XRP value has been down greater than 3% within the final 24 hours as momentum reveals indicators of slowing. Whereas RSI has dropped beneath 40, indicating weakening power, whale exercise has remained stagnant, suggesting that enormous holders usually are not but accumulating.

Moreover, EMA strains are nearing a possible loss of life cross, which may result in additional draw back if promoting stress will increase. Nonetheless, if XRP breaks key resistance ranges and reclaims sturdy bullish momentum, it may arrange for a rally towards $4 in February.

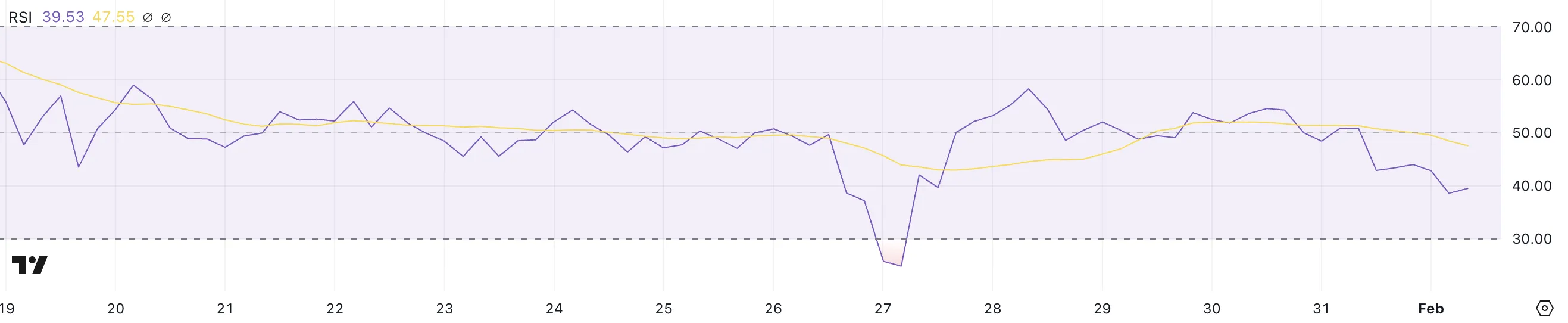

XRP RSI Is Presently Impartial, Beneath 40

XRP RSI is at the moment at 39.5, having remained in a impartial vary since January 28, when it peaked at 58. The Relative Power Index (RSI) is a momentum indicator that measures the power of value actions on a scale from 0 to 100.

Readings above 70 point out overbought situations, usually resulting in a pullback, whereas ranges beneath 30 recommend oversold situations, the place a rebound could also be possible. A impartial RSI between 40 and 60 alerts consolidation, the place neither patrons nor sellers have clear dominance.

With XRP’s RSI nearing the oversold zone, it suggests weak momentum, which may result in additional draw back if shopping for stress doesn’t improve.

Nonetheless, for the XRP value to method $4 within the coming weeks, the RSI would wish to maneuver again above 50, signaling renewed power. That might occur with extra optimistic developments round its ETF, or with a confirmed withdrawal of the SEC lawsuit.

A breakout above 60 would verify bullish momentum, whereas a transfer previous 70 may point out an overheated rally. If RSI stays weak, XRP might battle to keep up its present ranges and will face additional consolidation.

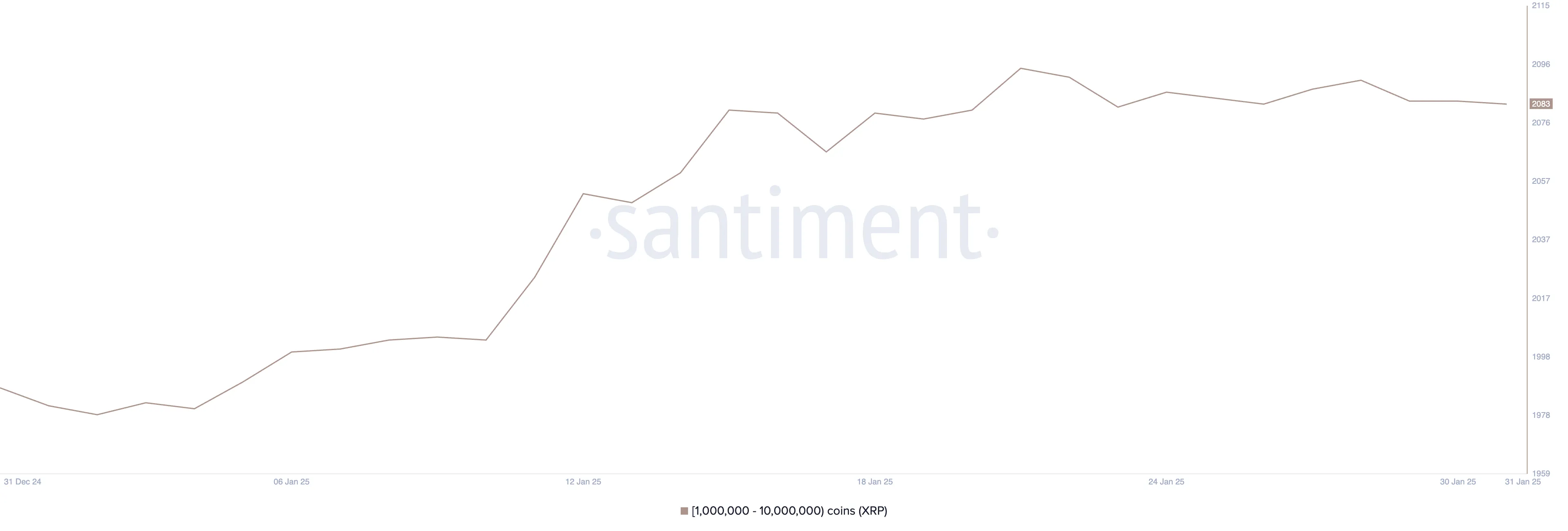

XRP Whales Are Shifting Sideways Since January 21

The variety of XRP whale addresses – these holding between 1 million and 10 million XRP – has remained stagnant since January 21. It has been fluctuating between 2,095 and a pair of,082, with the most recent rely at 2,083.

