The crypto market will witness $10.31 billion in Bitcoin and Ethereum choices contracts expire immediately. This large expiration might influence short-term value motion, particularly as each property have just lately declined.

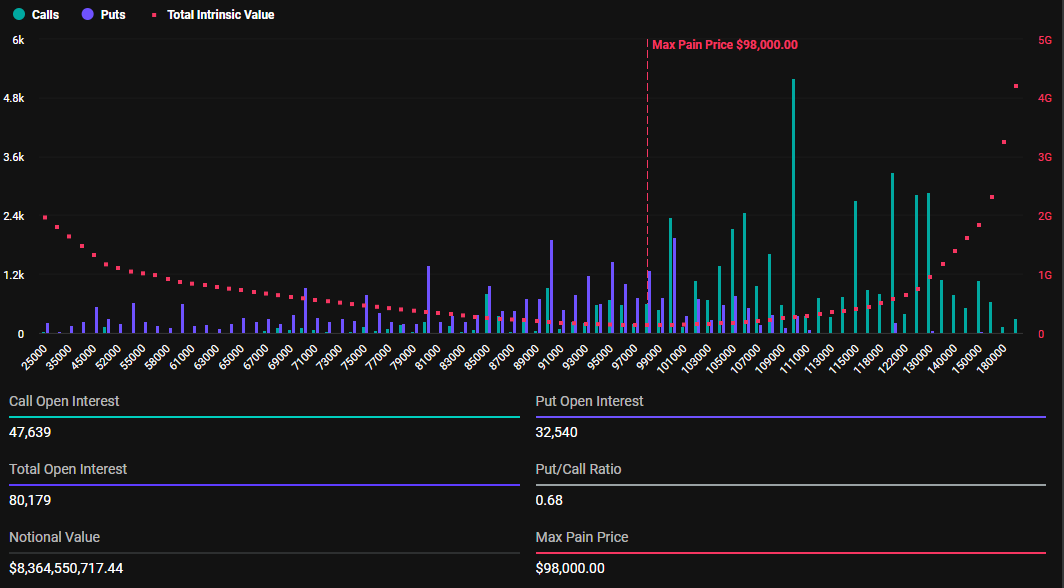

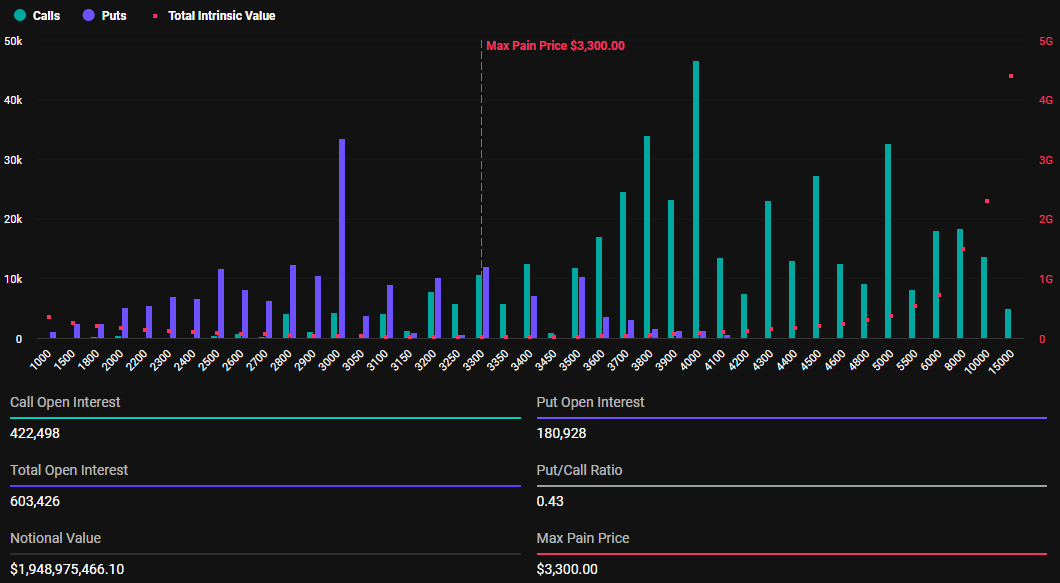

With Bitcoin choices valued at $8.36 billion and Ethereum at $1.94 billion, merchants are bracing for potential volatility.

Excessive-Stakes Crypto Choices Expirations: What Merchants Ought to Watch Immediately

Immediately’s expiring choices mark a major enhance from final week, because it expires on the finish of the month. Based on Deribit information, Bitcoin choices expiration includes 80,179 contracts, in comparison with 30,645 contracts final week. Equally, Ethereum’s expiring choices whole 603,426 contracts, up from 173,830 contracts the earlier week.

These expiring Bitcoin choices have a most ache value of $98,000 and a put-to-call ratio 0.68. This means a typically bullish sentiment regardless of the asset’s current pullback. As compared, their Ethereum counterparts have a most ache value of $3,300 and a put-to-call ratio of 0.43, reflecting an analogous market outlook.

Put-to-call ratios under 1 for Bitcoin and Ethereum counsel optimism out there, with extra merchants betting on value will increase. However, analysts name for warning as a result of tendency of choices expiration to trigger market volatility.

“This might deliver important market volatility as merchants reposition forward of expiry, anticipate sharp value actions and potential liquidations,” Crypto Dad, a well-liked consumer on X, warned.

The warning comes as choices expirations typically trigger short-term value fluctuations, creating market uncertainty. In the meantime, BeInCrypto information exhibits Bitcoin’s buying and selling worth has dropped by 0.64% to $104,299. Alternatively, Ethereum’s value is up by a modest 1.04%, now buying and selling at $3,226.

Implications of Choices Expiry on BTC and ETH

With their present costs, Bitcoin stands effectively above its most ache degree of $98,000, whereas Ethereum is under the strike value of $3,300. The utmost ache level or strike value is a vital metric that guides market habits. It represents the value degree at which most choices expire nugatory.

Based mostly on the Max Ache idea, BTC and ETH costs will seemingly method their respective strike costs, therefore anticipated volatility. Right here, the biggest variety of choices (each calls and places) would expire nugatory as these choices contracts close to expiration.

Choice patrons who lose all the worth of their choices would really feel the “ache.” Alternatively, choice sellers would profit because the contracts expire out-of-the-money, they usually hold the credit score obtained from promoting the choices.

This occurs as a result of the utmost ache idea operates on the idea that choice writers are usually massive establishments or skilled merchants, in any other case termed good cash. Subsequently, they’ve the sources and market affect to drive the inventory’s closing value towards the utmost ache level on expiration day.

“Merchants typically monitor this degree as it will probably affect value actions as expiration approaches,” one analyst on X wrote.

Based mostly on this assumption, these market makers will hedge their positions to keep up a delta-neutral portfolio. As their positions close to expiration, they offset their quick choice positions by promoting or shopping for the contract, influencing the value towards the utmost ache level.

Of observe, nonetheless, is that markets often stabilize quickly after as merchants adapt to the brand new value atmosphere. With immediately’s high-volume expiration, merchants and traders can anticipate an analogous final result, doubtlessly influencing crypto market traits into the weekend.

The put up Over $10 Billion in Crypto Choices Expiring Immediately: What It Means for Bitcoin and Ethereum appeared first on BeInCrypto.