Bitcoin (BTC) worth has remained above $100,000 for the final three days, exhibiting resilience regardless of latest volatility. A golden cross has fashioned on BTC’s EMA traces, indicating potential for a bullish breakout if key resistance ranges are cleared.

Nonetheless, BTC has struggled to maneuver previous $106,000, and failure to take action might result in a retest of decrease assist ranges. Whether or not BTC can push towards $110,000 or face a pullback relies on the way it reacts to those crucial worth zones within the coming days.

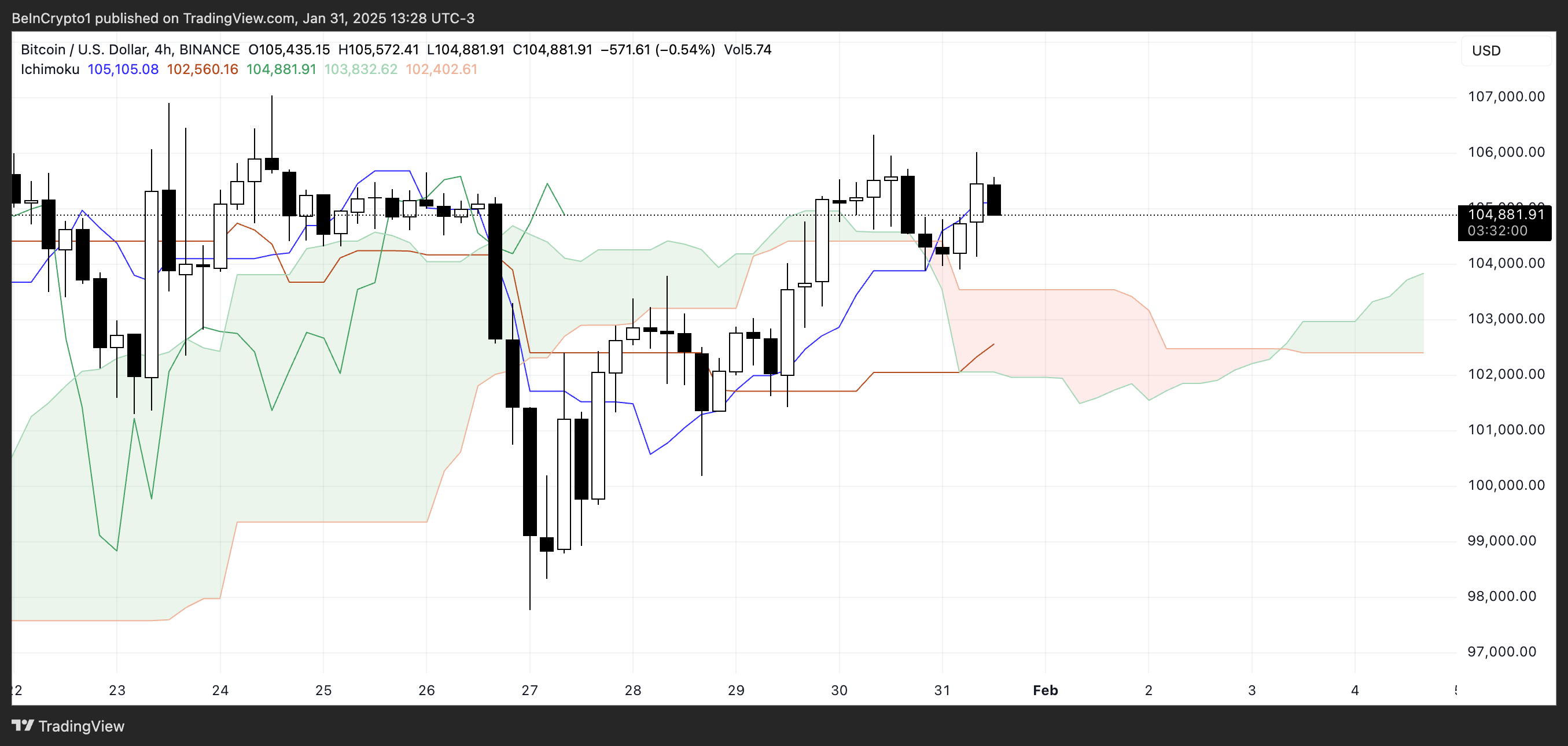

BTC Ichimoku Cloud Exhibits Combined Alerts

The Ichimoku Cloud chart for Bitcoin presents a blended outlook. The worth is at present above the Tenkan-sen (blue line), indicating short-term bullish momentum. In distinction, the Kijun-sen (crimson line) is barely decrease, suggesting a possible development continuation if worth stays above it.

The Chikou Span (inexperienced lagging line) is above a lot of the previous worth motion, reinforcing the present bullish bias. Nonetheless, the Kumo (cloud) has a skinny construction forward, which means there’s much less assist or resistance energy within the close to future.

The cloud itself is transitioning from crimson to inexperienced, which generally alerts a possible development shift towards bullish circumstances. Nonetheless, the flat nature of Senkou Span B (crimson cloud boundary) suggests some hesitation in momentum. If Bitcoin worth stays above the cloud, the bullish bias strengthens, however any dip again into the cloud might point out consolidation or indecision.

The skinny future cloud means the development lacks robust conviction, making the subsequent few candles essential for figuring out whether or not BTC can preserve its upward trajectory.