Monitoring these giant holders is essential as a result of whale accumulation usually precedes sturdy value strikes, as their shopping for or promoting exercise can considerably affect market liquidity and sentiment.

An increase in whale addresses suggests rising confidence from giant traders, whereas a decline might point out decreased conviction or profit-taking.

For XRP value to reclaim $4 in February, whale accumulation would possible have to resume its upward pattern, much like early January, when the variety of whales surged from 1,981 on January 4 to 2,080 on January 16. Throughout that interval, XRP’s value jumped from $2.41 to $3.4, marking a 41% improve.

If an identical sample of accumulation happens, it may sign renewed demand and gasoline one other rally. Nonetheless, if the variety of whales continues shifting sideways, XRP value might battle to realize the mandatory momentum for a sustained breakout.

XRP Value Prediction: Can XRP Hit $4 In February?

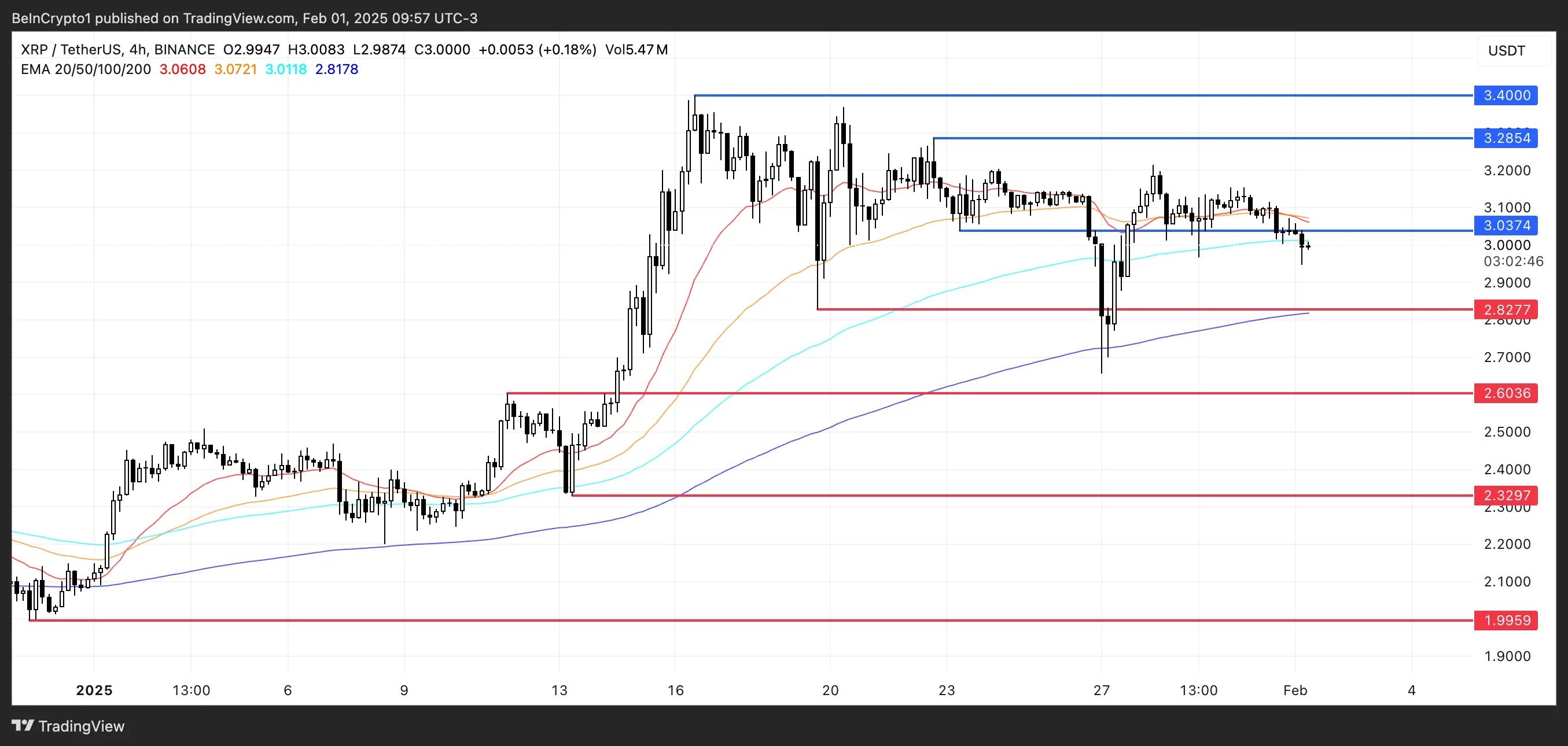

XRP’s EMA strains point out {that a} loss of life cross may kind quickly, signaling potential draw back momentum. If this bearish crossover occurs, the XRP value might check help at $2.82. If that stage fails, additional declines towards $2.6 and $2.32 may observe.

In a extra excessive situation, if promoting stress stays sturdy and these helps are misplaced, XRP may drop as little as $1.99, marking its lowest stage in 2025.

Then again, if XRP value exams and breaks the $3.03 resistance, it may regain bullish momentum and push towards $3.28 and $3.4.

A breakout above these ranges may permit XRP value to check $4, representing a possible 33.3% upside from present ranges.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.