Be a part of Our Telegram channel to remain updated on breaking information protection

The Stacks value prediction exhibits that STX is displaying indicators of consolidation and potential bullish momentum, if the worth efficiently breaks to the upside, it might set off a robust bullish rally.

Stacks Prediction Knowledge:

- Stacks value now – $1.33

- Stacks market cap – $2.05 billion

- Stacks circulating provide – 1.51 billion

- Stacks whole provide – 1.51 billion

- Stacks CoinMarketCap rating – #55

Getting in early on crypto tasks generally is a game-changer, as historical past has proven with quite a few tokens surging in worth over time. Take Stacks (STX) for instance—since hitting its all-time low of $0.04501 on March 13, 2020, it has skyrocketed by a staggering +2929.4%, proving the ability of long-term holding in the suitable tasks. Whereas its all-time excessive of $3.84 in April 2024 is a distant reminiscence, STX stays a robust performer within the crypto house. Maintaining a tally of such tokens and their historic progress can assist you determine promising alternatives early.

STX/USD Market

Key Ranges:

Resistance ranges: $2.10, $2.20, $2.40

Assist ranges: $0.60, $0.40, $0.20

STX/USD is presently displaying a continuation of its downward pattern inside a descending channel. The worth is buying and selling at $1.33, barely above the decrease boundary of the channel, indicating that the market is testing an important help degree. Nonetheless, the 9-day MA (pink line) stays beneath the 21-day MA (inexperienced line), confirming ongoing bearish momentum. Subsequently, if the worth fails to interrupt above the 9-day MA, sellers might push the worth decrease towards the important thing help at $1.00, which aligns with the decrease trendline of the channel. A robust bearish shut beneath this degree might set off additional draw back motion, extending losses into deeper value zones.

Stacks Value Prediction: STX/USD Might Consolidate Beneath the Shifting Common

Stacks (STX) value is on its manner towards the 9-day and 21-day shifting averages at $1.33. On the bullish aspect, there’s a likelihood for a short-term rebound as the worth is close to a historic help zone. If patrons acquire momentum and the worth closes above the 9-day MA, the subsequent goal could be the 21-day MA, presently round $1.43. A profitable breakout past this shifting common would sign a possible pattern shift, resulting in a retest of the most important resistance degree at $2.0. Nonetheless, any additional bullish motion might hit the resistance ranges of $2.10, $2.20, and $2.40.

Nonetheless, the market outlook for STX/USD stays bearish except a breakout above the 21-day MA and the descending trendline happens. If the worth stays beneath these resistance ranges, the chance of testing the helps at $0.60, $0.40, and $0.20 will increase. In the meantime, merchants ought to look ahead to value motion close to the present help zone and monitor whether or not the 9-day MA acts as resistance or is breached to the upside. A decisive transfer in both path will decide whether or not STX continues its downtrend or begins forming a bullish restoration sample.

