XRP reached a brand new all-time excessive of $3.41 on January 16. Nevertheless, it has remained rangebound since then, going through resistance at $3.27 and discovering assist at $2.94.

Whereas this sideways motion signifies a relative steadiness between shopping for and promoting pressures, on-chain information suggests {that a} draw back breakout could also be on the horizon within the coming weeks.

Surge in Revenue-Taking Could Threaten New Features

XRP skilled a dramatic 500% surge in November 2024, fueled by Bitcoin’s rally and Donald Trump’s 2024 presidential election win. Following this, the token witnessed a minor correction, settling between $2.6 and $2.0 earlier than bouncing again.

By January 16, XRP broke via the $3 resistance and reached a brand new all-time excessive of $3.41. Since then, the altcoin has traded inside a value vary, suggesting that neither the patrons nor sellers have full dominance. Nevertheless, BeInCrypto’s evaluation of XRP’s on-chain efficiency hints at rising bearish strain, which can end in a value dip within the coming weeks.

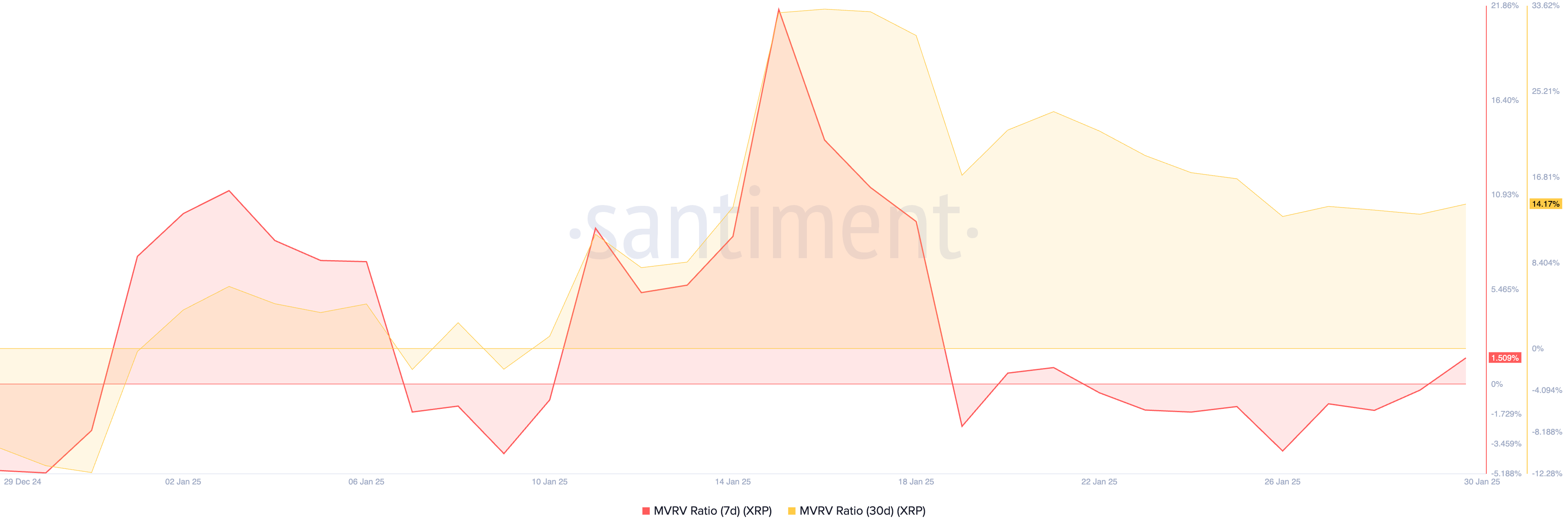

For instance, XRP’s Market Worth to Realized Worth (MVRV) ratios assessed over a number of transferring averages recommend that the altcoin is overvalued, which may immediate holders to promote for revenue. In accordance with Santiment, as of this writing, the token’s seven-day and 30-day MVRV ratios are 1.50% and 14.17%, respectively.

An asset’s MVRV ratio identifies whether or not it’s overvalued or undervalued by measuring the connection between its market worth and its realized worth. When the ratio is unfavourable, the asset’s market worth is decrease than its realized worth. This implies that the market is undervaluing the cryptocurrency in comparison with what individuals initially paid for it.

