Disclaimer: The opinions expressed by our writers are their very own and don’t symbolize the views of U.Immediately. The monetary and market data offered on U.Immediately is meant for informational functions solely. U.Immediately shouldn’t be responsible for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary consultants earlier than making any funding choices. We imagine that each one content material is correct as of the date of publication, however sure presents talked about might now not be accessible.

Toncoin, the native cryptocurrency of The Open Community (TON) blockchain, has seen a surge in change netflows, catching the eye of the market and prompting discussions concerning the implications for TON.

In line with IntoTheBlock, Toncoin has seen a 357% enhance in change netflows. The intriguing half is that this unfavourable netflow has optimistic implications for Toncoin.

The netflow indicator highlights the development of merchants sending cash out and in of exchanges. Unfavorable netflows point out a higher quantity is being withdrawn from exchanges. This could possibly be seen as an indication of accumulation or addresses shopping for again following main drops. That mentioned, the 357% enhance in change netflows will be seen as a bullish sign for Toncoin.

TON has steadily declined since reaching highs of $7.20 on Dec. 4. This drop led to lows of $4.67, the place consumers shortly purchased the dip. On the time of writing, TON was down 2.06% within the final 24 hours, mirroring the declines on the crypto market as buyers await the Federal Reserve’s first rate of interest determination of 2025. TON stays down 8.81% weekly amid combined value exercise because the previous week.

In the meantime, netflows are optimistic when extra funds are getting into than leaving exchanges.

Indicator factors to retail exercise

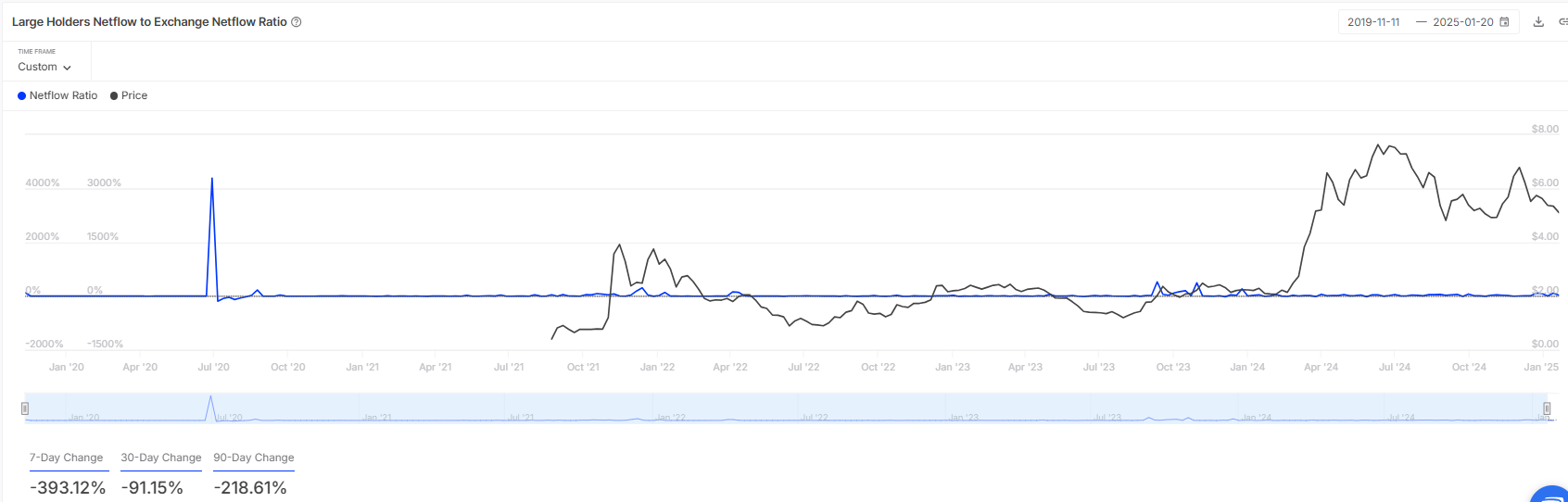

A key indicator from IntoTheBlock, giant holders’ netflow to change netflows, suggests the predominance of retail exercise.

The massive holders’ netflow to change web flows indicator computes the ratio of huge holders’ netflows (inflows minus outflows) to these of centralized exchanges. It offers insights into retail and large-holder actions, indicating potential market patterns akin to cashing out or asset accumulation.

This indicator compares the behaviors of huge holders known as whales and retail merchants. A excessive ratio may suggest that whales are extra energetic than retail merchants, indicating a development towards accumulation. In distinction, a low ratio might point out extra exercise by retail buyers.

For Toncoin, this key metric has surged 393% within the final seven days, suggesting elevated exercise by retail merchants.