Disclaimer: The opinions expressed by our writers are their very own and don’t characterize the views of U.In the present day. The monetary and market info offered on U.In the present day is meant for informational functions solely. U.In the present day shouldn’t be answerable for any monetary losses incurred whereas buying and selling cryptocurrencies. Conduct your personal analysis by contacting monetary consultants earlier than making any funding choices. We imagine that every one content material is correct as of the date of publication, however sure provides talked about might not be obtainable.

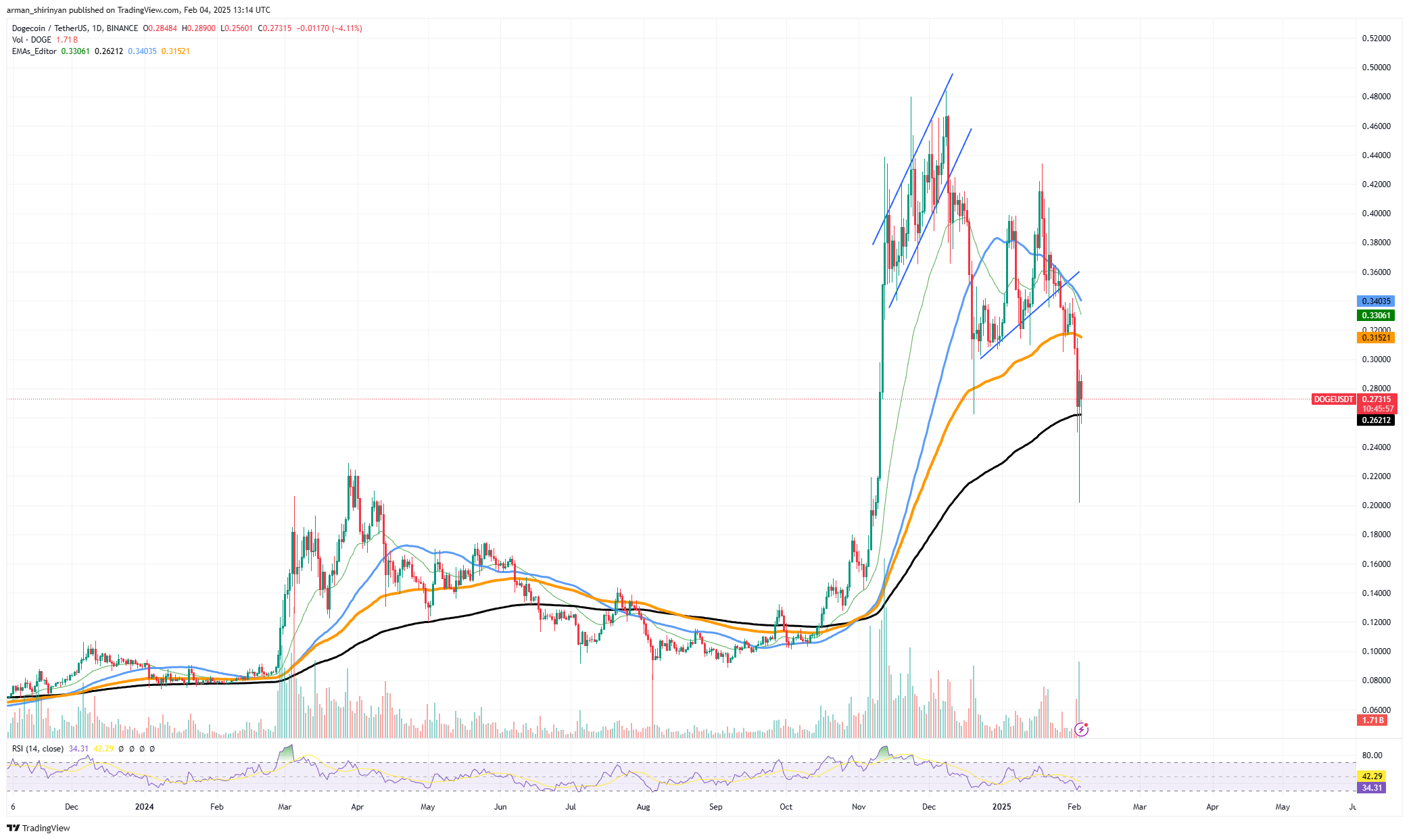

Dogecoin is at present on the 200 EMA, a traditionally vital zone for development reversals, having reached a important assist stage following a protracted decline. Dogecoin has beforehand used this stage as an important turning level, making it a important space the place both a major rebound or extra breakdown might happen.