Alternatively, as with XRP, when the ratio is optimistic, its market worth is increased than the realized worth, suggesting it’s overvalued. This metric means that XRP’s present value of $3.10 is increased than the acquisition foundation for a lot of of its holders. This will likely immediate them to promote their holdings for revenue, placing downward strain on the token’s value.

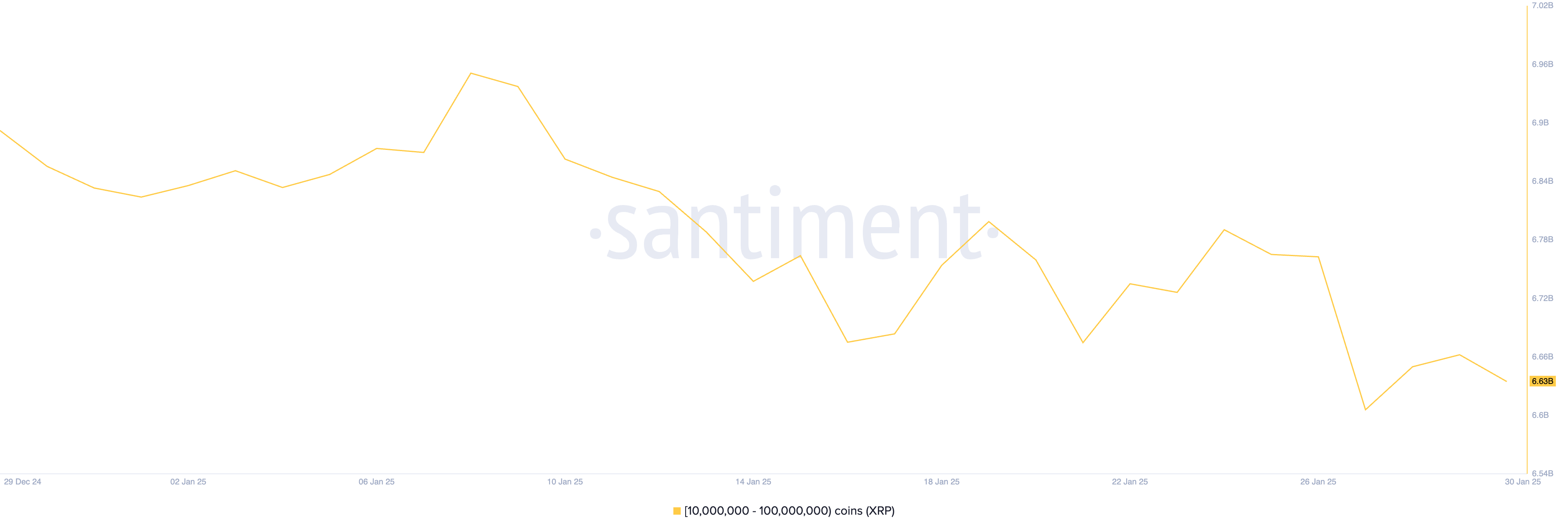

Additional, the actions of XRP whales could contribute to this downward strain. Per Santiment, XRP whale addresses that maintain between 10 million and 100 million tokens have decreased their holdings by 1% because it reached an all-time excessive. Over the previous month, this group of huge traders has bought 60 million XRP valued above $180 million.

When whales scale back their holdings like this, it places downward strain on the asset’s value, particularly if the market struggles to soak up the promoting quantity. If this pattern continues, XRP will expertise a decline within the subsequent few weeks.

XRP Value Prediction: Will It Push Larger or Drop to $2.13?

A breakdown beneath the horizontal channel because of a spike in profit-taking exercise will XRP’s value away from its all-time excessive. On this case, its value may drop beneath $3 and pattern towards $2.13.

Nevertheless, if profit-taking stalls and XRP holders resume accumulation, this might push the token’s value previous the resistance shaped at $3.27 towards its all-time excessive of $3.41. If demand is robust sufficient, it might even break above this value peak to file a brand new excessive.

Disclaimer

According to the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.