Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.In the present day. The monetary and market data offered on U.In the present day is meant for informational functions solely. U.In the present day just isn’t chargeable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your individual analysis by contacting monetary specialists earlier than making any funding choices. We consider that each one content material is correct as of the date of publication, however sure affords talked about might now not be out there.

One of many worst bloodbaths within the historical past of the cryptocurrency market simply occurred, with liquidations skyrocketing previous $2.24 billion within the final day. With Bitcoin plummeting to $94,000 and your entire market collapsing together with it, this huge wipeout has destroyed leveraged merchants. The magnitude of the losses has damaged all earlier information, making this some of the vicious sell-offs within the historical past of cryptocurrency.

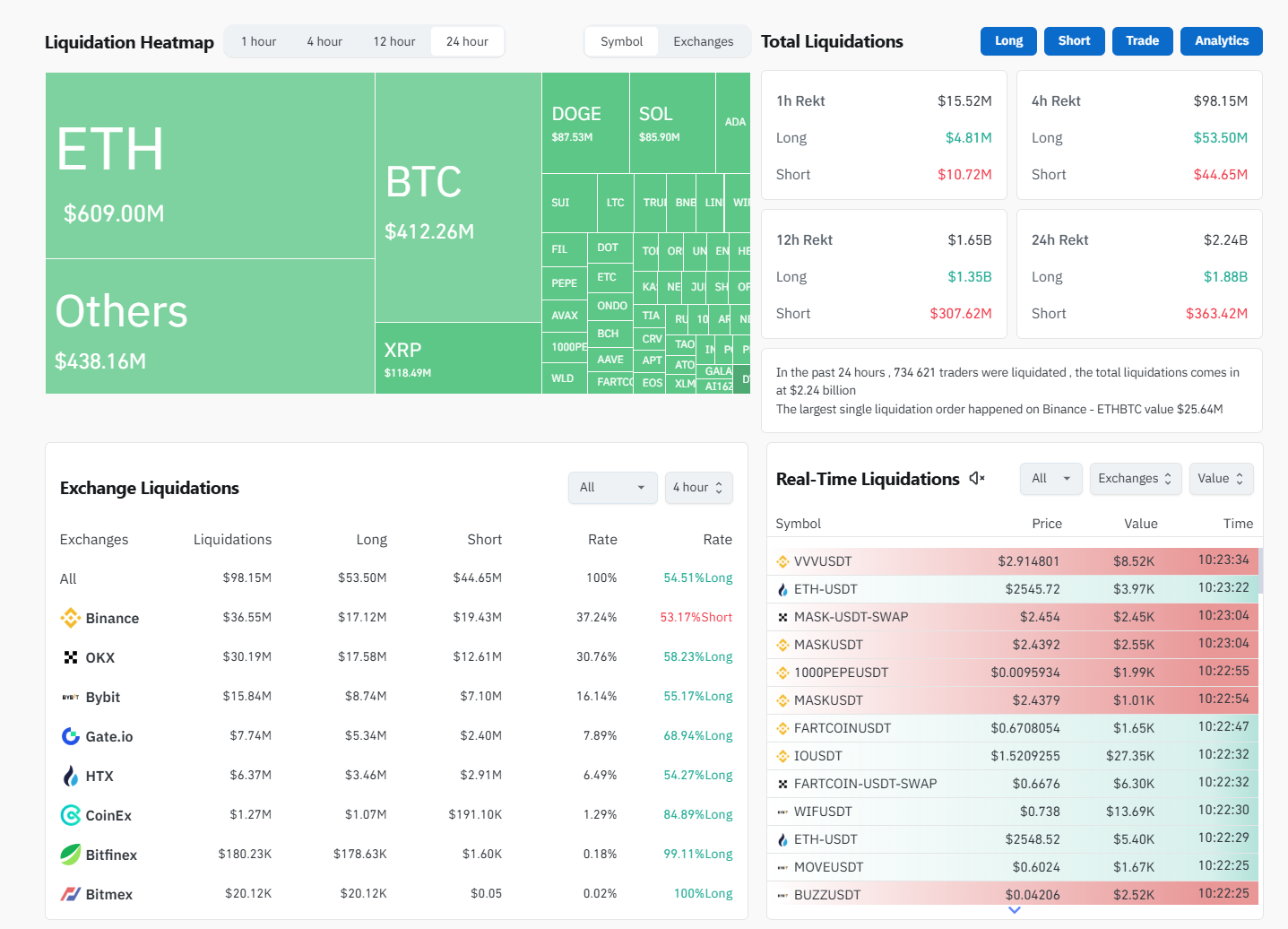

With $609 million in liquidations, Ethereum merchants have been probably the most negatively impacted, based on the liquidation heatmap. At $412 million, Bitcoin trailed carefully behind, whereas liquidations exceeding $85 million have been reported by XRP, Dogecoin and Solana. The largest single loss occurred on Binance, with an ETHBTC commerce price $25.64 million and a whopping 734,621 merchants liquidated in a single day.

After shedding essential help at $97,000, Bitcoin is at the moment testing $92,000 – a degree which will dictate its course within the close to future. The value of Bitcoin might drop to $83,000 if it drops beneath this degree, signaling a extra important correction. With Bitcoin on the prime of the market, altcoins are doing even worse; some have already dropped greater than 80% from their peak.

Altcoin momentum has fully collapsed, falling to 38 out of 100, based on the CMC Altcoin Season Index, which signifies a powerful part dominated by Bitcoin. This alteration displays merchants’ swift decline in threat urge for food and their flight from altcoins to safer property. The cryptocurrency market is in a panic proper now. If Bitcoin is unable to remain above $92,000, it’s prone to proceed declining.

Significantly for altcoins which have already been in free fall, losses might get even worse. Overleveraged merchants have paid the worth, and this carnage might not finish but until volatility ranges off.