Tesla noticed a lift in its monetary efficiency within the fourth quarter of 2024, thanks partially to its Bitcoin holdings.

The corporate reported a $600 million acquire resulting from a change in accounting guidelines. The transfer allowed Tesla to worth its Bitcoin at market costs.

Tesla Makes $600 Million on Bitcoin

This shift in accounting requirements stems from a brand new rule by the Monetary Accounting Requirements Board (FASB). The rule mandates that beginning in 2025, firms holding digital property should mark these property to market every quarter.

The brand new FASB rule offers firms the choice to implement this alteration earlier, which Tesla seems to have achieved. Earlier than this rule, firms had been required to report their digital property based mostly on the bottom valuation of these property throughout their time of possession.

Now, after adjusting values to present market costs, Tesla noticed a marked improve within the valuation of its Bitcoin holdings. Furthermore, as per its earnings launch, Tesla didn’t promote any Bitcoin in This autumn.

In This autumn 2024, Tesla’s Bitcoin holdings had been valued at $1.076 billion, up from simply $184 million in earlier quarters after the rule change. The dramatic improve displays the altering market worth of Bitcoin, which has seen fluctuations over time.

This improve in Bitcoin’s market worth contributed to a $600 million acquire, boosting Tesla’s monetary efficiency. The corporate’s complete GAAP revenue for This autumn reached $2.3 billion, that means that Bitcoin acquire performed a key position within the outcomes.

“It’s essential to level out that the web revenue in This autumn was impacted by a $600 million mark-to-market profit from Bitcoin as a result of adoption of a brand new accounting customary for digital property,” CFO Vaibhav Taneja reportedly famous on the earnings name.

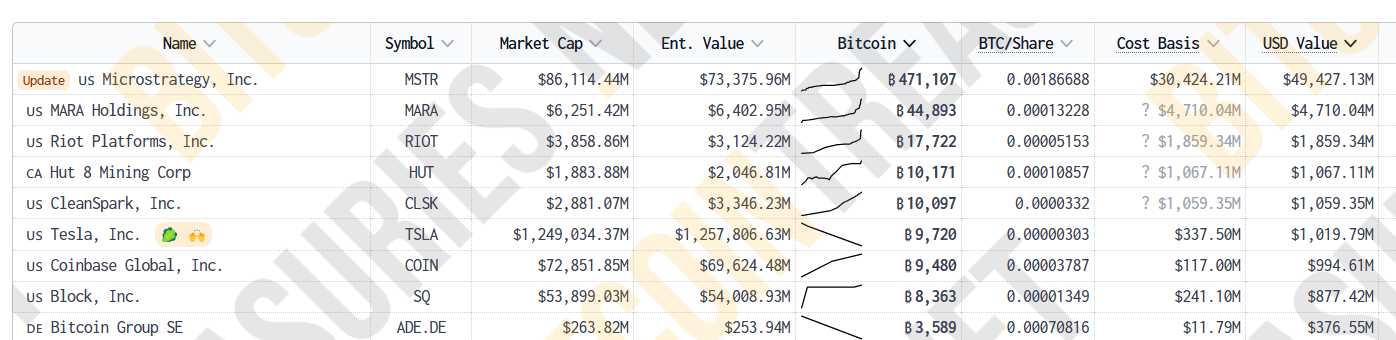

Based on Bitcoin Treasuries, Tesla holds 9,720 BTC, making it the sixth-largest publicly traded firm holding Bitcoin.

Tesla entered the Bitcoin market in 2021 with the acquisition of 43,200 BTC. Following this preliminary buy, Tesla bought a part of its Bitcoin holdings over time.

The change in Tesla’s Bitcoin valuation has additionally raised questions concerning the impact the brand new accounting guidelines could have on Microstrategy earnings.

“What on earth goes to occur when MicroStrategy announce their earnings subsequent week. They’ve 471,107 Bitcoin and most probably may also benefit from the brand new FASB accounting rule,” a X person posted.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.