- Publish-Merge, each long-term and short-term holders are decreasing Ethereum accumulation.

- Whales holding massive ETH balances present stagnation, signaling cautious sentiment.

Ethereum’s [ETH] much-anticipated transition from PoW to PoS in a transfer dubbed as “The Merge” in September 2022 was hailed as a groundbreaking shift for the blockchain trade.

Quick ahead almost two years, and the optimism surrounding the improve has begun to fade.

Each long-term and short-term Ethereum holders have sharply diminished their accumulation, elevating questions in regards to the long-term affect of the PoS transition.

This shift in sentiment is additional evident in Ethereum’s current efficiency, with ETH plummeting 27% through the newest market sell-off.

Because the panorama for digital belongings grows extra unsure, the query stays: Has Ethereum’s post-Merge path set it up for sustained development, or is it struggling to regain its footing amidst tightening market circumstances?

The Merge: Sport-changer or setback?

Ethereum’s swap from PoW to PoS in September 2022 aimed to enhance power effectivity, safety, and scalability. Not like PoW, the place miners use computational energy to validate transactions, PoS depends on validators who stake ETH to safe the community.

This drastically reduces power consumption – by over 99% – and lowers entry limitations for community participation.

Nevertheless, this transition marginalized miners, and based on Joao Wedson, drastically diminished ETH accumulation by each long-term holders (LTHs) and short-term holders (STHs).

With massive entities, former miners, and main funds additionally avoiding ETH purchases, considerations about Ethereum’s post-Merge market resilience proceed to mount.

