Main meme coin Shiba Inu (SHIB) has seen a big drop in worth, falling by 20% over the previous week. Attributable to this double-digit value fall, a key on-chain metric means that SHIB has develop into undervalued, indicating it could be time to purchase.

Nevertheless, whereas the MVRV ratio suggests a positive shopping for alternative, SHIB’s downtrend is probably not over.

Shiba Inu Turns into Undervalued, However There Is a Catch

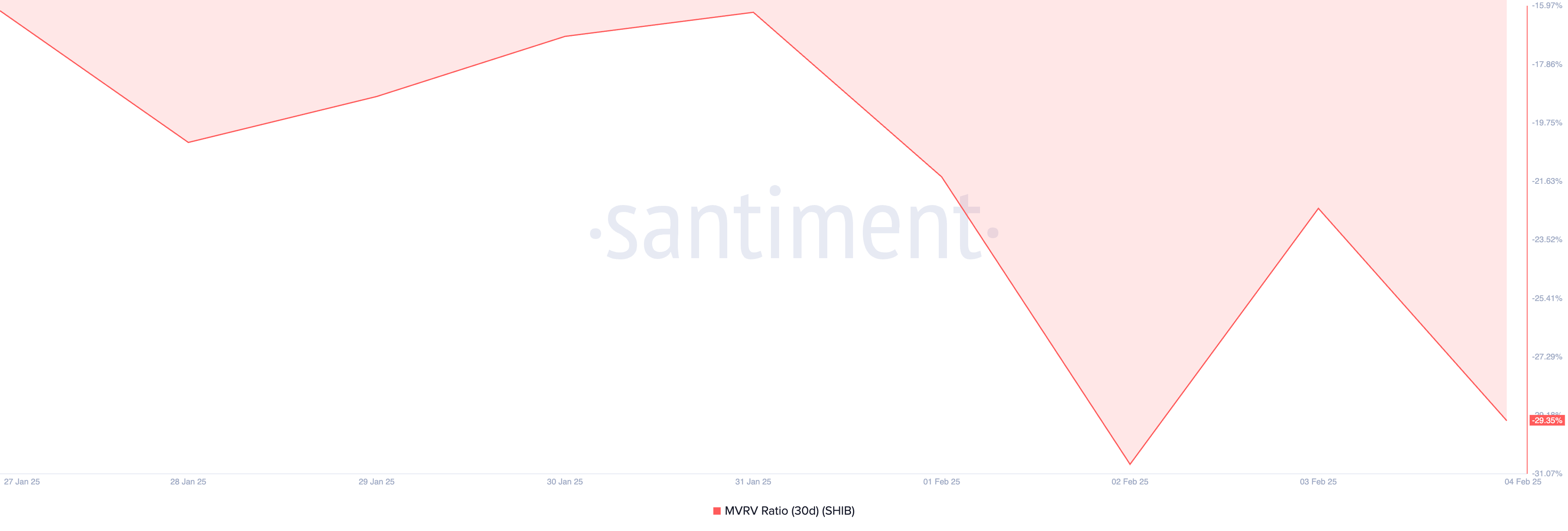

An evaluation of SHIB’s market worth to realized worth (MVRV) ratio utilizing a 30-day transferring common confirms its undervalued standing. In response to Santiment’s information, this ratio is -29.35% at press time.

An asset’s MVRV ratio identifies whether or not it’s overvalued or undervalued by measuring the connection between its market worth and its realized worth. When an asset’s MVRV ratio is constructive, its market worth is larger than the realized worth, suggesting it’s overvalued.

Alternatively, as with SHIB, when the ratio is unfavourable, the asset’s market worth is decrease than its realized worth. This implies that the coin is undervalued in comparison with what folks initially paid for it.

Traditionally, unfavourable MVRV ratios current a shopping for alternative for these seeking to “purchase the dip” and “promote excessive.” Nevertheless, the robust bearish sentiment plaguing SHIB means that the probability of a value rebound within the close to time period could also be low.

