SUI value has been up roughly 4% within the final 24 hours however has remained down 30% over the previous month. Regardless of slight restoration, its technical indicators nonetheless level to an total bearish setup, with each the Ichimoku Cloud and EMA traces suggesting sturdy resistance forward.

Nonetheless, SUI continues to point out spectacular buying and selling exercise, rating because the sixth-largest blockchain by every day quantity, forward of Avalanche and Polygon. Whether or not SUI can maintain this momentum and reclaim $4 within the coming days will rely upon its potential to interrupt key resistance ranges and ensure a development reversal.

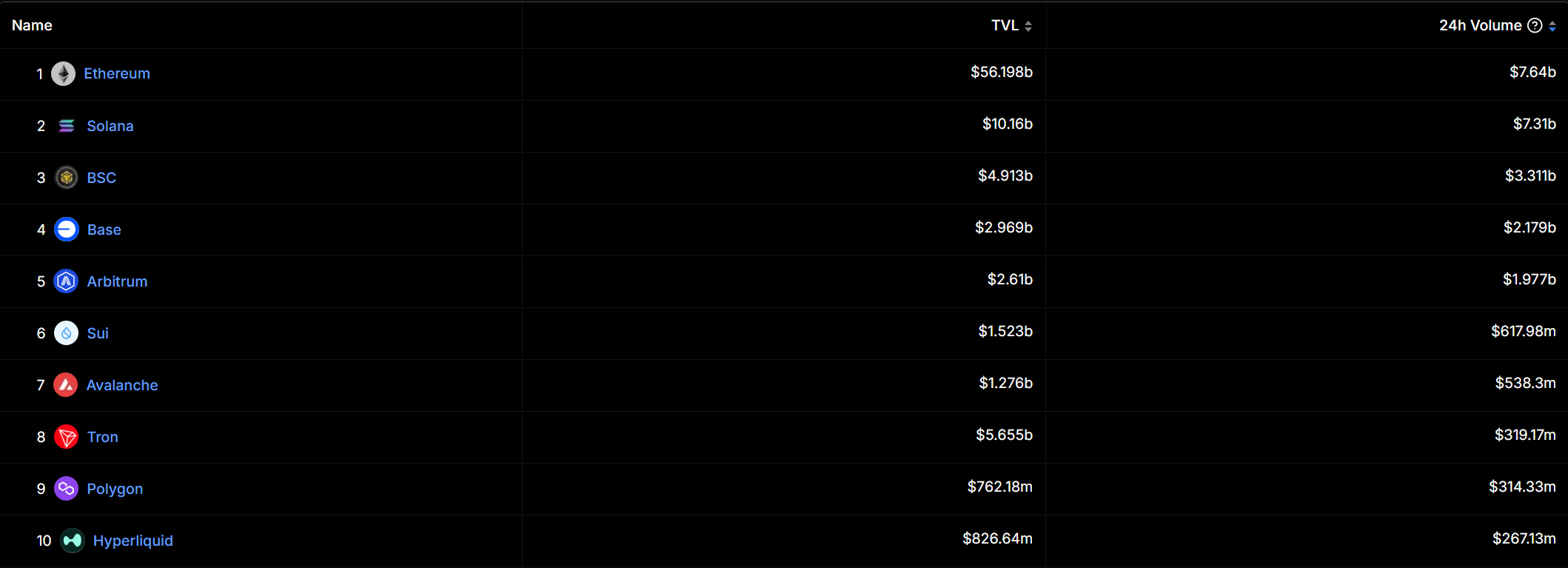

SUI Is Now The sixth Largest Chain In Phrases of Every day Quantity

SUI blockchain every day quantity reached $615 million within the final 24 hours, making it the sixth-largest blockchain by quantity. This places it forward of well-established networks like Avalanche, Hyperliquid, Polygon, and Tron, signaling sturdy market exercise.

Whereas SUI is a comparatively new participant, its potential to generate such a excessive quantity suggests rising curiosity from merchants and buyers.

Monitoring every day quantity is essential for blockchains because it displays person engagement, liquidity, and total demand. Regardless of attracting $615 million in every day quantity, SUI nonetheless has far fewer protocols than older networks like Avalanche and Polygon.

This implies that whereas its ecosystem isn’t but as developed, the sturdy buying and selling exercise may drive extra initiatives to construct on SUI, doubtlessly accelerating its adoption and development.

