Cardano’s largest buyers, also known as ADA whales, have been scaling again their buying and selling exercise, indicating a shift in sentiment across the altcoin.

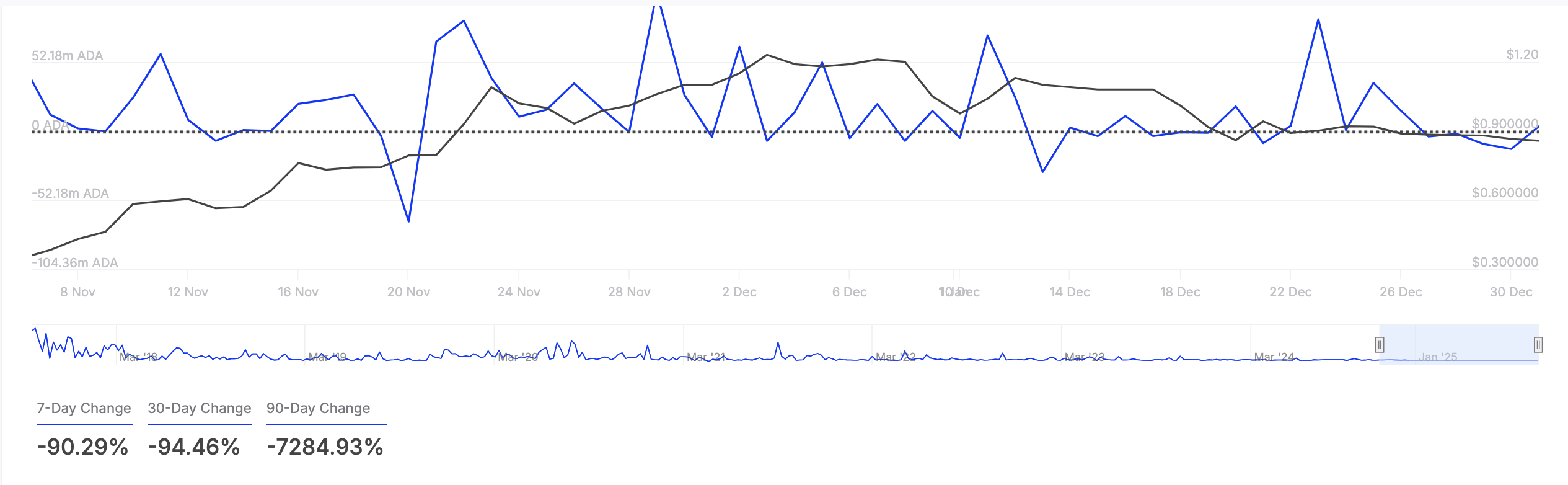

Over the previous week, on-chain knowledge from IntoTheBlock has proven a staggering 90% lower within the netflow of ADA from these main holders. This decline means that these giant buyers are both offloading their holdings or refraining from including extra to their positions.

The drop in whale exercise may very well be a crimson flag for ADA, as it might result in decrease liquidity and elevated worth volatility.

With these key gamers pulling again, there’s much less shopping for strain, which might contribute to an extra decline within the coin’s worth. This modification in habits aligns with a rising bearish outlook on ADA.

Including to the damaging sentiment is the growing demand for brief positions in ADA’s futures market, highlighted by its damaging funding charge of -0.005%.

A damaging funding charge signifies that extra merchants are betting towards the asset, additional suggesting a insecurity in ADA’s short-term efficiency. Because the market sentiment continues to bitter and whale exercise stays subdued, ADA faces the chance of extended downward strain except new shopping for momentum materializes.