Bitcoin Whales Dropped to 12 months-Lows, However It Might Be Recovering

The variety of whales holding at the least 1,000 BTC dropped considerably between January 22 and January 29, falling from 2,061 to 2,034, the bottom stage since February 2024. This regular decline instructed that enormous holders have been lowering their publicity, doubtlessly signaling decreased confidence or profit-taking available in the market.

Monitoring whale exercise is essential as a result of these massive holders typically affect market developments. When whales accumulate, it may possibly point out rising confidence and potential worth appreciation, whereas distribution phases could precede downturns or elevated volatility. Their actions present insights into broader market sentiment and potential development shifts.

After consecutive drops, the variety of whales has began to rise once more, at present again at 2,039. Whereas this stays low in comparison with earlier months, it might sign a return of huge holders to BTC. If this development continues, it might point out renewed accumulation, which might assist BTC’s worth within the coming days.

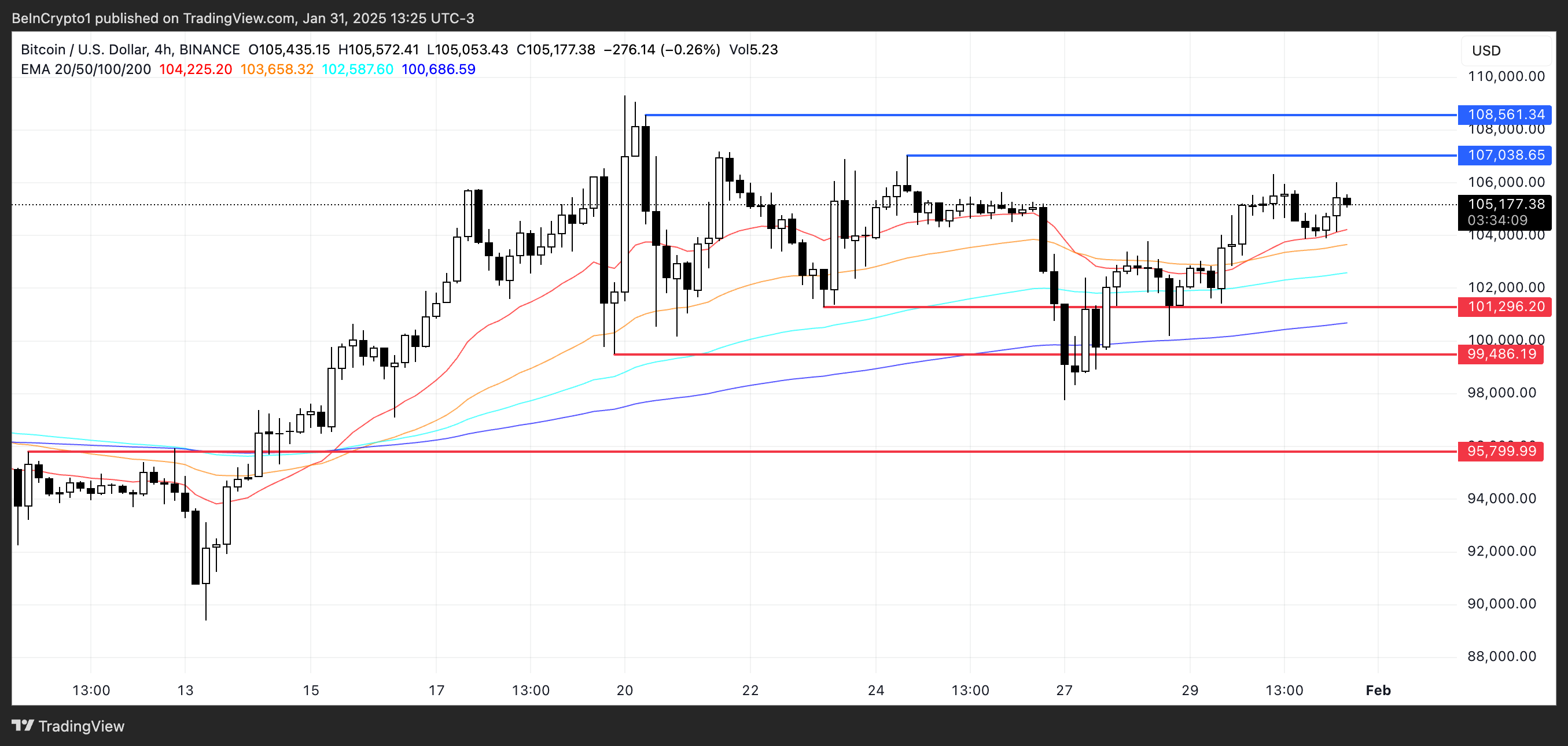

BTC Worth Prediction: Can BTC Attain $110,000 In February?

BTC’s EMA traces lately fashioned a golden cross, signaling potential bullish momentum, however the worth has struggled to interrupt above $106,000. If Bitcoin makes one other try and efficiently clears this stage, it might shortly check $107,000.

A breakout above that resistance might push Bitcoin worth towards $108,000, and if shopping for stress stays robust, it’d even attain $110,000, marking a brand new all-time excessive.

On the bearish facet, if BTC worth fails to carry momentum and the development reverses, it might drop to $101,296, a key assist stage. Dropping that stage might speed up promoting stress, pushing BTC right down to $99,486.

If that assist additionally breaks, BTC would possibly proceed its decline towards $95,800, at which level consumers might step in to stop additional draw back.

Disclaimer

In step with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.