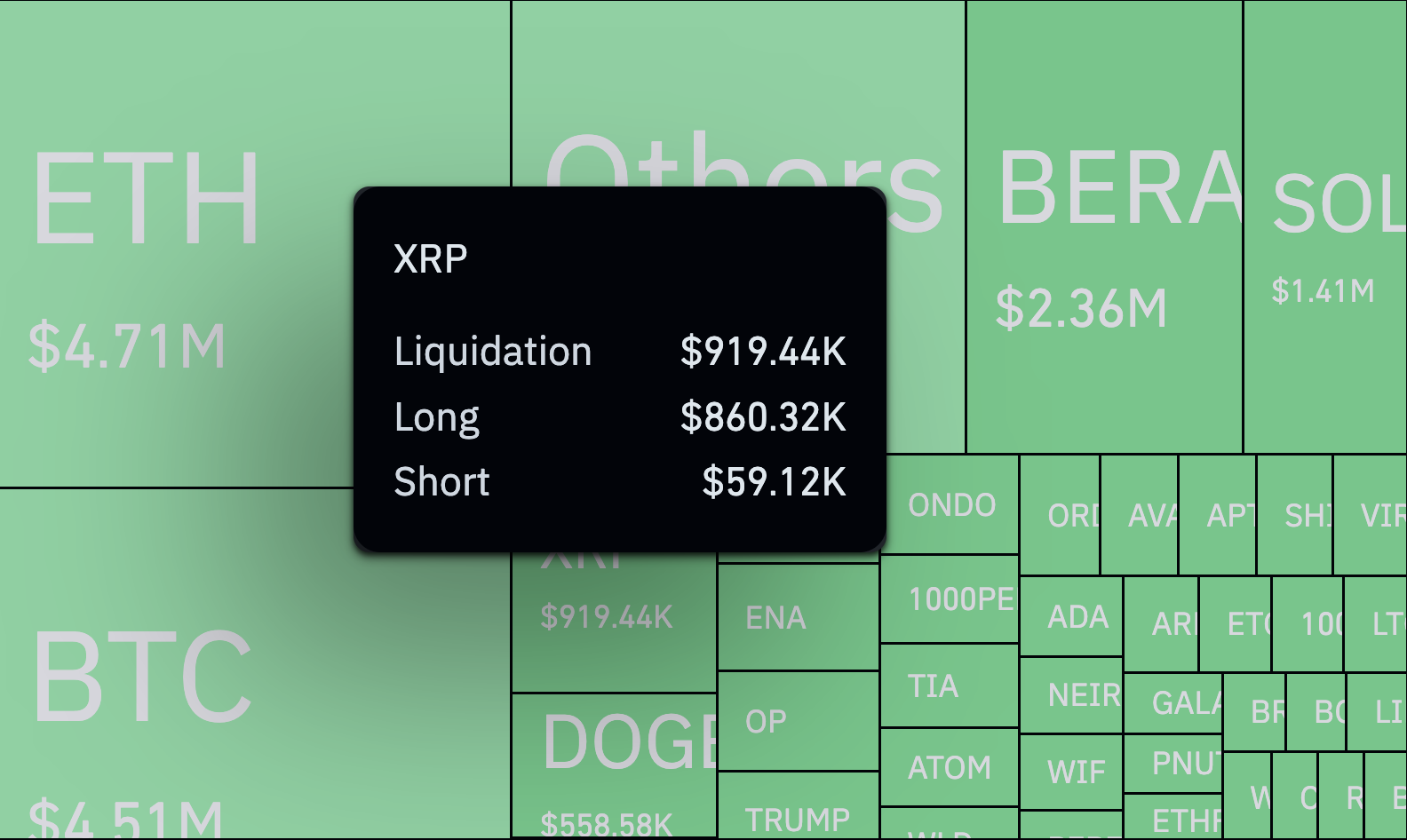

There was a large 1,455% hole between liquidated lengthy and brief positions on the XRP perpetual futures market in only one hour. Information from CoinGlass places the entire liquidation in that brief interval at $920,000.

However the actual shock? Virtually all of it – 93.4% – got here from lengthy positions. That’s, about $860,000 was worn out, leaving solely $60,000 tied to shorts.

Much more putting is the truth that XRP didn’t expertise a giant value collapse. It solely dropped 2.7%. Nothing too wild. However merchants have been feeling fairly bullish after a 3% achieve and went all-in on the lengthy facet. However then, within the blink of a watch, the whole lot modified, and people bets began to collapse.

This was not only a downside for XRP. The complete crypto market felt the strain. In only one hour, a whopping $27.7 million in positions have been worn out. That’s over 10% of the entire liquidation during the last 24 hours. Lengthy merchants have been hit the toughest, with losses of $24.41 million, far exceeding the $3.51 million in losses from brief positions.

Why did this occur?

XRP’s chart had been sending bullish indicators, reinforcing a dealer’s bias to go lengthy. However the steadiness shifted as momentum slowed, and what appeared like a stable technique rapidly unraveled. Sentiment alone was not sufficient to maintain costs afloat.

This type of setup raises questions. Goes lengthy on XRP nonetheless a wise transfer? Proper now, the numbers say no. It seems like each time there’s a probability for a bounce, there may be simply extra promoting. If consumers maintain pushing, however the market isn’t prepared to show, XRP might proceed to slip till the strain lastly eases.