- Ripple CEO Brad Garlinghouse opposes a Bitcoin reserve, advocating for a multichain method to foster crypto progress.

- Trade debates intensified as critics accused Ripple of anti-Bitcoin propaganda, fueling tensions within the crypto house.

- Regulatory uncertainty and safety considerations proceed to form discussions across the Bitcoin reserve proposal.

Ripple CEO Brad Garlinghouse has voiced sturdy opposition to the concept of making a Bitcoin strategic reserve, advocating as an alternative for a multi-token framework. His stance highlights ongoing considerations over Bitcoin’s regulatory challenges, market volatility, and safety dangers, sparking intense debates within the crypto neighborhood.

A Name for Multi-Token Unity

In discussions concerning the Bitcoin reserve proposal, Garlinghouse emphasised the significance of embracing a multichain ecosystem:

“I personal XRP, BTC, and ETH, amongst a handful of others—we dwell in a multichain world. I’ve at all times advocated for a degree enjoying subject, relatively than pitting one token in opposition to one other.”

Many within the crypto business have rallied behind his perspective, arguing {that a} Bitcoin-only reserve overlooks the complexities of a various and evolving crypto market. Safety dangers and volatility within the sector have solely added weight to Garlinghouse’s argument in opposition to putting all bets on a single asset like Bitcoin.

Heated Trade Debates

The Bitcoin reserve proposal has fueled fiery exchanges amongst business leaders. Pierre Rochard, VP of analysis at Riot Platforms, dismissed Ripple’s stance, claiming:

“Ripple is a failed firm begging for a bailout.”

Equally, Michael Goldstein, president of the Satoshi Nakamoto Institute, criticized Ripple’s intentions, stating:

“Ripple has spent thousands and thousands on propaganda campaigns geared toward destroying Bitcoin.”

The talk displays broader tensions within the crypto world, the place competing visions for the way forward for digital finance typically conflict.

Regulatory Uncertainty Looms

Including to the complexity, Bitcoin’s regulatory panorama stays unsure. Some analysts estimate a 55% chance of the U.S. authorities establishing a nationwide Bitcoin reserve by 2025, additional dividing opinions within the crypto house.

Garlinghouse responded to the concept by emphasizing the hazards of maximalism:

“Maximalism is the enemy of crypto progress. It’s outdated and misinformed considering, and fortunately, fewer individuals are subscribing to it now.”

Impression on the Crypto Market

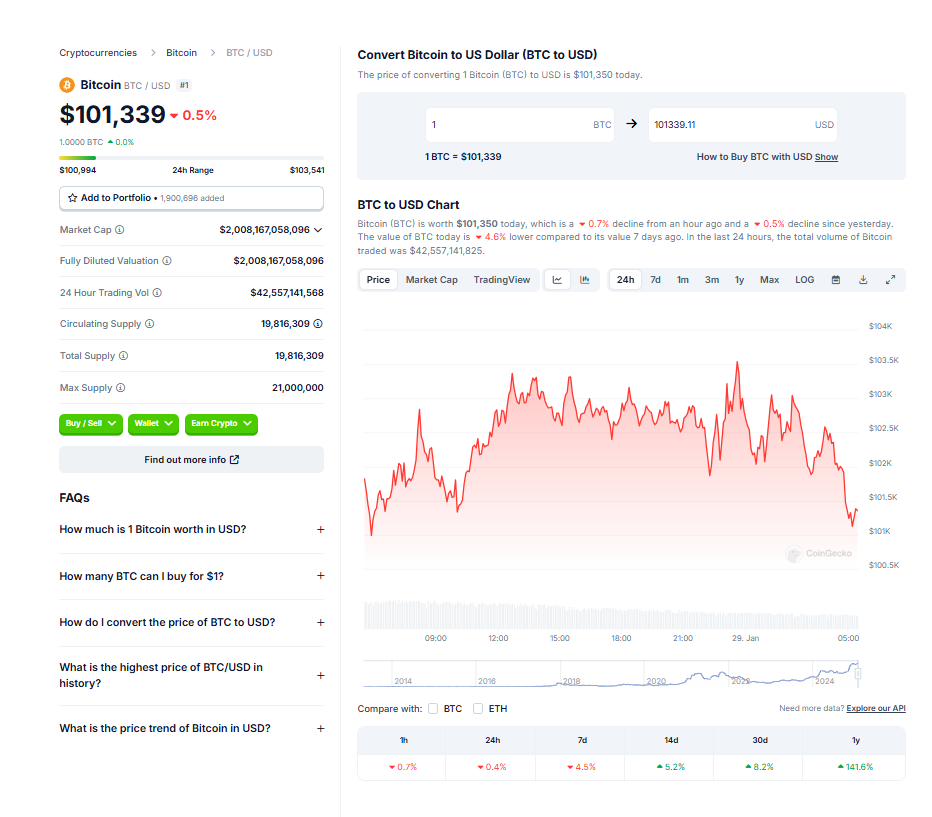

The controversy surrounding the Bitcoin reserve proposal has added gasoline to cryptocurrency market volatility. Some market analysts argue that these debates, coupled with unresolved safety dangers, are shaping the course of digital finance.

Because the Ripple vs. Bitcoin debate heats up, it’s clear that the crypto business continues to be grappling with foundational questions on its future. For now, the trail ahead appears divided—whether or not it results in a unified multichain imaginative and prescient or a fragmented ecosystem stays to be seen.