- Ripple minted one other 1 million RLUSD tokens on the third of January.

- This indicated elevated traction however was nonetheless comparatively small in comparison with different USD stablecoins.

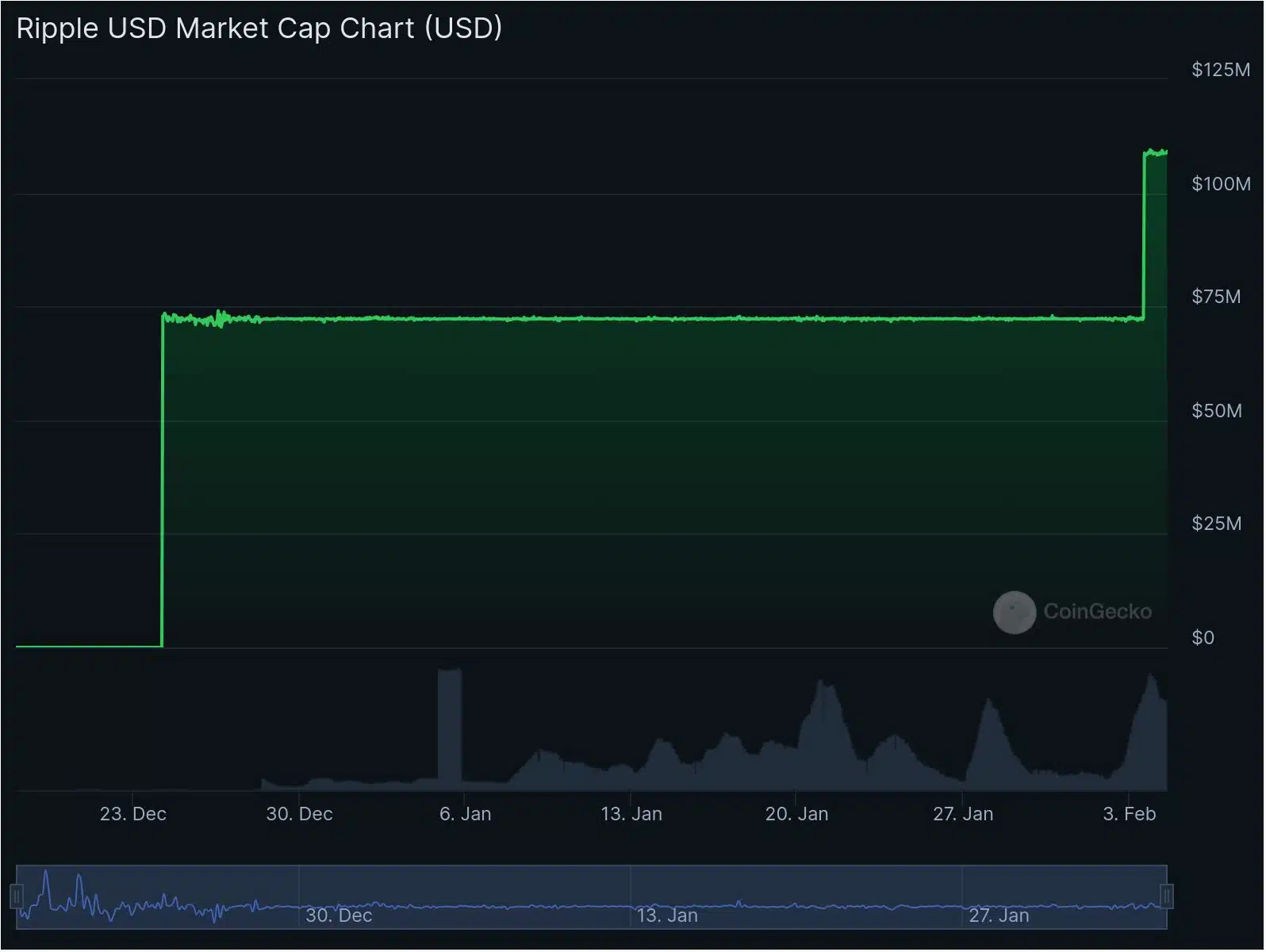

On the third of February, Ripple[XRP] minted one other a million RLUSD tokens, suggesting elevated traction and adoption of the brand new stablecoin.

Apparently, the latest minting additionally coincided with a whopping surge in buying and selling volumes, which topped $402 million.

Consequently, Coingecko information confirmed that the stablecoin’s market cap surged to $108M, simply shy of $110M.

Supply: Coingecko

Will RLUSD improve market share?

RLUSD’s traction appears robust for a one-month-old stablecoin. Nevertheless, it pales in comparison with established USD stablecoins. Tether’s USDT, the most important stablecoin by market share, has a $140B market cap.

Circle’s USDC, the second-largest, has a $54B market cap. Others like Typical USD (USDO) and Ethena’s USDE have over $1B in market measurement.

