Crypto narratives are present process main shifts this week, with AI tokens, Actual-World Property (RWA), and meme cash all seeing important corrections. The AI sector, as soon as a top-performing class, has seen its market cap drop 42% prior to now month, with main tokens like FET and RENDER extending their losses.

In the meantime, the RWA sector has fallen from $72 billion to $55.5 billion in simply three days, although regulatory readability within the US might present long-term assist. Meme cash have additionally taken successful, with the highest 10 largest tokens all down a minimum of 22% within the final week.

AI Tokens

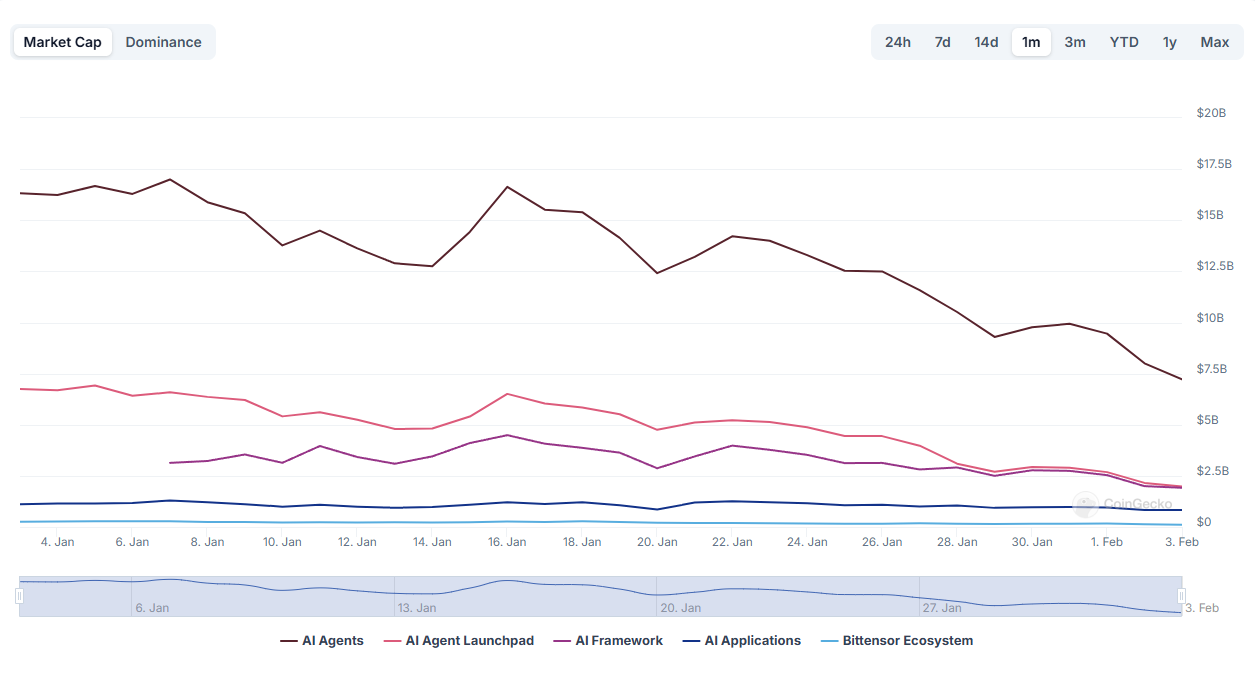

The synthetic intelligence sector has been one of many hardest-hit areas within the crypto market over the previous month. After reaching a peak market cap of $60 billion on January 6, it has now fallen to $32.8 billion, reflecting a pointy decline.

A few of the greatest AI tokens have taken heavy losses prior to now seven days, with FET down 32.2%, RENDER dropping 27.21%, and VIRTUAL dropping 35%.

The correction, which started roughly two weeks in the past with DeepSeek’s influence, has prolonged throughout the sector, pushing many AI tokens to multi-month lows.

With the AI crypto market cap down almost 42% in 30 days, this week could possibly be essential in figuring out whether or not these property stabilize and prepare for a rebound or face additional draw back.