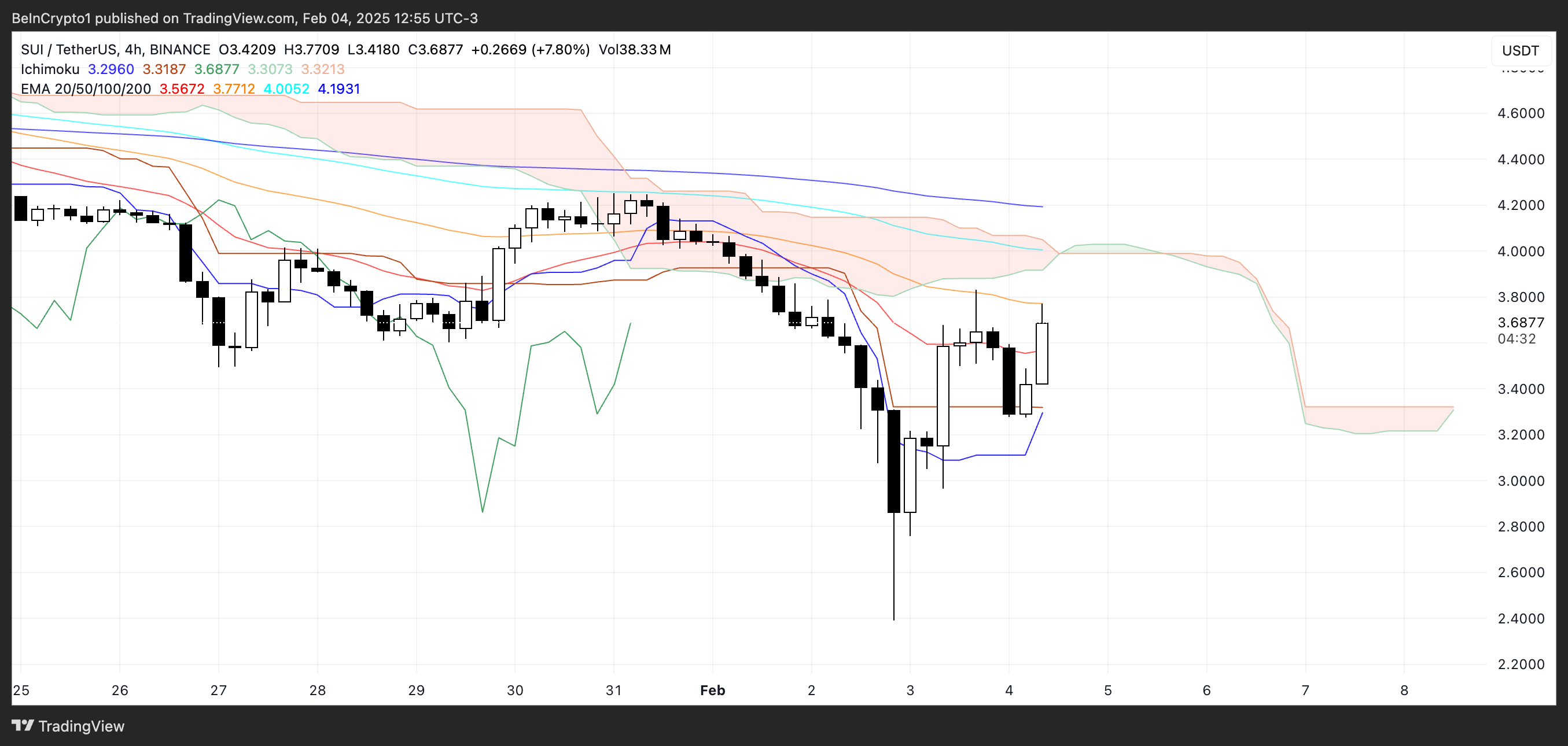

Ichimoku Cloud Photos a Bearish Setup for SUI

The Ichimoku Cloud chart reveals that the SUI value is at present buying and selling beneath the cloud, indicating that the broader development stays bearish. The cloud itself is thick and sloping downward, suggesting sturdy resistance overhead and a continuation of the downtrend if momentum doesn’t shift.

The conversion line (blue) has lately turned upward and is trying to cross the baseline (pink), which might be an early sign of potential short-term bullish momentum. Nonetheless, the lagging span (inexperienced) remains to be beneath the value and the cloud, reinforcing that the longer-term development has not but shifted bullish.

The long run cloud can be forming a bearish construction, with its main span A (inexperienced) beneath main span B (pink), displaying that bearish momentum nonetheless dominates.

Regardless of the current value leap, the cloud stays a powerful resistance zone, and except the value can break above it and ensure a development reversal, the general sentiment stays cautious. The truth that SUI value is hovering close to the decrease fringe of the cloud suggests a interval of consolidation earlier than a clearer development route emerges.

SUI Value Prediction: Can SUI Reclaim $4 In The Subsequent Days?

SUI EMA traces stay bearish, with short-term transferring averages nonetheless beneath the longer-term ones regardless of the current value surge. This implies that whereas momentum has improved, the general development has not but reversed into a transparent uptrend.

If the present bullish momentum continues, SUI value may take a look at $3.94, and a breakout above that degree may result in a transfer towards $4.25. A stronger development shift may push the value even increased, doubtlessly reaching $4.76 or $5.14 within the coming weeks.

Nonetheless, as each the Ichimoku Cloud and EMA construction point out, the broader market sentiment for SUI remains to be bearish. If the value fails to keep up its present momentum and exams help at $3.35, shedding that degree may result in an additional drop beneath $3.

In that situation, SUI value may decline towards $2.97, and if promoting stress stays sturdy, it’d fall as little as $2.38. Till a decisive development shift happens, the market stays in a cautious part, with each upside and draw back prospects in play.

Disclaimer

Consistent with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.