Ripple’s management is assured RLUSD may achieve extra market share, particularly in regulated markets.

In a December interview, Ripple’s president, Monica Lengthy, reiterated the stablecoin market will develop to $3 trillion by 2028. She believes regulated and diversified stablecoins like RLUSD will play a big function.

Tether’s USDT has confronted regulatory challenges in Europe after strict MiCA pointers went stay final yr. This has given USDC a comparative moat within the EU market.

Nevertheless, whether or not RLUSD will compete with USDC in regulated markets stays to be seen.

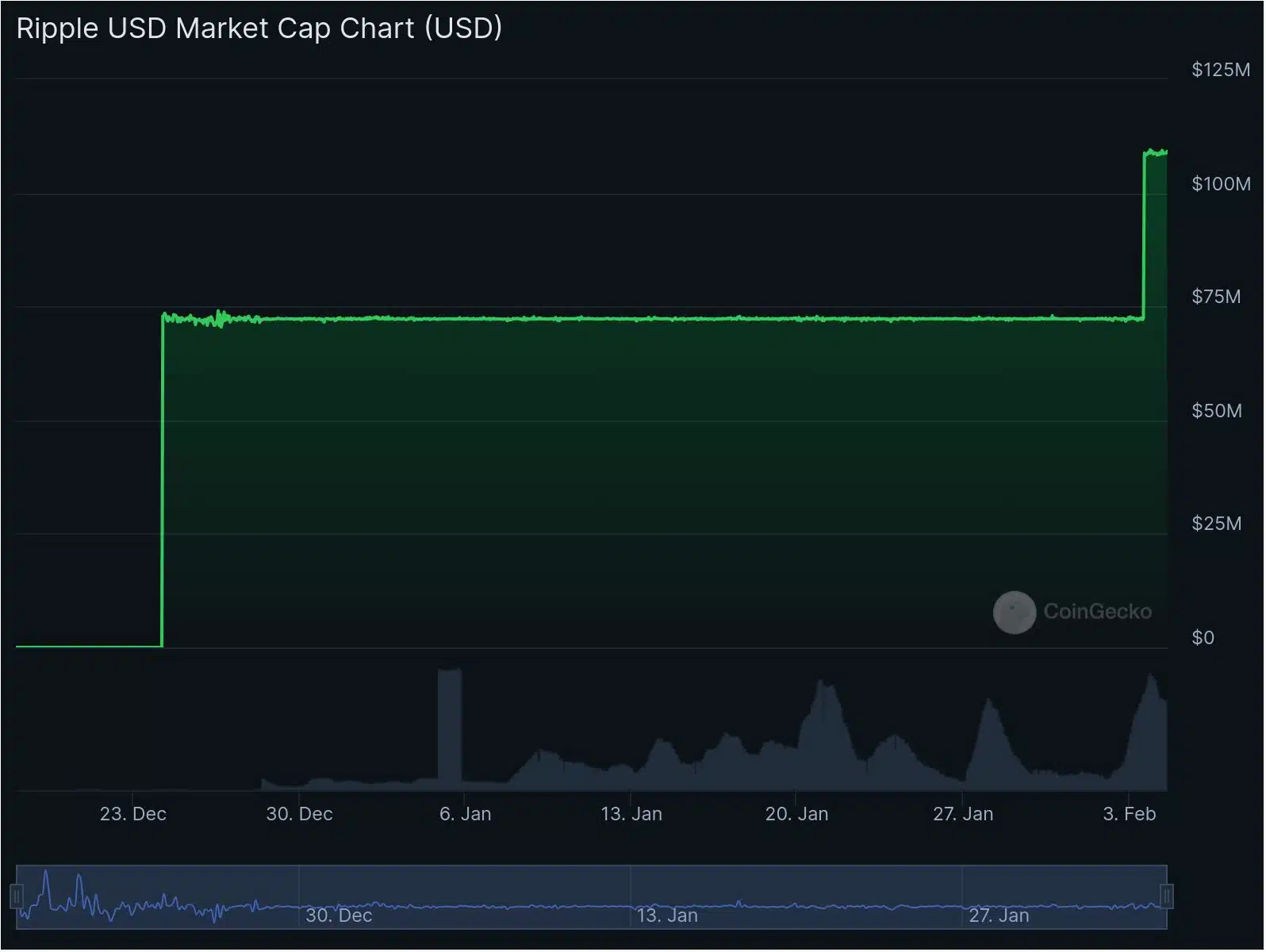

The latest traction in RLUSD can’t be straight attributed to XRP’s worth motion. After the deleveraging occasion on the third of February, the broader market, together with XRP, noticed a V-shape restoration.

Any stronger demand for RLUSD will counsel a web constructive for the XRPL ecosystem and its native token, XRP.

Supply: XRP/USDT, TradingView