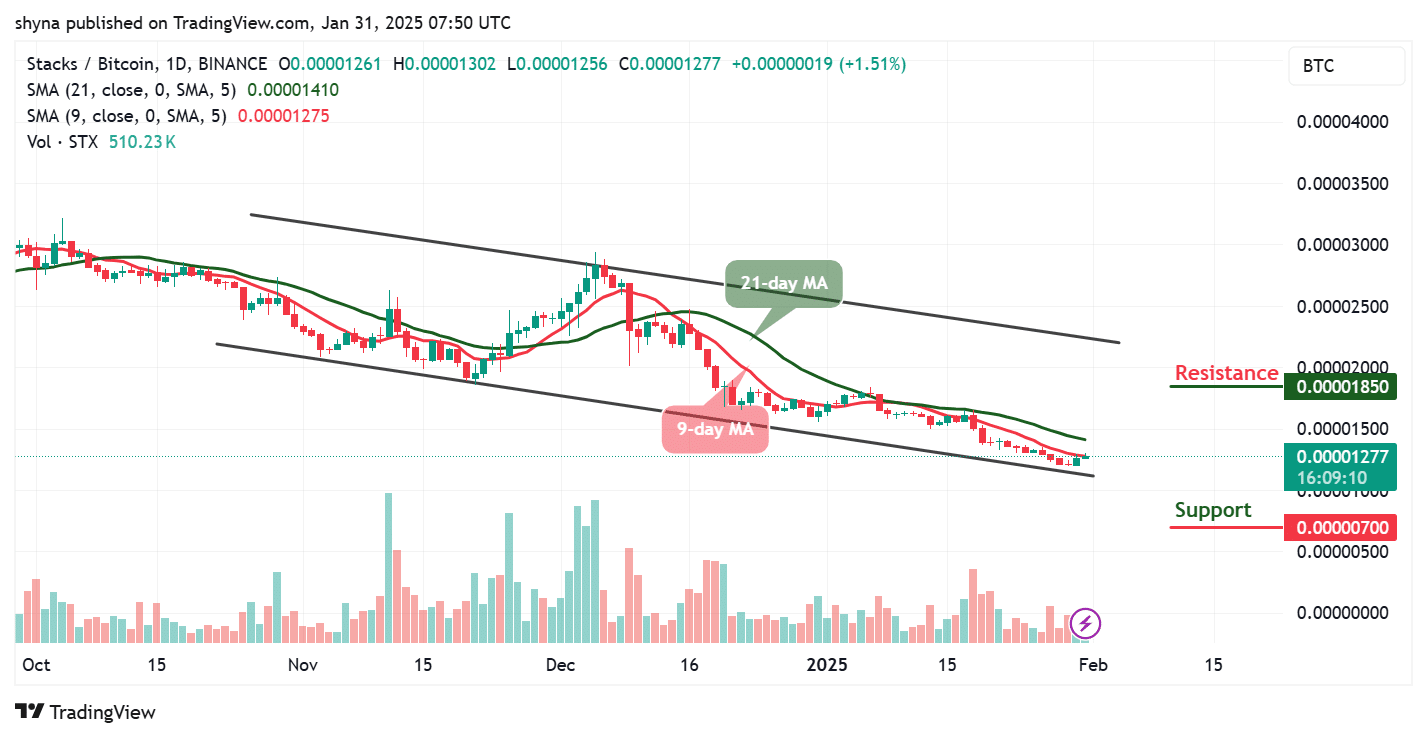

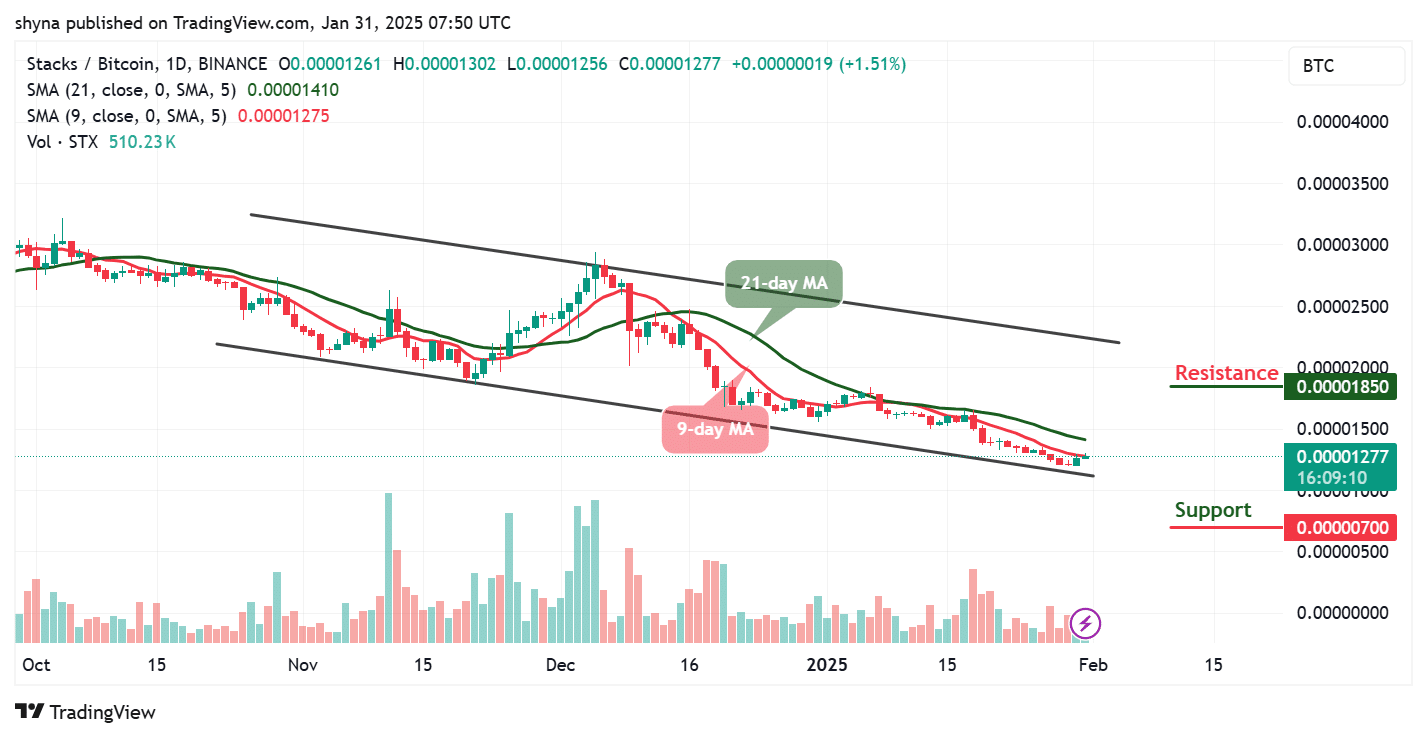

STX/BTC Might Cross Beneath the Trendline

STX/BTC every day chart continues to commerce inside a descending channel, with the present value at 1277 SAT. The market stays bearish because the 9-day MA (1275 SAT) is beneath the 21-day MA (1410 SAT), confirming downward stress. Nonetheless, the worth is close to the channel’s decrease boundary, suggesting a possible help take a look at at 700 SAT. If this degree holds, a short-term rebound towards the 9-day MA and even the 21-day MA may very well be anticipated. Failing to keep up this help, nevertheless, might speed up the bearish momentum and push costs decrease.

On the upside, for STX/BTC to reverse its present pattern, the worth should break above the 21-day MA and goal the subsequent resistance at 1850 SAT. Nonetheless, a bullish breakout from the descending channel might sign a pattern shift, however present quantity ranges stay weak, suggesting low shopping for curiosity. If bulls fail to maintain momentum, the downtrend might proceed. In the meantime, merchants ought to monitor how the worth reacts close to the help zone and whether or not it could actually reclaim the 9-day MA as preliminary resistance.

Furthermore, @inmortalcrypto shared on X (previously Twitter) that $STX caught their consideration because the first-ever SEC-qualified crypto venture, emphasizing that with America main the crypto house, U.S.-based cash like Stacks are prone to outperform.

One of many predominant causes $STX catch my consideration is as a result of it was the first-ever SEC-qualified crypto venture.