Actual-World Property (RWA)

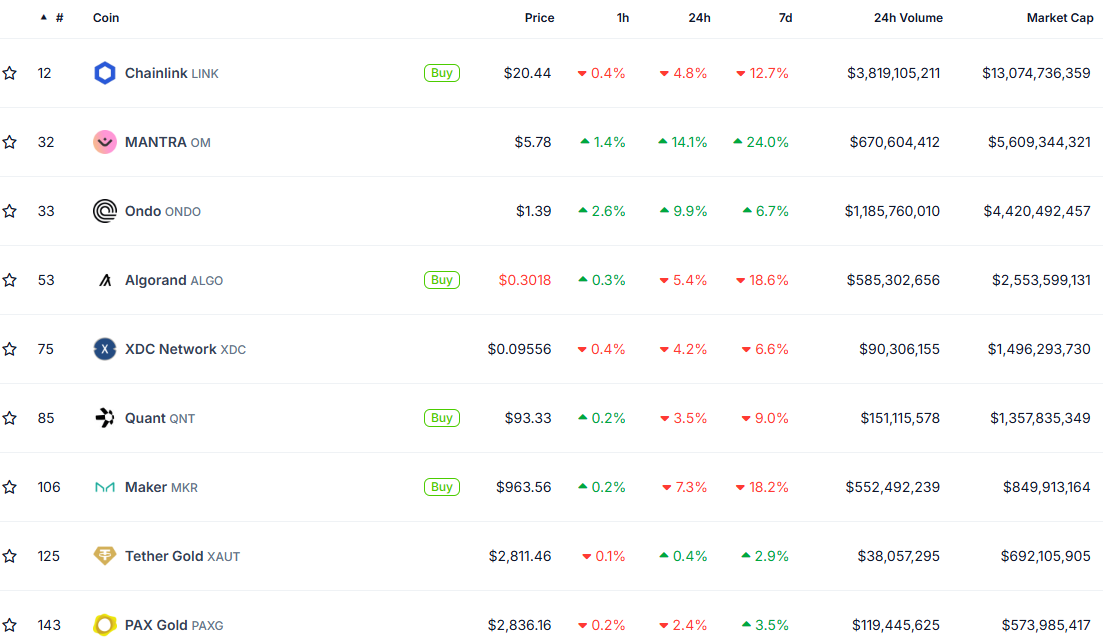

The Actual-World Property (RWA) sector has skilled a pointy decline, with its market cap dropping from $72 billion on January 31 to $55.5 billion in simply three days.

Regardless of this downturn, RWA stays a big asset class inside crypto, at present comprising 9 tasks with market caps above $1 billion. Key gamers reminiscent of Chainlink, Avalanche, Hedera, Mantra, and Ondo proceed to drive the sector’s growth.

Though the latest correction has impacted RWA valuations, the sector continues to be some of the attention-grabbing crypto narratives. It stands to realize from potential regulatory developments within the US, a robust promise made by Donald Trump.

A clearer and extra favorable regulatory framework might unlock new alternatives for RWA purposes. With institutional giants like BlackRock and Morgan Stanley exhibiting curiosity, the sector is already drawing mainstream consideration, additional strengthening its long-term progress prospects.

