Bitcoin is exhibiting indicators of a possible restoration, rising from a validated bullish sample. The crypto has managed to regain momentum, with whale buyers taking part in a vital position in its value surge.

As bigger holders accumulate extra BTC, Bitcoin is inching nearer to crucial resistance ranges.

Bitcoin Buyers Are Unsure

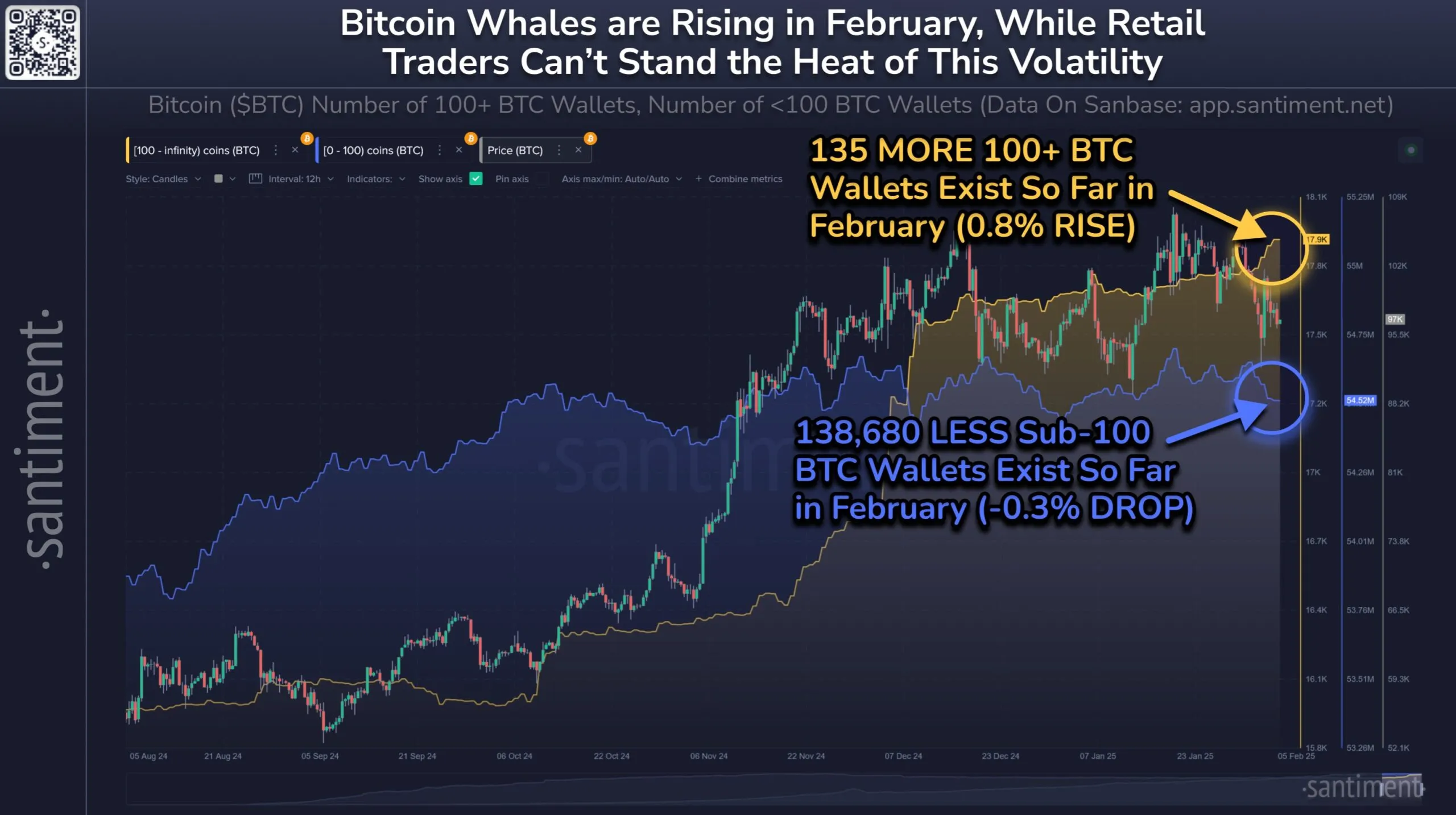

Whale holders have been actively accumulating Bitcoin throughout the current mid-sized drop and risky market circumstances. Not like smaller retail merchants, who’ve been liquidating their holdings, giant buyers are profiting from the worth swings to broaden their portfolios. This development highlights a rising divide between seasoned buyers and newcomers.

February knowledge reveals a notable shift in pockets distribution. The variety of wallets holding 100+ BTC has grown by 135, whereas smaller wallets holding lower than 100 BTC have declined by 138,680. This shift signifies that whale buyers are reinforcing their positions whereas smaller merchants exit the market.

