In a current memo, Bitwise Chief Funding Officer (CIO) Matt Hougan shared his ideas on the Bitcoin (BTC) 4-year cycle and its relevance beneath Donald Trump’s administration. Particularly, he examined whether or not a shift in Washington DC’s stance on cryptocurrencies might prolong the present bull market into 2026 and past.

Bitcoin 4-12 months Cycle Not Pushed By Halvings

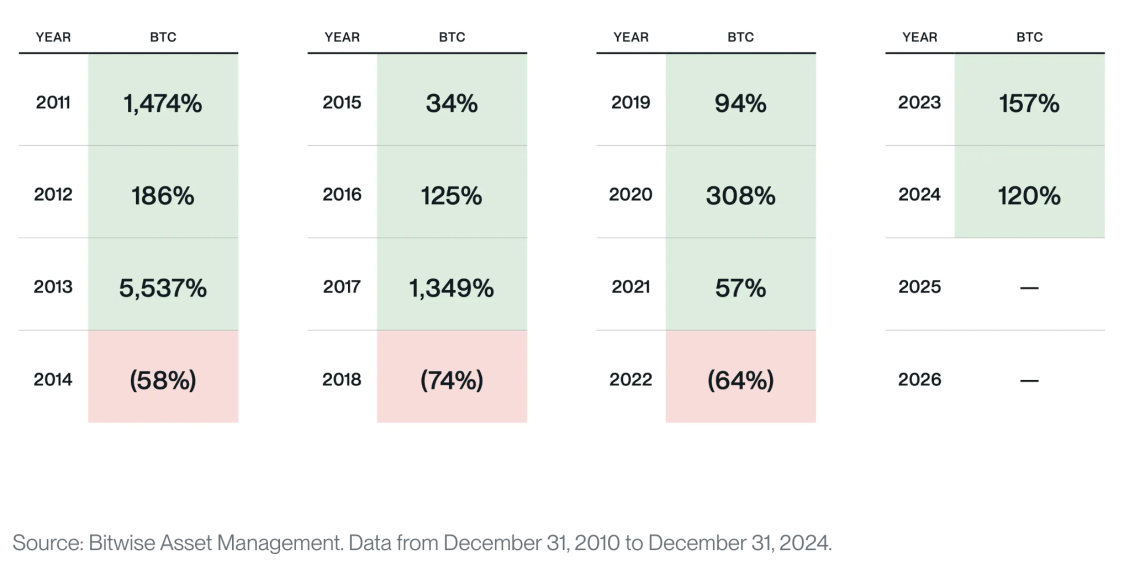

The Bitcoin 4-year cycle refers back to the digital asset’s historic worth sample, usually consisting of three years of sturdy appreciation adopted by a 12 months of main pullback throughout all cryptocurrencies. The next chart supplies a transparent image of this cycle.

Based on the chart, 2025 needs to be one other 12 months of constructive worth motion for BTC, whereas 2026 might carry a ‘crypto winter,’ characterised by sustained deleveraging and declining costs throughout digital belongings.

Hougan challenged the frequent perception that Bitcoin’s 4-year cycle is pushed by its halving occasions. He clarified that BTC’s quadrennial halvings – occurring in 2016, 2020, and 2024 – usually are not completely aligned with the cycle’s peaks and troughs.

As for the present market section, Hougan reaffirmed Bitwise’s earlier prediction that BTC might double in worth this 12 months, surpassing $200,000. He recognized the first catalysts as institutional inflows into crypto exchange-traded funds (ETFs) and elevated BTC purchases by firms and governments.

Market Pullbacks Possible To Be Shallow, Hougan Says

Hougan described Trump’s just lately issued crypto govt order (EO) as “overwhelmingly bullish,” emphasizing the way it frames the enlargement of the US crypto ecosystem as a nationwide precedence. The EO additionally requires the institution of a “nationwide crypto stockpile” and lays the groundwork for Wall Road banks and institutional traders to enter the market beneath favorable rules. Hougan defined:

In my opinion, the launch of ETFs was a sufficiently big occasion to carry a whole lot of billions of {dollars} into the crypto ecosystem from new traders. That was what was driving this cycle. However the full mainstreaming of crypto – the one contemplated by Trump’s govt order, the place banks custody crypto alongside different belongings, stablecoins are built-in broadly into the worldwide funds ecosystem, and the biggest establishments set up positions in crypto – I’m satisfied will carry trillions.

Hougan acknowledged that the EO’s full influence will unfold over years somewhat than months, highlighting key causes for this gradual development. First, newly appointed White Home crypto czar David Sacks will want time to develop a complete regulatory framework. Second, main Wall Road companies will possible take even longer to completely acknowledge and combine crypto’s potential.

In conclusion, Hougan steered that whereas the market has not completely damaged free from Bitcoin’s conventional 4-year cycle, any pullbacks will possible be shallower and shorter-lived in comparison with earlier downturns.

Much like Bitwise’s prediction, Commonplace Chartered just lately forecasted that BTC could surge as excessive as $200,000 by the top of 2025. At press time, BTC trades at $106,119, up 3.7% prior to now 24 hours.

Featured Picture from Unsplash.com, Charts from Bitwise and TradingView.com