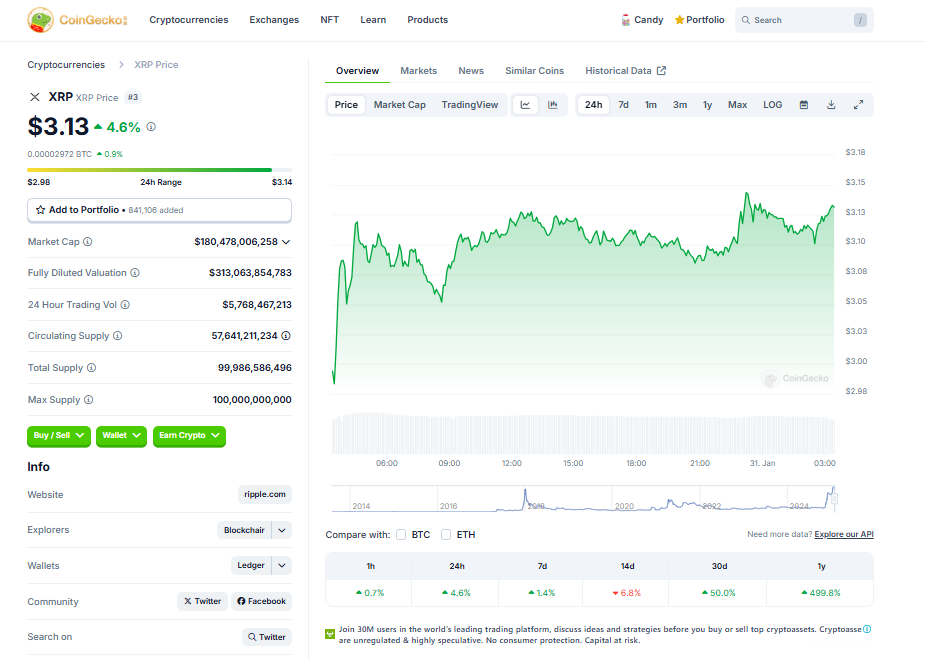

- Grayscale has filed for a Spot XRP ETF on the NYSE, signaling main progress for crypto funding within the U.S.

- The agency’s XRP Belief surged 300% in January amid hypothesis of ETF approval throughout the subsequent yr.

- Grayscale additionally filed for a Spot Solana ETF and launched a Bitcoin Miners ETF, increasing its crypto choices.

In a significant shake-up for the crypto world, Grayscale has filed to launch a Spot XRP ETF on the New York Inventory Trade (NYSE). Yep, it’s official—a submitting with the U.S. Securities and Trade Fee (SEC) confirmed the transfer, marking one other step towards bringing new crypto funding autos to market.

Grayscale isn’t alone on this race, both. They’ve joined forces with 5 different asset managers, together with Bitwise and WisdomTree, all vying to push their very own spot ETFs ahead. And if that wasn’t sufficient, Grayscale can also be seeking to roll out a Spot Solana ETF, a transfer that would change the sport solely for crypto buyers within the U.S., particularly with the latest coverage shifts we’ve been seeing.

A Large Shift in Crypto Regulation

It’s wild to suppose how a lot has modified in such a short while. Not way back, Ripple was locked in a grueling authorized battle with the SEC, which appeared hell-bent on holding XRP beneath its thumb. The SEC was decided to manage the sector by way of fixed enforcement, difficult XRP’s very legitimacy at each alternative.

Quick ahead to in the present day, and it’s like a very totally different world. With Donald Trump again within the White Home and a pro-crypto stance taking root, the SEC has finished a full 180. Gary Gensler has resigned, and Mark Uyeda has stepped in as the brand new chairman, signaling a friendlier strategy towards digital property. On the heels of those modifications, Grayscale has now formally submitted its Spot XRP ETF software to the NYSE.

Ripple’s Comeback and Grayscale’s Enlargement

Grayscale’s timing couldn’t be higher. Their present XRP Belief has been crushing it currently, surging 300% simply firstly of January, due to hypothesis in regards to the ETF’s approval. Based on Nasdaq experiences, buyers have been piling in, anticipating that XRP might lastly get its ETF within the subsequent 12 months.

This isn’t Grayscale’s first foray into the ETF area both. In 2024, the U.S. authorized its first two crypto-based ETFs for Bitcoin and Ethereum. These launches had been enormous—the Bitcoin ETF was even hailed as the best ETF debut in historical past. With that success in thoughts, there’s now mounting anticipation for altcoin ETFs, together with XRP and Solana.

On prime of their XRP ambitions, Grayscale filed for a Spot Solana ETF late final yr and just lately launched a Bitcoin Miners ETF this previous Thursday. Clearly, they’re making critical strikes to broaden crypto funding alternatives.

The takeaway? Crypto ETFs are rapidly changing into a cornerstone of the U.S. market, and Grayscale is true on the middle of all of it. With coverage shifts and new funding merchandise on the horizon, the following few months may very well be pivotal for digital property in America. Keep tuned.