Bitcoin’s worth actions have at all times been a topic of debate amongst traders and analysts. With latest market retracements, many are questioning whether or not Bitcoin has already reached its peak on this bull cycle. This text examines the info and on-chain metrics to evaluate Bitcoin’s market place and potential future actions.

For an in-depth full evaluation, consult with the unique Has The Bitcoin Value Already Peaked? full video presentation out there on Bitcoin Journal Professional’s YouTube channel.

Bitcoin’s Present Market Efficiency

Bitcoin lately confronted a ten% retracement from its all-time excessive, resulting in issues in regards to the finish of the bull market. Nevertheless, historic developments counsel that such corrections are regular in a bull cycle. Usually, Bitcoin experiences pullbacks of 20% to 40% a number of occasions earlier than reaching its closing cycle peak.

Analyzing On-Chain Metrics

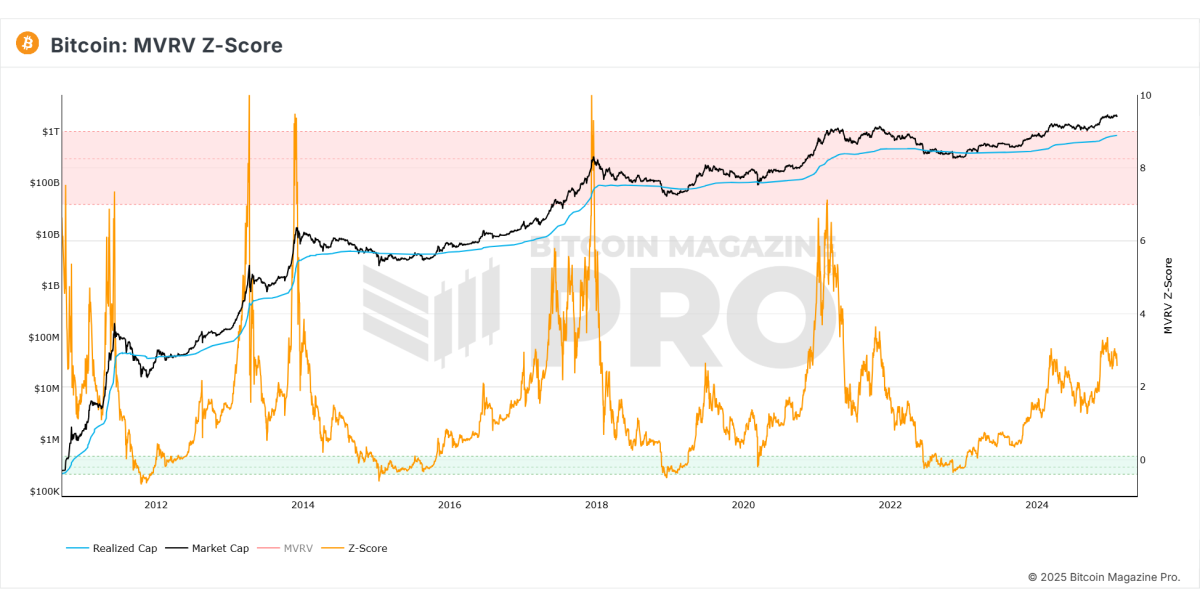

MVRV Z-Rating

The MVRV Z-score, which measures the market worth to realized worth, presently signifies that Bitcoin nonetheless has appreciable upside potential. Traditionally, Bitcoin’s cycle tops happen when this metric enters the overheated crimson zone, which isn’t the case presently.

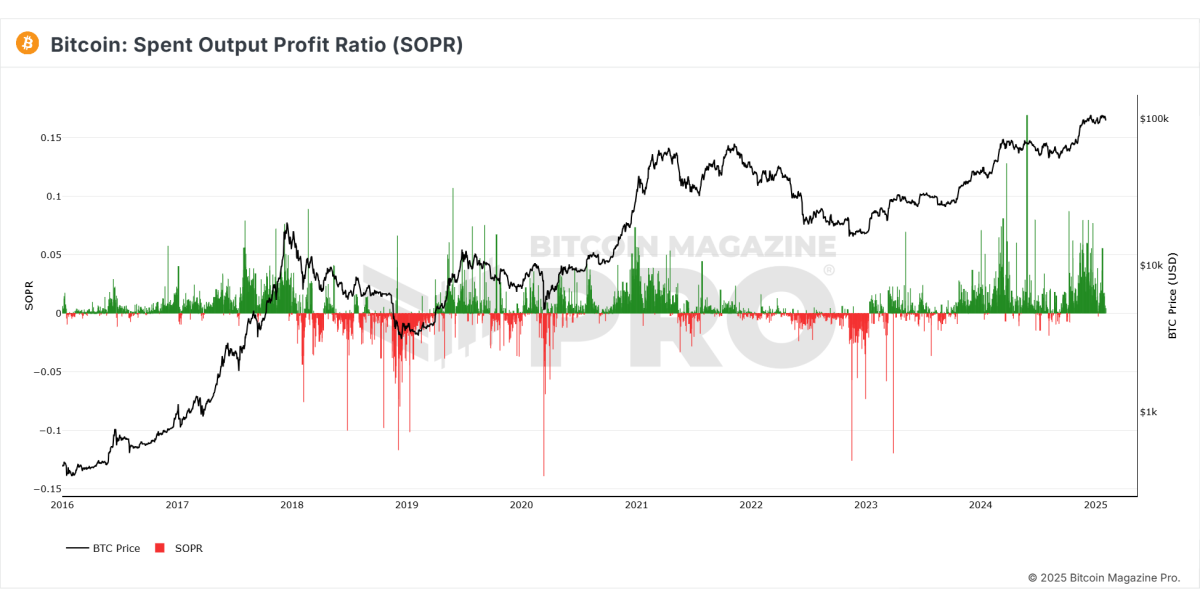

Spent Output Revenue Ratio (SOPR)