Ethereum: Declining accumulation and stagnation amongst whales

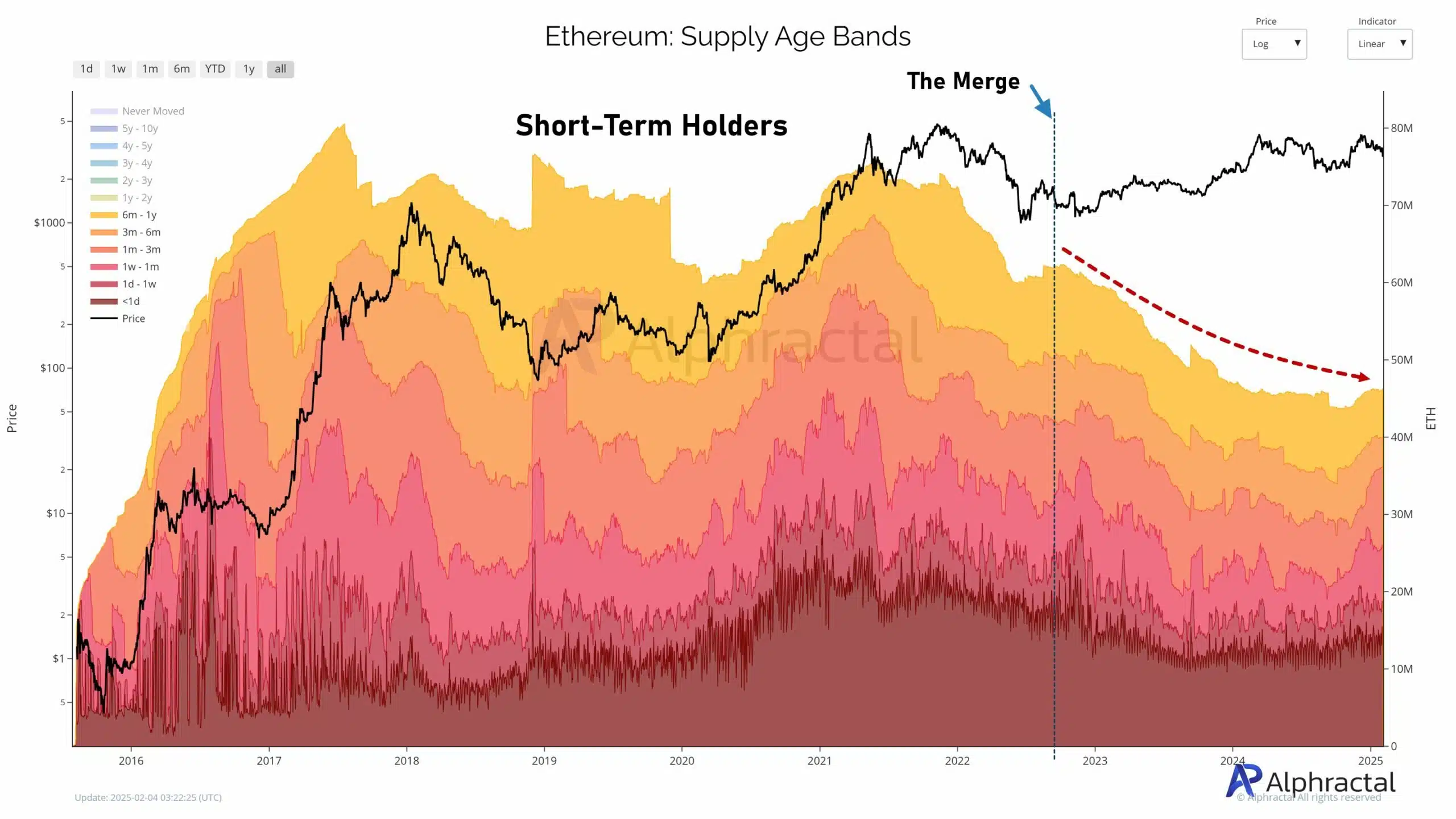

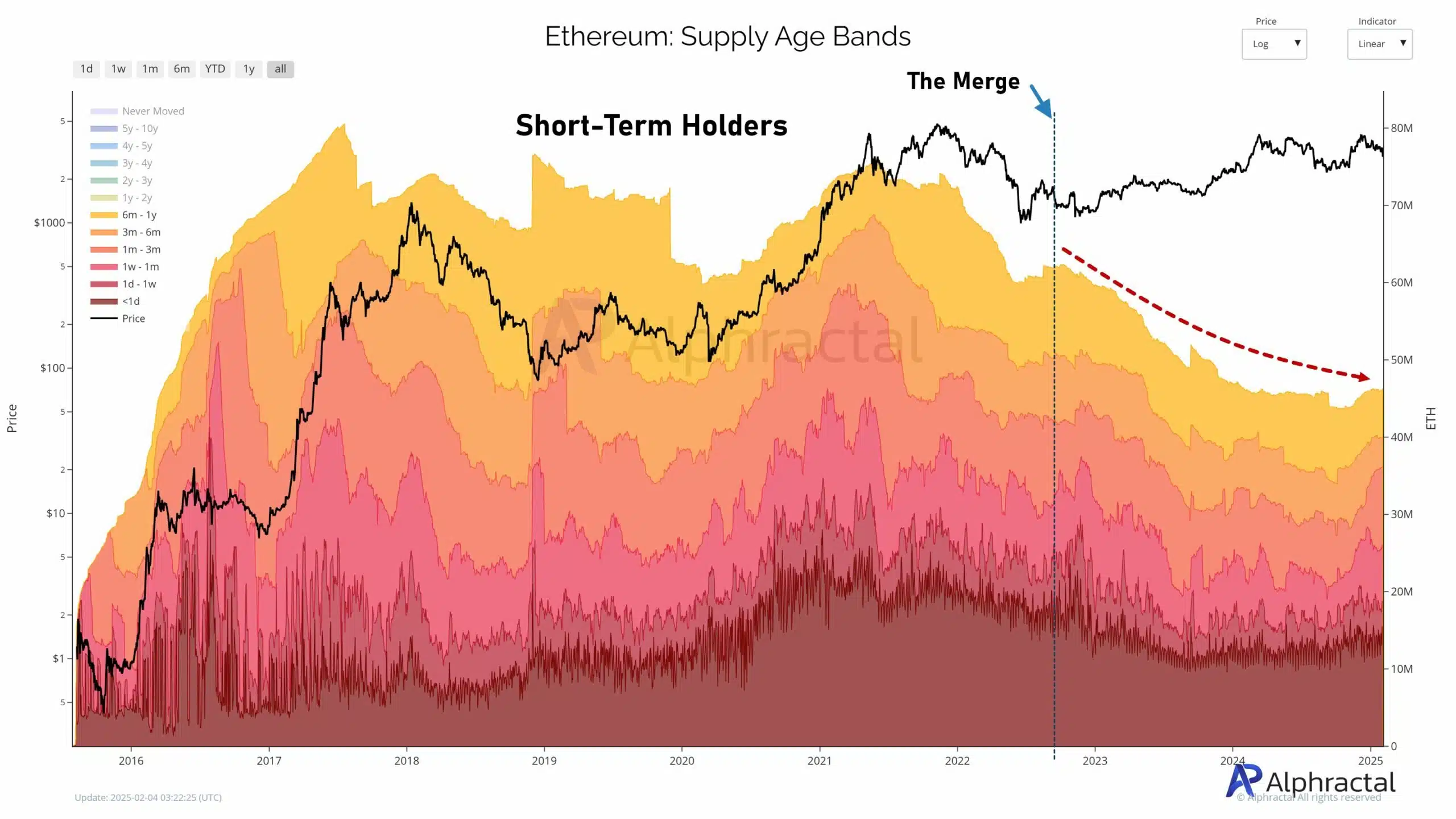

Supply: Alphractal

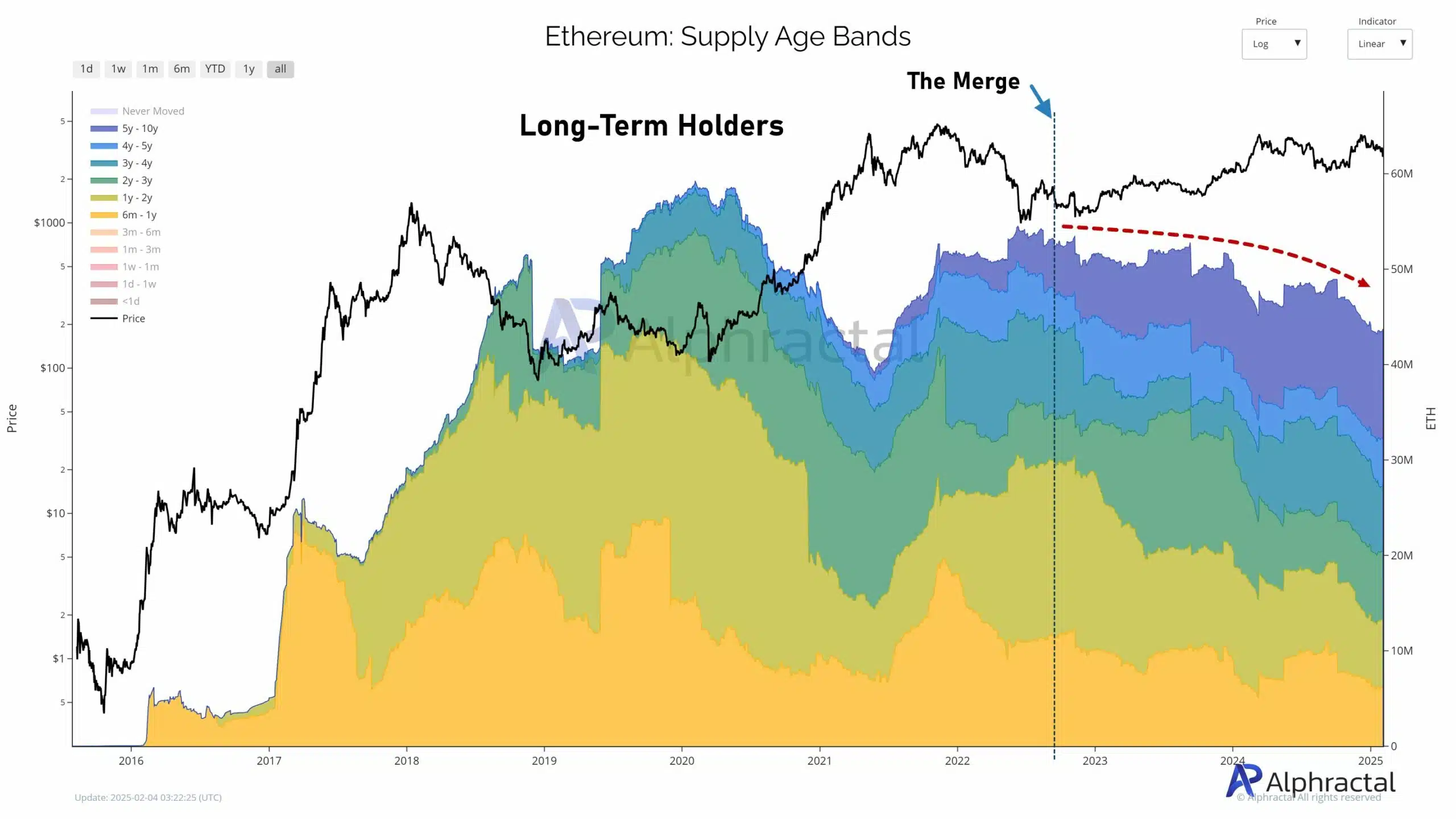

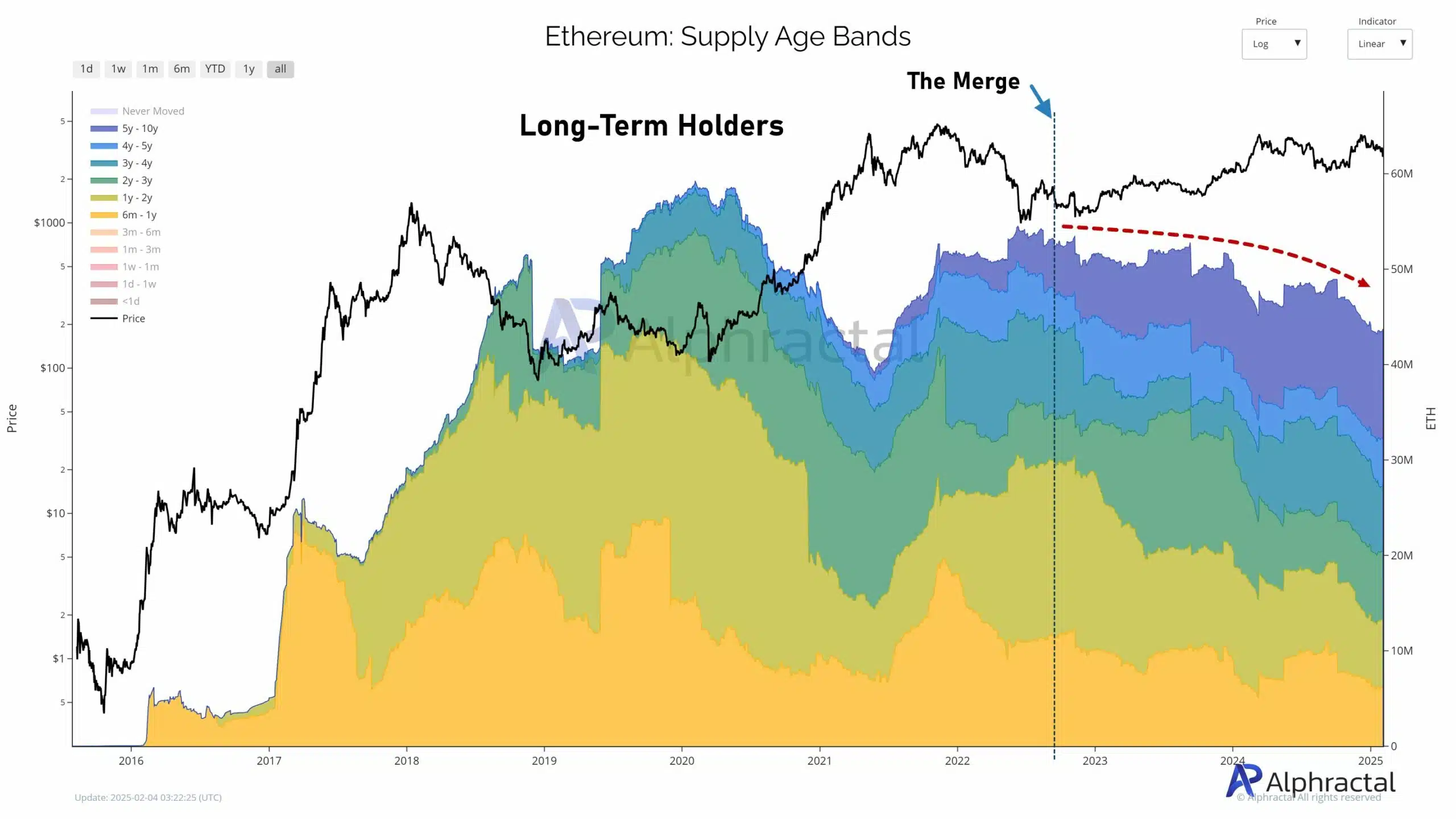

Ethereum’s provide dynamics have modified notably because the Merge, with LTHs and STHs considerably decreasing their accumulation.

The info reveals that LTHs, who as soon as held ETH for prolonged durations, have sharply reduce on shopping for. STHs have additionally proven a noticeable decline of their holdings.

This development signifies a shift in investor habits, presumably as a result of market uncertainty, diminished staking rewards beneath PoS, or broader bearish sentiment.

Supply: Alphractal

Moreover, the Ethereum Provide by Handle Measurement chart highlights stagnation amongst massive holders, notably whales holding over 100,000 ETH, who’ve proven little motion because the Merge.

Supply: Alphractal

This means a cautious, wait-and-see method, indicating a insecurity available in the market’s fast future and a probably decrease liquidity setting.

The ripple results

Ethereum’s PoS transition pushed miners out, decreasing their common liquidations and easing promoting strain.

Nevertheless, this shift has impacted trade inflows, with fewer contributions from miners and declining exercise from LTHs and STHs.

This might create a provide bottleneck and tighten liquidity. On the demand aspect, Ethereum’s ecosystem struggles to compensate for diminished accumulation.

Metrics like gasoline charges, DApp utilization, and DeFi quantity present restricted development, reflecting muted community exercise.

Mixed with bearish sentiment from on-chain and social information, questions on Ethereum’s skill to maintain value momentum stay unresolved.

Is your portfolio inexperienced? Verify the Ethereum Revenue Calculator

Ethereum: Quick-term outlook

Supply: TradingView