Este artículo también está disponible en español.

Bitcoin (BTC) has had a risky 24 hours, plunging from $99,500 to as little as $91,231 amid mounting considerations over impending US commerce tariffs on Canada, Mexico, and China. Nevertheless, some crypto analysts see this sharp decline as a shopping for alternative, suggesting that BTC could also be oversold and poised for a rebound.

Is Bitcoin Poised For A Aid Rally?

Yesterday, the crypto market skilled one in every of its largest sell-offs in historical past, with over $2.3 billion in liquidations affecting greater than 742,000 merchants. This degree of liquidations surpasses these seen through the COVID market crash in March 2020 and the FTX collapse in November 2022.

Associated Studying

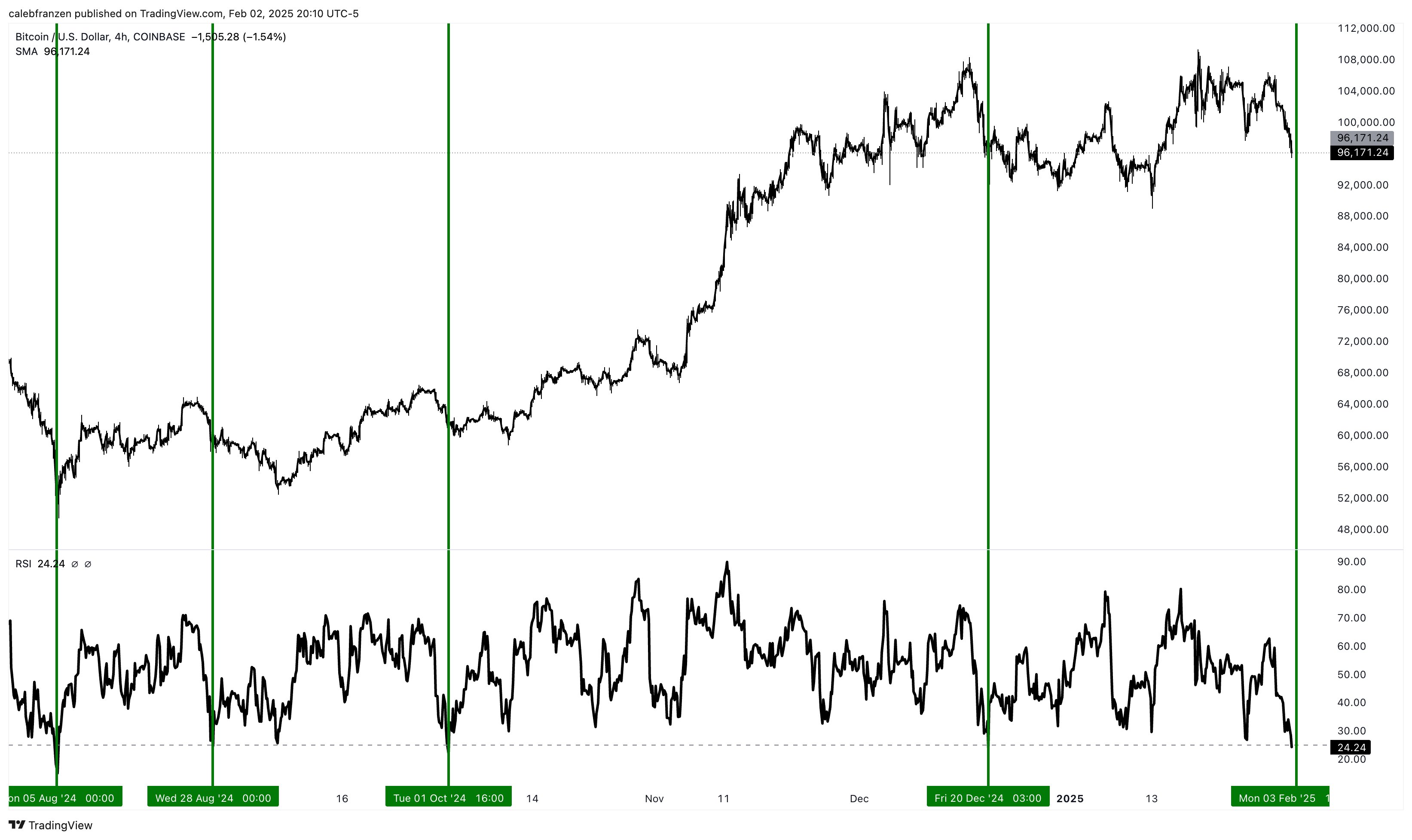

Regardless of the downturn, some analysts argue that BTC might have entered oversold territory, signaling a possible reduction rally. Crypto analyst Caleb Franzen shared insights in a put up on X, highlighting that Bitcoin’s 4-hour Relative Energy Index (RSI) has dipped into oversold ranges. He famous:

For the fifth time since August 2024, Bitcoin’s 4-hour RSI is turning into oversold. Every of the prior indicators had been enticing accumulation intervals, even when value made new short-term lows after the sign flashed.

For the uninitiated, the RSI is a momentum indicator that measures the pace and magnitude of current value modifications to find out whether or not BTC is overbought or oversold. A studying above 70 suggests overbought situations – potential for a pullback – whereas a studying beneath 30 signifies oversold situations – potential for a rebound.

In keeping with Franzen’s chart, Bitcoin’s present RSI is hovering round 24 on the 4-hour timeframe, indicating that BTC could also be in a horny accumulation zone. If historic tendencies maintain, BTC may very well be on the verge of a short-term restoration.

Is There Extra Bother For BTC Forward?

As of the most recent updates, Donald Trump and his Mexican counterpart Claudia Sheinbaum have agreed to briefly delay the proposed commerce tariffs, providing some reduction to monetary markets. Nevertheless, uncertainty stays relating to commerce negotiations with Canada, leaving buyers cautious about BTC’s subsequent transfer.

Associated Studying

In the meantime, fellow crypto analyst Johnny’s evaluation signifies that “the meat” of BTC’s present down transfer is probably going over. The analyst added that so long as BTC continues to commerce above vary lows and the yearly open, it is going to “look good in comparison with the remainder of the market.”

Nevertheless, not all consultants are optimistic. Famend businessman and creator Robert Kiyosaki warns that BTC may face additional draw back stress if Trump follows via along with his tariff plans.

In keeping with Kiyosaki, elevated tariffs may strengthen the US greenback, probably driving buyers away from danger property like Bitcoin within the quick time period. At press time, BTC trades at $98,644, up 0.4% up to now 24 hours.

Featured picture from Unsplash, Charts from X and TradingView.com