Fried, simply earlier than FTX spectacularly imploded in 2022. If MicroStrategy faces any turmoil—be it operational mishaps or a sudden Bitcoin sell-off—the ripple results may very well be devastating. Bitcoin’s value would nearly actually nosedive, sparking panic throughout the complete digital asset market.

For now, although, Saylor appears unfazed. Whether or not you see him as a visionary or a gambler, one factor’s clear: his high-stakes guess on Bitcoin has reshaped how institutional buyers take into consideration crypto—find it irresistible or hate it. And, in at present’s unpredictable monetary world, possibly that’s precisely what’s wanted.