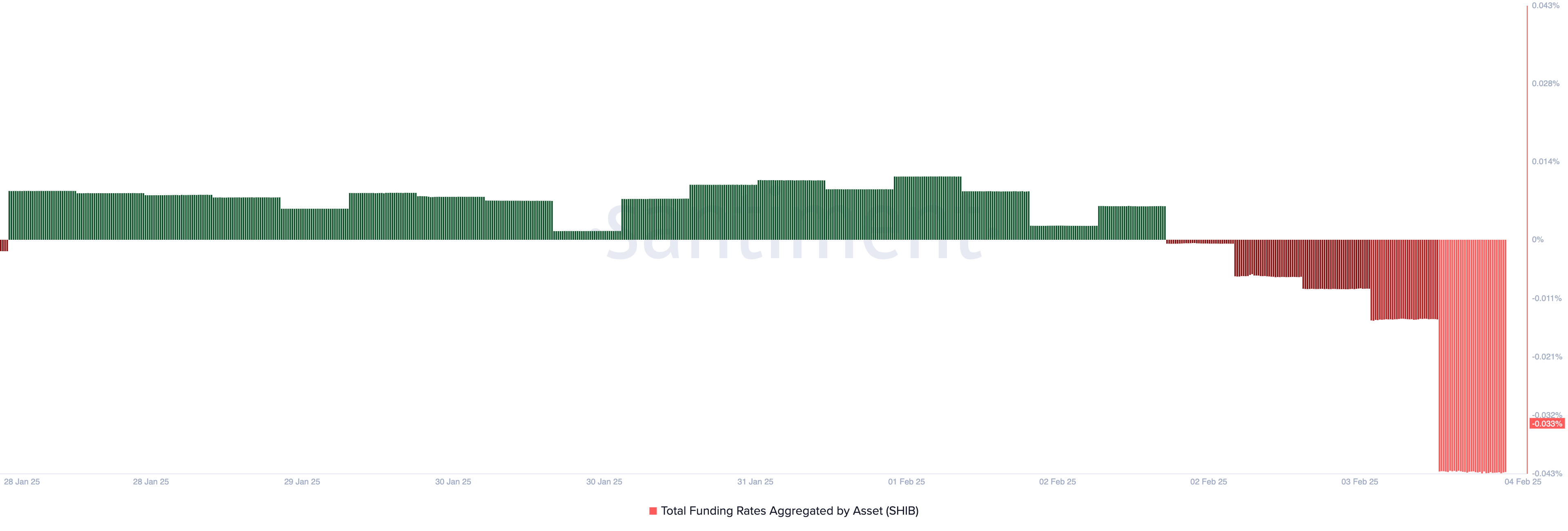

Notably, the bearish bias is mirrored by the meme coin’s unfavourable funding charge of -0.03% at press time.

The funding charge is the periodic cost exchanged between lengthy and brief merchants in perpetual futures markets. It’s designed to maintain the value of a spinoff near the underlying asset. When the funding charge is unfavourable, brief merchants pay lengthy merchants, indicating bearish sentiment as extra merchants wager on the value happening.

Due to this fact, whereas SHIB’s MVRV ratio signifies that the meme coin is at present undervalued, making it a gorgeous entry level for merchants seeking to “purchase the dip,” the prevailing bearish sentiment means that the downtrend is probably not over.

SHIB Worth Prediction: Will Patrons Step In?

On the every day chart, SHIB’s Chaikin Cash Circulation (CMF) helps the bearish outlook above. As of this writing, the CMF indicator is beneath zero at -0.03, indicating a powerful promoting exercise amongst merchants.

An asset’s CMF measures cash move into and out of its market. When its worth is beneath zero, shopping for exercise is minimal. If SHIB’s demand stays low, it would prolong its decline to $0.000014.

Conversely, if coin distribution stalls, it might drive SHIB’s worth as much as $0.000016.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.