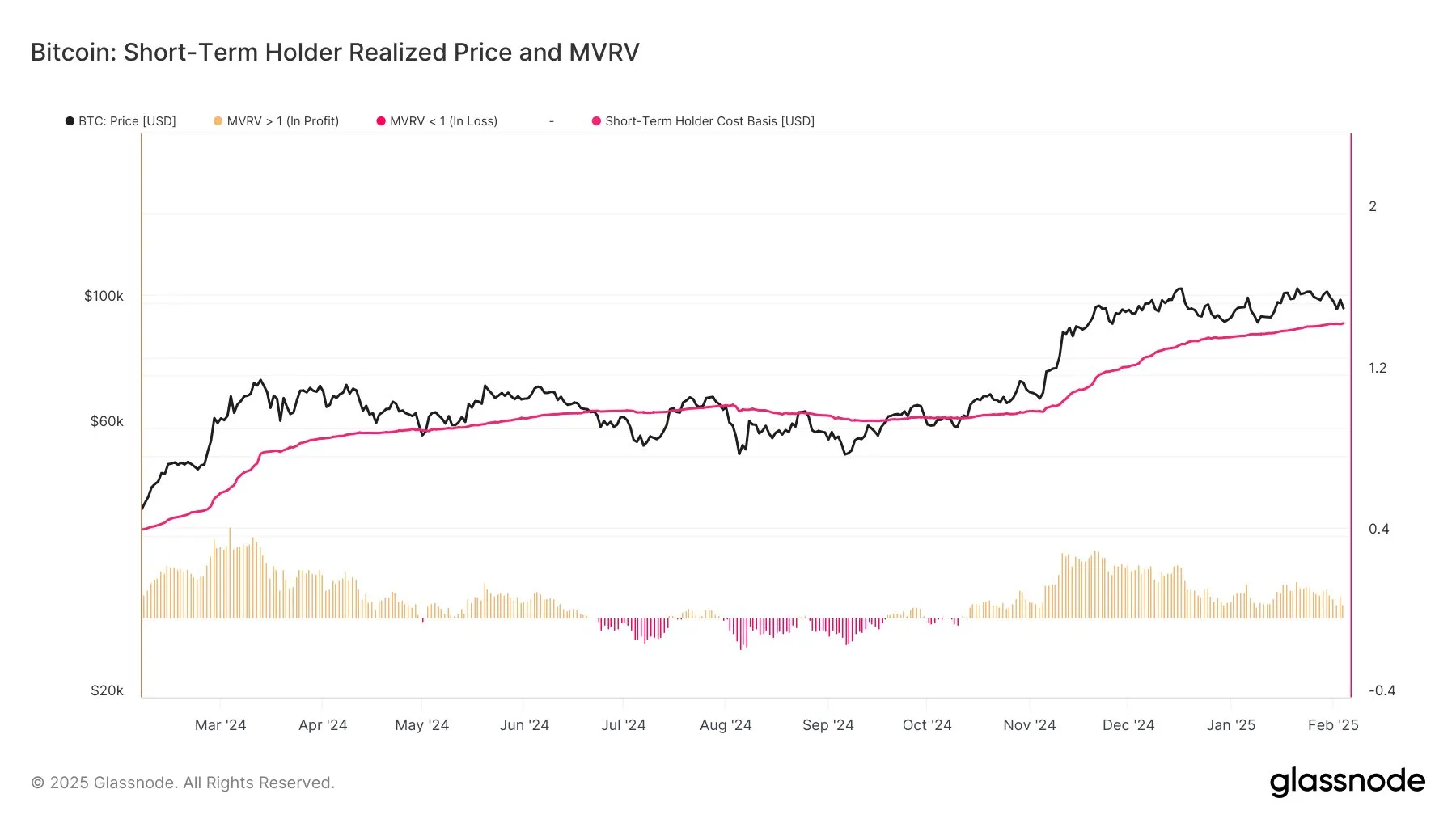

Analyzing Bitcoin’s macro momentum, the Price Foundation Distribution reveals {that a} key help vary lies between $97,500 and $99,999. Final month’s knowledge confirms that just about 200,000 BTC had been amassed at these ranges, reinforcing value stability.

Moreover, buyers with a price foundation above $99,000 have acquired over 150,000 BTC. This accumulation additional strengthens the essential vary between $97,500 and $99,999, serving as a basis for Bitcoin’s subsequent potential transfer upwards.

BTC Value Prediction: Recovering for Breakout

Bitcoin’s value is on monitor to validate an ascending wedge sample as soon as it reaches $106,100, requiring a 7% enhance. Nonetheless, for this to occur, buyers should resist the urge to promote prematurely and preserve upward momentum.

Given the buildup developments and whale exercise, Bitcoin may first retest the $100,000 resistance. If this degree is efficiently breached, BTC is more likely to proceed its uptrend, escape of the ascending wedge, and surge towards $106,100 and past.

On the draw back, failure to interrupt $100,000 may result in a decline, with Bitcoin probably dropping to $95,668 or decrease. This situation would invalidate the bullish thesis and prolong market losses, disrupting the present restoration development.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.