America might be on the forefront of crypto, and cash like Stacks, actually an American coin, will probably outperform.$STX pic.twitter.com/G0UAT8Q3P8

— Inmortal (@inmortalcrypto) January 21, 2025

Stacks Options

Current market developments point out that the worth of STX is presently squeezed inside a falling wedge, which might quickly resolve in a breakout. If the worth breaks above the higher resistance of this wedge, the technical goal could be round $3.50, which aligns with the earlier breakout targets. In different phrases, Wall Avenue Pepe has gained vital traction within the crypto market, elevating over $65 million in its presale with a tough cap of $73 million. In comparison with USD, $WEPE’s momentum suggests robust early demand, however post-launch value motion will rely upon investor conduct.

This Will Not Final – Wall Avenue Pepe Doubtless To Promote Out Early

With every day inflows of over $1 million, demand is hovering, and early buyers are positioning themselves for potential exponential features. The venture has already attracted main curiosity from holders of earlier profitable tokens, displaying robust neighborhood backing and confidence. Because the crypto market heats up, $WEPE stands out with its distinctive branding, rising ecosystem, and bullish sentiment. Don’t miss out — safe your place now earlier than the presale sells out and $WEPE takes off on main exchanges.

Go to Wall Avenue Pepe

Associated Information

Latest Meme Coin ICO – Wall Avenue Pepe

- Audited By Coinsult

- Early Entry Presale Spherical

- Non-public Buying and selling Alpha For $WEPE Military

- Staking Pool – Excessive Dynamic APY

Be a part of Our Telegram channel to remain updated on breaking information protection