Berachain (BERA) worth surged to $15 within the first hours after the mainnet launch however shortly started to say no. The Berachain airdrop was some of the anticipated distributions of 2025, following a optimistic yr of improvement all through 2024.

Nonetheless, technical indicators now counsel weakening momentum, with RSI dropping from overbought ranges and CMF turning adverse. With different current airdrops like HYPE and PENGU struggling post-launch, BERA faces a difficult path to restoration until market sentiment shifts.

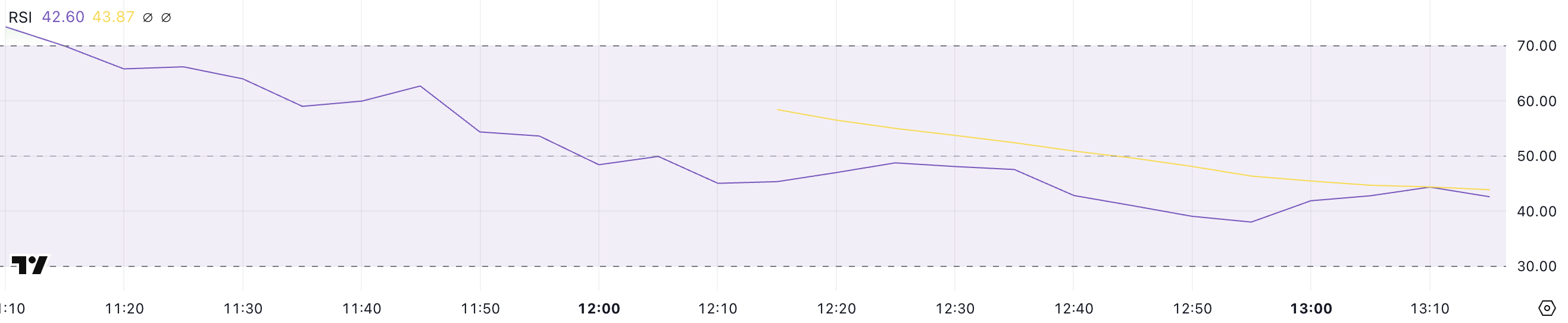

BERA RSI Is Dropping Quick

BERA is the native token of Berachain, some of the hyped layer-1 blockchains in the previous couple of years. After launching earlier right this moment, it presently has an RSI of 42.6, falling from almost 70 just some hours in the past.

The Relative Energy Index (RSI) is a momentum indicator that measures the velocity and magnitude of worth adjustments to evaluate whether or not an asset is overbought or oversold.

Readings above 70 point out overbought situations and potential for a pullback, whereas ranges beneath 30 counsel oversold situations that would result in a rebound. With BERA’s RSI now properly beneath 70, the current promoting stress has weakened its momentum, signaling a shift in development.

At 42.6, BERA’s RSI means that its worth is in impartial territory however leaning towards bearish momentum. The drop from overbought ranges signifies that the earlier uptrend has misplaced power, and additional draw back motion might observe if promoting stress persists.

Nonetheless, if RSI stabilizes or reverses close to this degree, it might counsel consolidation earlier than the subsequent transfer. A continued decline towards 30 would sign growing weak point, whereas a bounce from this zone might point out that consumers are stepping in to assist a possible restoration.

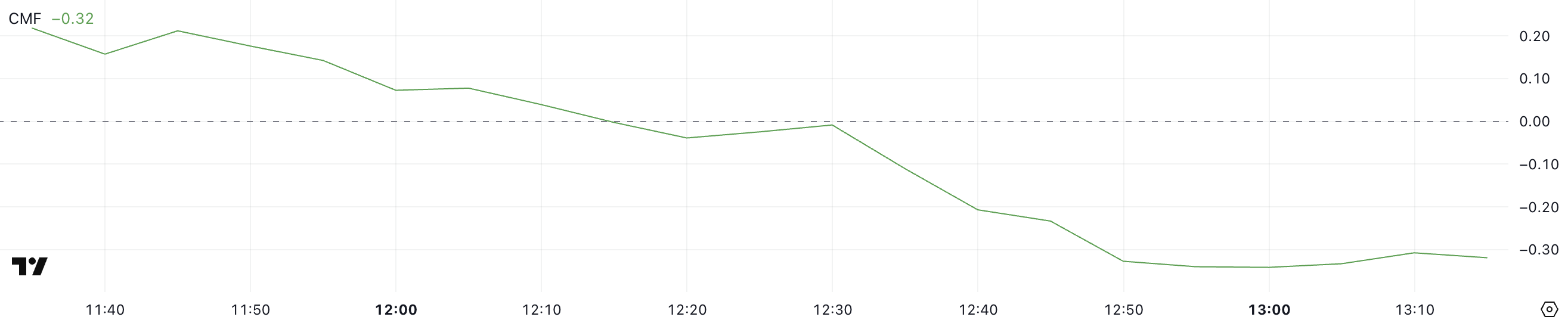

BERA CMF Is Very Detrimental After Touching 0.2

BERA presently has a Chaikin Cash Stream (CMF) of -0.32, after sitting round 0.20 just some hours in the past earlier than beginning to drop. CMF is an indicator that measures shopping for and promoting stress by analyzing quantity and worth actions over a selected interval.

A optimistic CMF worth suggests accumulation, indicating robust shopping for curiosity, whereas a adverse worth indicators distribution and promoting stress. With BERA’s CMF now deep in adverse territory, promoting stress has intensified, suggesting a shift in market sentiment.

This drop in CMF comes after Berachain launched its BERA airdrop following a yr of constructing all through 2024. Nonetheless, the broader development for airdrop tokens has been weak, with earlier highly-anticipated launches like HYPE and PENGU struggling when it comes to returns.

BERA’s CMF at -0.32 means that liquidity is flowing out, which means sellers are dominating the market. If this development continues, BERA might face additional downward stress until consumers step in to soak up the promoting and stabilize the value.

BERA Worth Prediction: Will BERA Recuperate Quickly?

BERA worth surged to $15 within the hours following its airdrop however shortly started to say no. With RSI now at 42.6, down from almost 70, and CMF dropping to -0.32, indicators counsel that purchasing momentum has pale whereas promoting stress is growing.

The falling RSI factors to weakening bullish power, whereas the adverse CMF indicators capital outflows, reinforcing the concept that sellers are in management. Given this setup, Berachain might proceed to wrestle until demand picks as much as counteract the promoting.

Latest airdrops like HYPE and PENGU have additionally carried out poorly after their preliminary buzz, highlighting a broader development of weak post-airdrop returns. If BERA follows an analogous sample, it might expertise additional draw back as early recipients unload their tokens.

Nonetheless, if promoting stress stabilizes and indicators begin to reverse, BERA might enter a consolidation part earlier than discovering its subsequent path. For now, the technical setup stays bearish, and a robust catalyst can be wanted to shift sentiment again in its favor.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.