Holding above 200 EMA: A restoration route is state of affairs 1. The downtrend might come to an finish and a reduction rally could also be triggered if DOGE is ready to preserve its place above the 200 EMA, which is at present at $0.26. If this stage is efficiently defended, patrons will likely be intervening to cease extra losses.

The subsequent resistance zone on this state of affairs is $0.34, and a restoration towards $0.30 to $0.32 is possible. A return to the $0.36-$0.38 vary may happen if momentum picks up pace. For a development reversal to be confirmed, DOGE should exhibit larger quantity and shopping for energy.

State of affairs 2: Bearish continuation with a break beneath the 200 EMA. A big bearish sign that might pave the way in which to a extra thorough correction could be generated if Dogecoin dropped beneath the 200 EMA. A speedy drop towards $0.22, the following essential assist stage, may end result from a break beneath $0.26.

At worst, DOGE may even return to $0.18, wiping out a big portion of its current beneficial properties. The meme coin could be in a dangerous place in consequence, and merchants could be intently monitoring any attainable indicators of restoration. It is a make-or-break state of affairs for DOGE. Whereas holding the 200 EMA may result in a short rally, a breakdown would improve promoting strain and trigger the asset to enter a extra extreme correction part. The approaching days will decide whether or not bulls can defend this important stage or if DOGE will enter one other leg down.

DXY pushes Bitcoin

Following a current rally, the U.S. Greenback Index (DXY), an important gauge of the greenback’s energy relative to different main currencies, is at present buying and selling at 108.60, indicating volatility. Bitcoin (BTC) and the DXY have traditionally had an inverse relationship; when the greenback rises, BTC usually struggles, and when it falls, Bitcoin often soars.

With the assistance of its 50 and 200 EMAs, which each point out continued energy, DXY has been on a powerful upward development. Bitcoin might be able to regain momentum, although, because the current rejection at 109.50 suggests potential weak point. An extra decline towards 106.40 or decrease may happen if DXY is unable to take care of assist at 107.70, offering a bullish setup for Bitcoin.

Bitcoin may get stronger and attempt to get away towards $100,000 if DXY begins to fall, assuming it stays at its present ranges. Nevertheless, BTC might expertise strain and a short-term decline again towards $92,000 to $90,000 if DXY recovers and breaks above 109.50. The Federal Reserve’s insurance policies and the forthcoming financial knowledge will likely be key components in figuring out how the DXY strikes.

The greenback might weaken and open the door for Bitcoin’s subsequent bullish transfer if inflation slows and price hikes sluggish. Nevertheless, if the economic system proves to be extra resilient than anticipated, DXY might rise whereas BTC struggles.

Ethereum’s worst efficiency

Ethereum has suffered vastly, performing worse than the opposite 10 hottest cryptocurrencies. Whereas XRP and Bitcoin have demonstrated indicators of stability and restoration, ETH continues to be plunging and is having hassle discovering assist. It’s at present the worst-performing main digital asset, with a current decline beneath $3,000 signifying a important breakdown.

In only a few days, ETH has dropped by nearly 30% and damaged beneath numerous essential assist ranges. Usually serving as highly effective dynamic helps, the 50 EMA ($3328) and 200 EMA ($3,192) have been damaged. If patrons don’t intervene, Ethereum, which is at present buying and selling at about $2,796, may lose more cash.

ETH is having a tough time recovering in distinction to Bitcoin, which continues to be buying and selling above $95,000, and XRP, which skilled a dramatic restoration following a major decline. The shortage of momentum suggests weak shopping for curiosity, leaving Ethereum susceptible to additional draw back strain.

The subsequent vital assist, which corresponds to earlier demand zones, is positioned round $2,600 if Ethereum is unable to get well $3,000. Ethereum may attain $2,300, a stage not seen in months, if it breaks beneath this. ETH might expertise a short reduction rally, nonetheless, if it recovers $3,000 and rises above $3,200. To substantiate a bullish reversal, it might nonetheless want to interrupt above $3,328.