Meme Cash

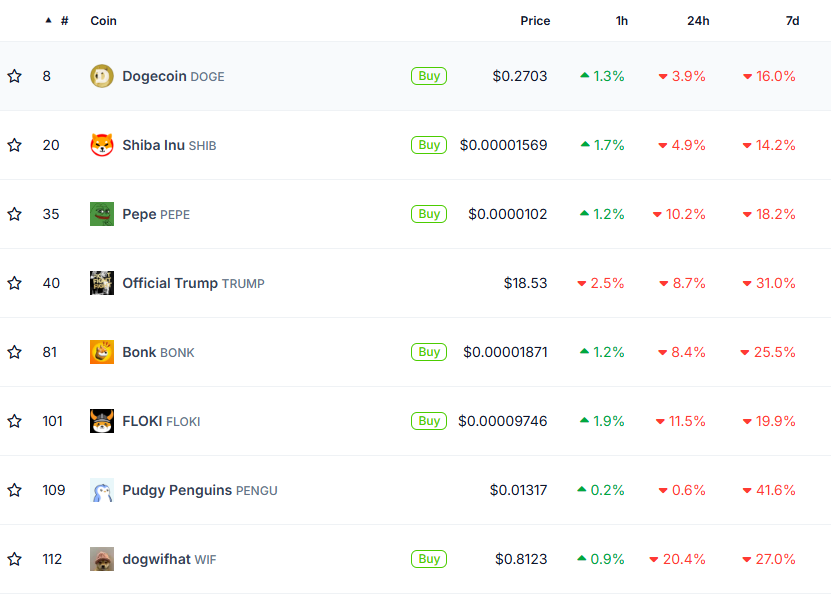

The meme coin sector, one of many greatest crypto narratives available in the market, has taken a significant hit in in the present day’s liquidation chaos. The highest 10 largest meme cash are all down a minimum of 22% prior to now week. PENGU has led the losses, dropping 46%, whereas solely 5 meme cash now keep a market cap above $1 billion.

Over the past 30 days, all the meme cash market has shrunk by 37%, bringing its whole valuation right down to $68 billion. This sharp correction highlights a shift in sentiment, with meme cash dropping the momentum that they had in earlier months.

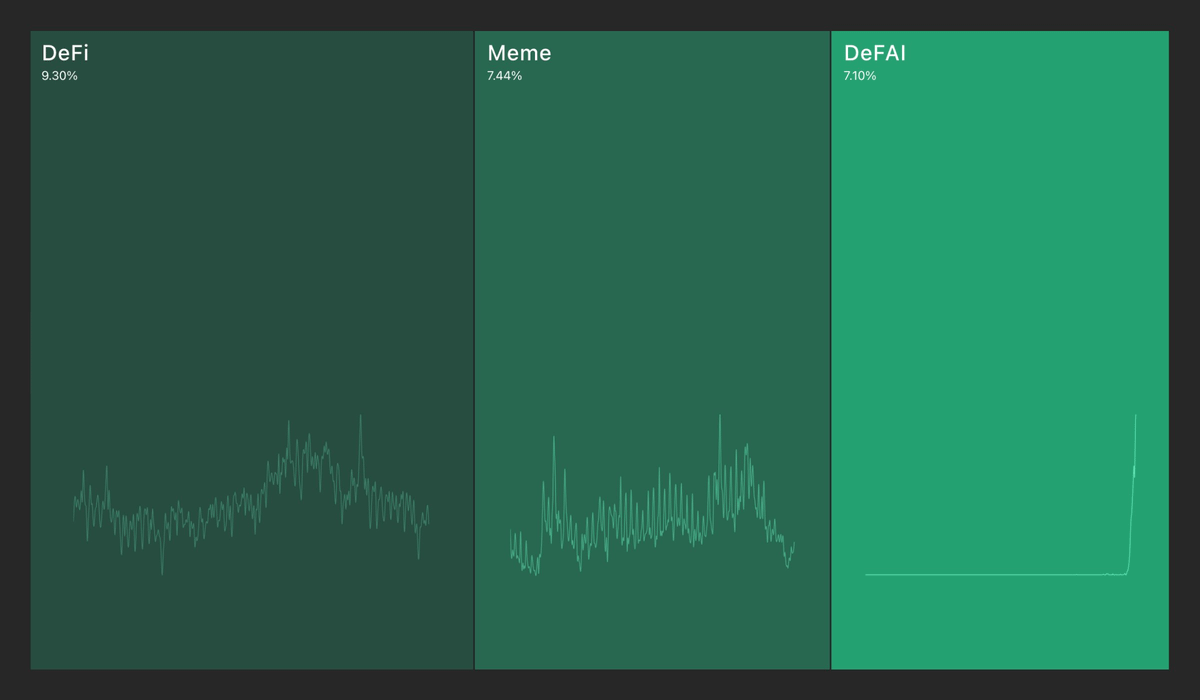

Latest information from Kaito means that meme coin mindshare has now fallen under that of DeFi, a development that hasn’t occurred in months.

This shift implies that buyers could also be rotating funds away from meme cash and into extra conventional DeFi property or stablecoins.

With decrease engagement and declining costs, meme cash are going through elevated promoting strain. Except a brand new catalyst emerges, their market dominance might proceed to fade.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.