This metric reveals the proportion of spent outputs in revenue. Not too long ago, the SOPR has proven lowering realized income, suggesting that fewer traders are promoting their holdings, reinforcing market stability.

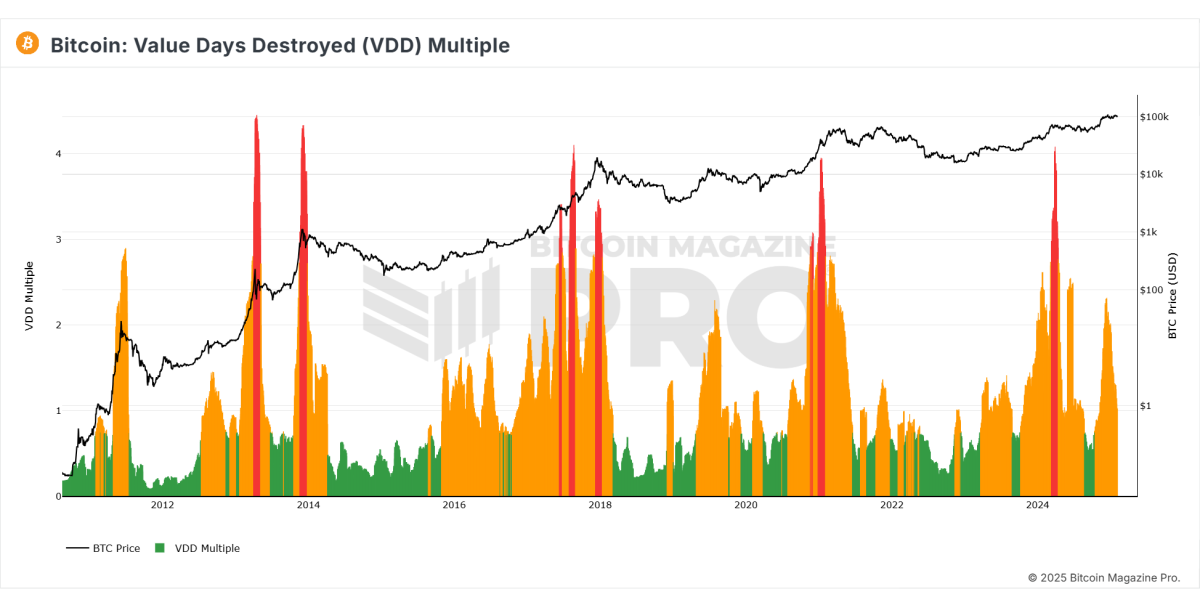

Worth Days Destroyed (VDD)

VDD signifies long-term holders’ sell-offs. The metric has proven a decline in promoting stress, suggesting that Bitcoin is stabilizing at excessive ranges fairly than heading into a protracted downtrend.

Institutional and Market Sentiment

- Institutional traders reminiscent of MicroStrategy proceed accumulating Bitcoin, signaling confidence in its long-term worth.

- Derivatives market sentiment has turned unfavorable, traditionally indicating a possible short-term worth backside as over-leveraged merchants betting in opposition to Bitcoin might get liquidated.

Macroeconomic Elements

- Quantitative Tightening: Central banks have been lowering liquidity, contributing to the short-term Bitcoin worth decline.

- International M2 Cash Provide: A contraction in cash provide has impacted threat belongings, together with Bitcoin.

- Federal Reserve Coverage: There are indications from main monetary establishments, together with JP Morgan, that quantitative easing may return by mid-2025, which might doubtless increase Bitcoin’s worth.

Associated: Is $200,000 a Practical Bitcoin Value Goal for This Cycle?

Future Outlook

- Bitcoin’s worth motion is displaying indicators of coming into a consolidation part earlier than one other potential rally.

- On-chain information suggests there may be nonetheless vital room for development earlier than reaching cycle peaks seen in earlier bull markets.

- If Bitcoin experiences additional pullbacks to the $92,000 vary, this might current a robust accumulation alternative for long-term traders.

Conclusion

Whereas Bitcoin has skilled a brief retracement, on-chain metrics and historic information counsel that the bull cycle just isn’t over but. Institutional curiosity stays robust, and macroeconomic situations may shift in favor of Bitcoin. As at all times, traders ought to analyze the info rigorously and think about long-term developments earlier than making any funding choices.

When you’re concerned with extra in-depth evaluation and real-time information, think about testing Bitcoin Journal Professional for invaluable insights into the Bitcoin market.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.