US Ethereum ETFs hit document quantity Monday as buyers purchased the dip regardless of market downturns. The 9 ETFs noticed $1.5 billion in whole buying and selling quantity, with a $84 million influx from new buyers.

Though the ETFs are performing fairly properly, hassle stays on the horizon. Their commerce volumes have gotten more and more uncoupled from Ethereum itself because the group faces management crises and shaken public confidence.

Ethereum ETFs See Document Buying and selling Volumes

Ethereum has been in a difficult spot these days, however its ETFs are pulling large numbers. Ethereum was already battling declining person counts and falling costs, however Trump’s tariff threats introduced large shocks to the entire crypto market.

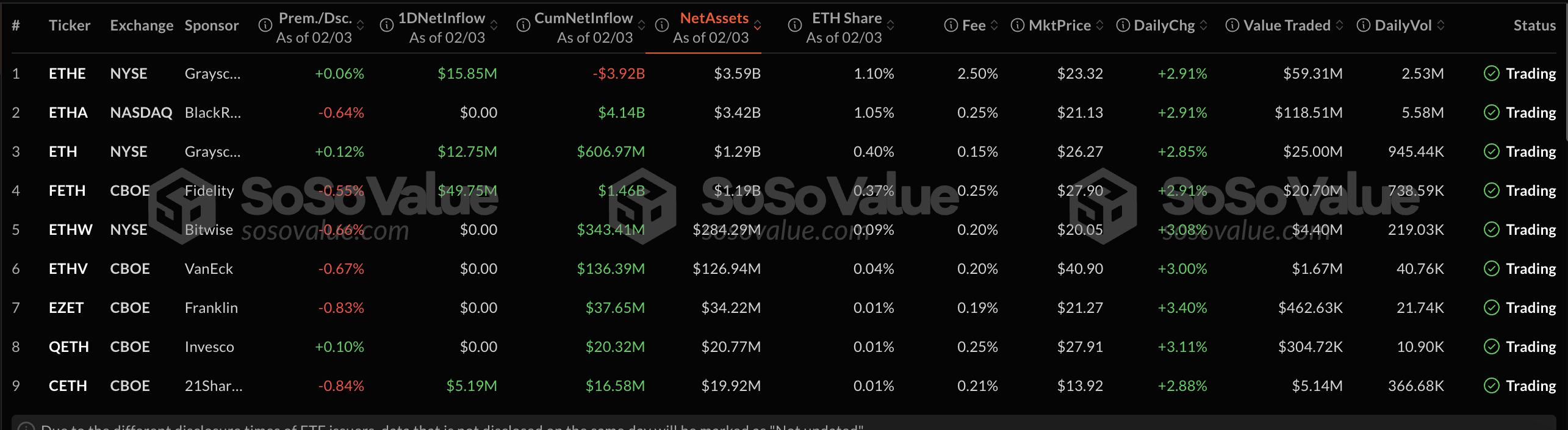

Nonetheless, even whereas the altcoin was struggling, ETF buyers purchased the dip in large quantities, resulting in $1.5 billion in buying and selling quantity.

Basically, the broader market shocks triggered large ranges of panic-selling, stop-loss triggers, and compelled liquidations. As a key asset for the DeFi area, ETH is susceptible to swings from general leveraged buying and selling.

These outflows pumped up the ETFs’ buying and selling quantity, and Ethereum delivered web inflows, together with $84 million from new buyers.

After these difficult actions, Ethereum’s worth considerably recovered from Monday’s early market crash.

Nonetheless, the main altcoin has been struggling for a number of totally different causes. Management restructuring at Ethereum has shaken public confidence within the agency, feeding worth considerations.

In the meantime, Ethereum ETFs even have a number of bullish components underneath their belt. They set a brand new document for inflows in December, attracting greater than $2 billion in institutional curiosity regardless of a flagging worth.

This development continued all through January, with heightened ETF commerce regardless of widening cracks within the Ethereum Basis.

Moreover, a number of outdoors components helped juice this rally. Donald Trump’s son, Eric Trump, inspired his followers to spend money on Ethereum through social media.

“In my view, it’s a good time so as to add ETH,” Eric Trump posted.

Open curiosity in ETH futures contracts on the CME additionally climbed round 6%, signaling institutional curiosity. Collectively, these income streams helped assure massive good points.

In the end, Ethereum ETFs are doing properly, however the underlying asset’s broader future continues to be unsure. Group turmoil is inflicting critical cracks within the asset’s assist base.

That is particularly regarding as a result of ETH enjoys status and fame on account of its lengthy historical past within the area. In the end, these ETF trades might solely paper over broader considerations.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.