- Normal Chartered predicts Bitcoin might attain $500,000 by 2028, pushed by improved investor entry and diminished volatility.

- Institutional inflows into spot Bitcoin ETFs are anticipated to develop beneath the pro-crypto Trump administration.

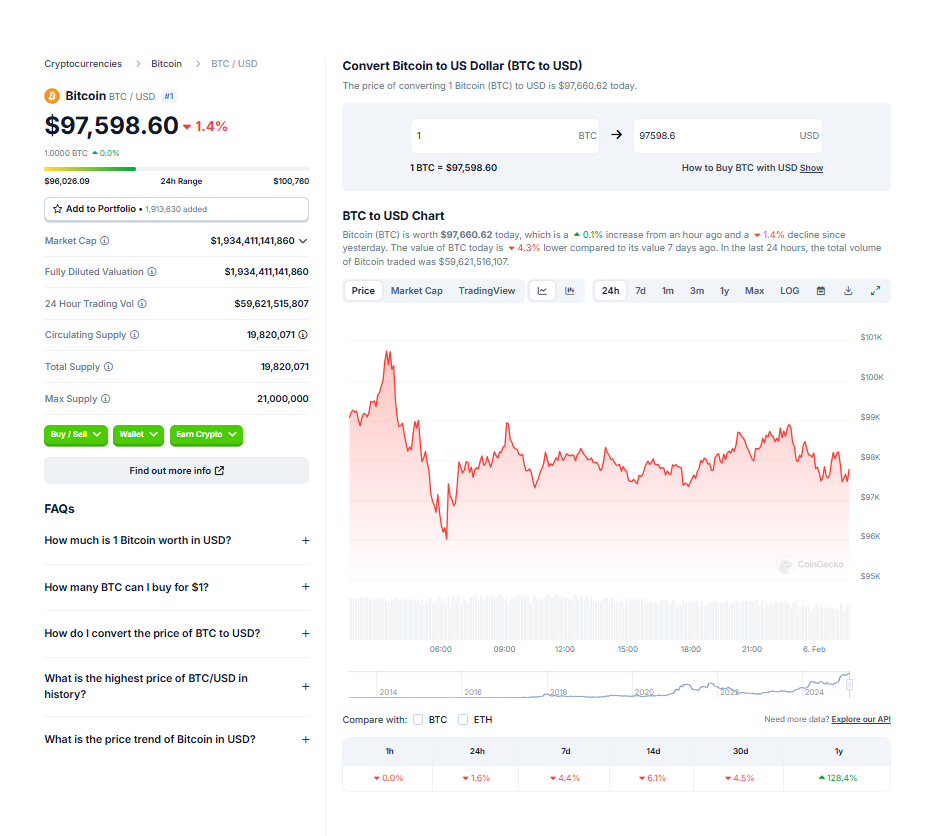

- Bitcoin is at present buying and selling round $98,000, whereas the BTC-to-gold ratio has dropped amid elevated demand for gold.

Bitcoin’s worth might soar to $500,000 by 2028, pushed by higher investor entry and diminished volatility, in response to a forecast by Normal Chartered. Geoffrey Kendrick, the financial institution’s world head of digital belongings analysis, famous in a report that because the U.S. spot Bitcoin ETF market matures, worth stability will enhance, bolstering Bitcoin’s attraction as a hedge towards conventional finance points.

The Path to $500,000

Kendrick predicts that institutional inflows into Bitcoin ETFs will proceed to rise, significantly beneath the pro-crypto Trump administration. This rising entry and adoption are anticipated to extend Bitcoin’s function in diversified portfolios, particularly alongside gold. “This dynamic might push Bitcoin’s worth to $500,000 earlier than Trump leaves workplace,” Kendrick wrote.

The financial institution additionally set shorter-term targets of $200,000 by the tip of this 12 months and $300,000 by 2026.

Bitcoin’s Present Market Place

Bitcoin is buying and selling close to $98,000 as of now. In the meantime, the BTC-to-gold ratio has hit its lowest level since mid-November, pushed by a surge in gold costs amid heightened considerations over a U.S.-China commerce conflict and rising demand from China.

Institutional Confidence Builds

As investor confidence strengthens, Bitcoin’s twin function as a hedge and progress asset turns into extra pronounced. Kendrick expects that this maturing market surroundings will appeal to extra capital, solidifying Bitcoin’s long-term progress trajectory and positioning it as a core digital asset in institutional portfolios.